Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 24-21 (Algorithmic) (LO. 1, 3, 4) Legends Corporation owns and operates two manufacturing facilities, one in State A and the other in State B.

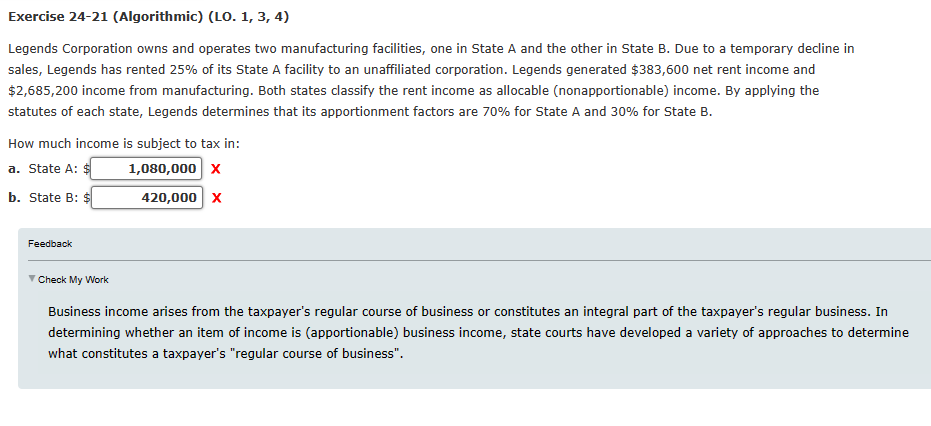

Exercise 24-21 (Algorithmic) (LO. 1, 3, 4) Legends Corporation owns and operates two manufacturing facilities, one in State A and the other in State B. Due to a temporary decline in sales, Legends has rented 25% of its State A facility to an unaffiliated corporation. Legends generated $383,600 net rent income and $2,685,200 income from manufacturing. Both states classify the rent income as allocable (nonapportionable) income. By applying the statutes of each state, Legends determines that its apportionment factors are 70% for State A and 30% for State B. How much income is subject to tax in: a. State A: \& x b. State B: \$ x Feedback Check My Work Business income arises from the taxpayer's regular course of business or constitutes an integral part of the taxpayer's regular business. In determining whether an item of income is (apportionable) business income, state courts have developed a variety of approaches to determine what constitutes a taxpayer's "regular course of business

Exercise 24-21 (Algorithmic) (LO. 1, 3, 4) Legends Corporation owns and operates two manufacturing facilities, one in State A and the other in State B. Due to a temporary decline in sales, Legends has rented 25% of its State A facility to an unaffiliated corporation. Legends generated $383,600 net rent income and $2,685,200 income from manufacturing. Both states classify the rent income as allocable (nonapportionable) income. By applying the statutes of each state, Legends determines that its apportionment factors are 70% for State A and 30% for State B. How much income is subject to tax in: a. State A: \& x b. State B: \$ x Feedback Check My Work Business income arises from the taxpayer's regular course of business or constitutes an integral part of the taxpayer's regular business. In determining whether an item of income is (apportionable) business income, state courts have developed a variety of approaches to determine what constitutes a taxpayer's "regular course of business Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started