Answered step by step

Verified Expert Solution

Question

1 Approved Answer

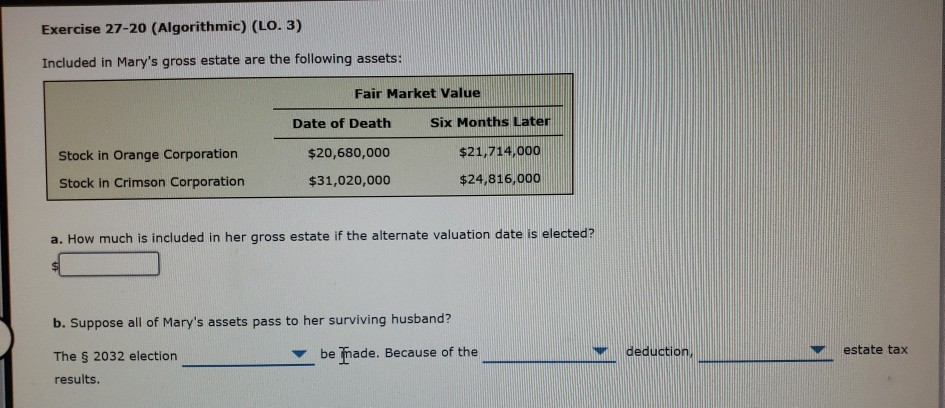

Exercise 27-20 (Algorithmic) (LO. 3) Included in Mary's gross estate are the following assets: Fair Market Value Date of Death Six Months Later $20,680,000 $21,714,000

Exercise 27-20 (Algorithmic) (LO. 3) Included in Mary's gross estate are the following assets: Fair Market Value Date of Death Six Months Later $20,680,000 $21,714,000 $31,020,000 $24,816,000 Stock in Orange Corporation Stock in Crimson Corporation a. How much is included in her gross estate if the alternate valuation date is elected? b. Suppose all of Mary's assets pass to her surviving husband? The $ 2032 election results. be made. Because of the RA - deduction, estate tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started