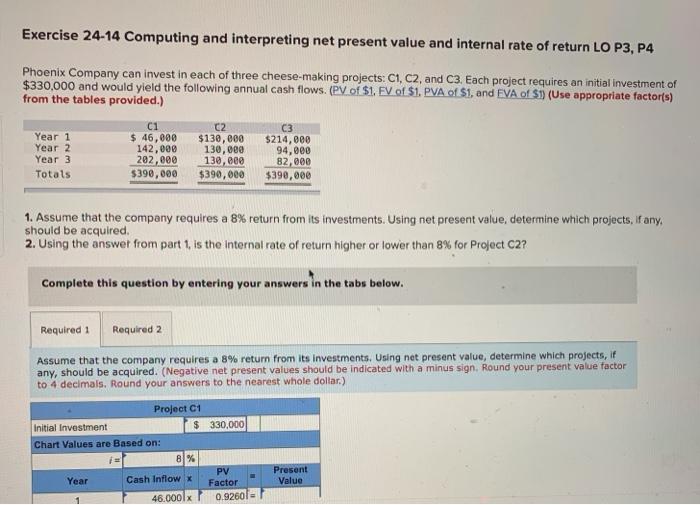

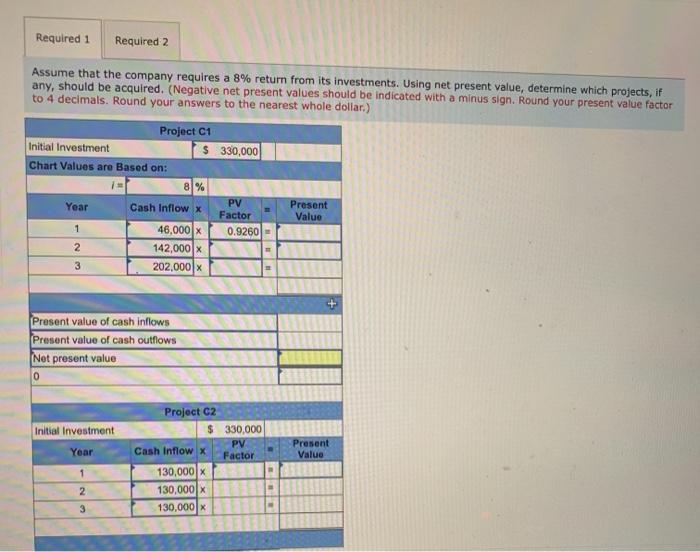

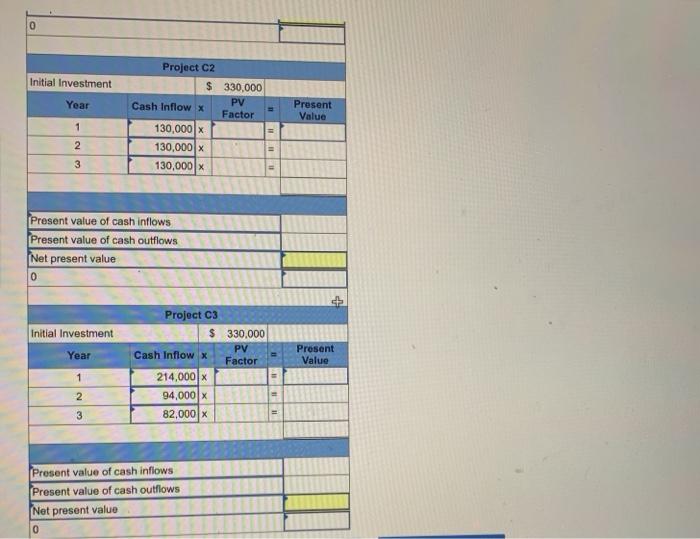

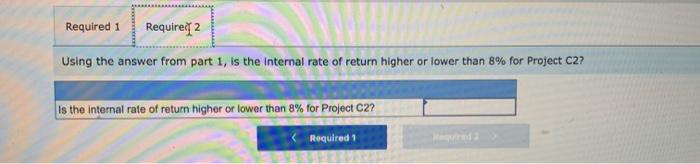

Exercise 24-14 Computing and interpreting net present value and internal rate of return LO P3, P4 Phoenix Company can invest in each of three cheese-making projects: C1, C2, and C3. Each project requires an initial investment of $330,000 and would yield the following annual cash flows. (PV of $1. FV of $1. PVA of S1, and FVA of S1) (Use appropriate factor(s) from the tables provided.) Year 1 Year 2 Year 3 Totals c1 $ 46,000 142,000 202,000 $390,000 C2 $130,000 130,000 130,000 $390,000 C3 $214,000 94,000 82,000 $390,000 1. Assume that the company requires a 8% return from its investments. Using net present value, determine which projects. If any. should be acquired 2. Using the answer from part 1 is the internal rate of return higher or lower than 8% for Project C2? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Assume that the company requires a 8% return from its investments. Using net present value, determine which projects, if any, should be acquired. (Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar) Project C1 Initial Investment $ 330,000 Chart Values are Based on: 81% PV Year Cash Inflow X Factor 46.000lx 0.92601 - Present Value Required 1 Required 2 Assume that the company requires a 8% return from its investments. Using net present value, determine which projects, if any, should be acquired. (Negative net present values should be indicated with a minus sign. Round your present value factor to 4 decimals. Round your answers to the nearest whole dollar.) Project C1 Initial Investment $ 330,000 Chart Values are Based on: 81% PV Year Cash Inflow X Factor 1 46.000 x 0.9260 2 142,000 x 3 202,000 Present Value Present value of cash inflows Present value of cash outflows Net present value 0 Project 2 $ 330,000 Initial Investment PV Year Cash Inflow X Present Value Factor 1 2 3 130,000 130,000 x 130,000) 0 Initial Investment Year Project C2 $ 330,000 Cash Inflow X PV Factor 130,000 130,000 x 130,000 x Present Value 1 2 3 11 Present value of cash inflows Present value of cash outflows Net present value 0 Initial Investment Year Project C3 $ 330,000 PV Cash Inflow X Factor 214,000 94,000 x Present Value 1 2 3 82,000 x Prosent value of cash inflows Present value of cash outflows Net present value 0 Required 1 Required 2 Using the answer from part 1, is the internal rate of return higher or lower than 8% for Project C2? Is the internal rate of return higher or lower than 8% for Project C2? Required 1