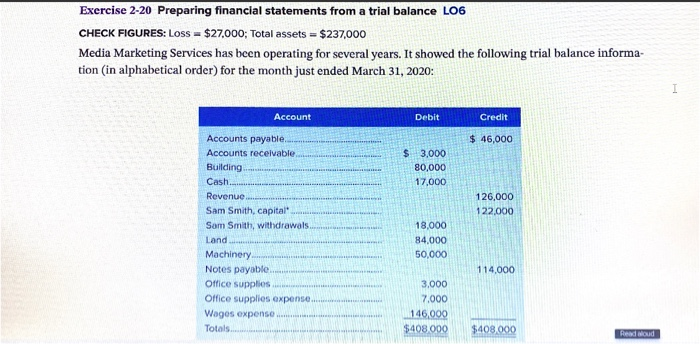

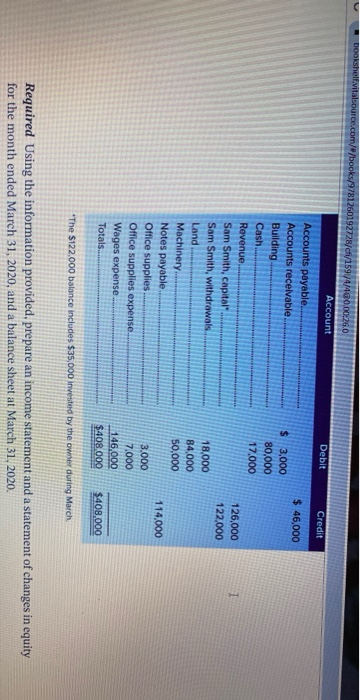

Exercise 2-20 Preparing financial statements from a trial balance 106 CHECK FIGURES: Loss = $27,000; Total assets = $237,000 Media Marketing Services has been operating for several years. It showed the following trial balance informa- tion (in alphabetical order) for the month just ended March 31, 2020: I Account Debit Credit $ 46,000 $ 3,000 80,000 17,000 126,000 122.000 Accounts payable Accounts receivable Building Cash Revenue Sam Smith, capital Sam Smith, withdrawals Land Machinery Notes payable Office supplies Office supplies expense. Wages expense Totals 18,000 84.000 50,000 114,000 3,000 7.000 146,000 $408.000 $408.000 Read Moud bookshelf vitalsource.com//books/9781260192728/1/15944/460.00-260 Account Debit Credit $ 46,000 $ 3.000 80.000 17,000 126,000 122,000 Accounts payable Accounts receivable. Building Cash Revenue Sam Smith, capital Sam Smith, withdrawals Land Machinery Notes payable Office supplies Office supplies expense. Wages expense Totals. 18,000 84,000 50,000 114,000 3.000 7.000 146,000 $408.000 $408,000 *The $122.000 balance includes $35,000 invested by the owner during March. Required Using the information provided, prepare an income statement and a statement of changes in equity for the month ended March 31, 2020, and a balance sheet at March 31, 2020. Exercise 2-20 Preparing financial statements from a trial balance 106 CHECK FIGURES: Loss = $27,000; Total assets = $237,000 Media Marketing Services has been operating for several years. It showed the following trial balance informa- tion (in alphabetical order) for the month just ended March 31, 2020: I Account Debit Credit $ 46,000 $ 3,000 80,000 17,000 126,000 122.000 Accounts payable Accounts receivable Building Cash Revenue Sam Smith, capital Sam Smith, withdrawals Land Machinery Notes payable Office supplies Office supplies expense. Wages expense Totals 18,000 84.000 50,000 114,000 3,000 7.000 146,000 $408.000 $408.000 Read Moud bookshelf vitalsource.com//books/9781260192728/1/15944/460.00-260 Account Debit Credit $ 46,000 $ 3.000 80.000 17,000 126,000 122,000 Accounts payable Accounts receivable. Building Cash Revenue Sam Smith, capital Sam Smith, withdrawals Land Machinery Notes payable Office supplies Office supplies expense. Wages expense Totals. 18,000 84,000 50,000 114,000 3.000 7.000 146,000 $408.000 $408,000 *The $122.000 balance includes $35,000 invested by the owner during March. Required Using the information provided, prepare an income statement and a statement of changes in equity for the month ended March 31, 2020, and a balance sheet at March 31, 2020