help me ASAP! thanks

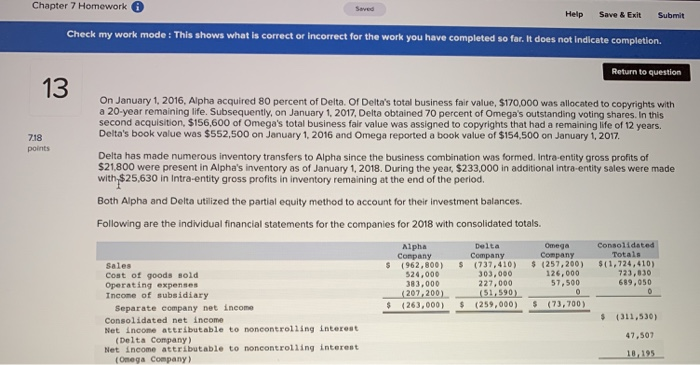

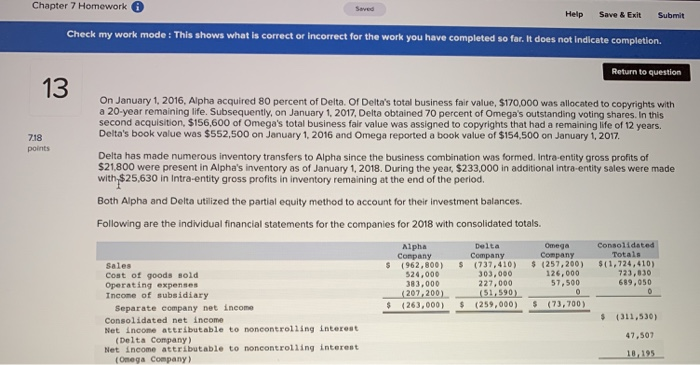

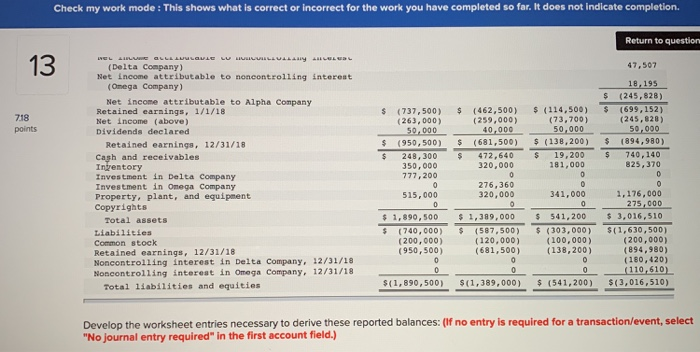

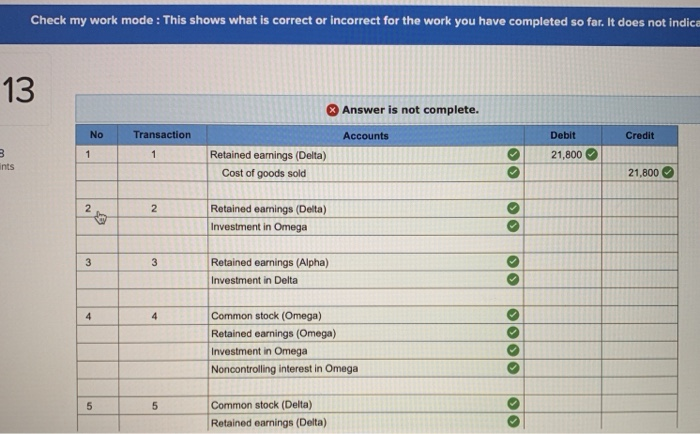

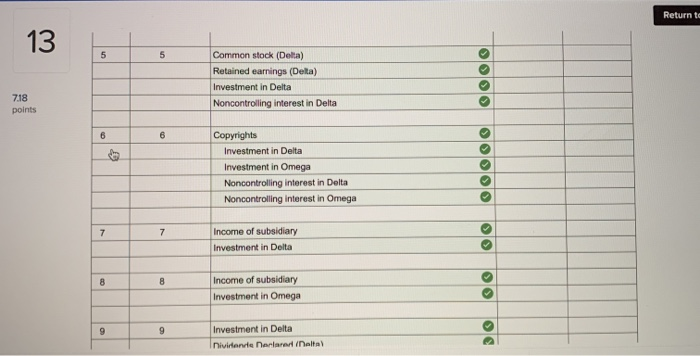

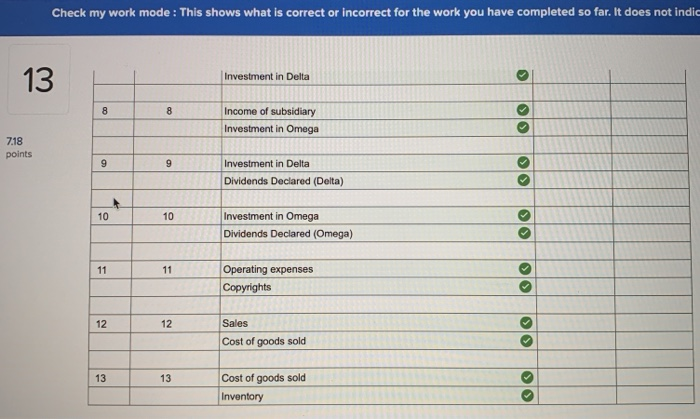

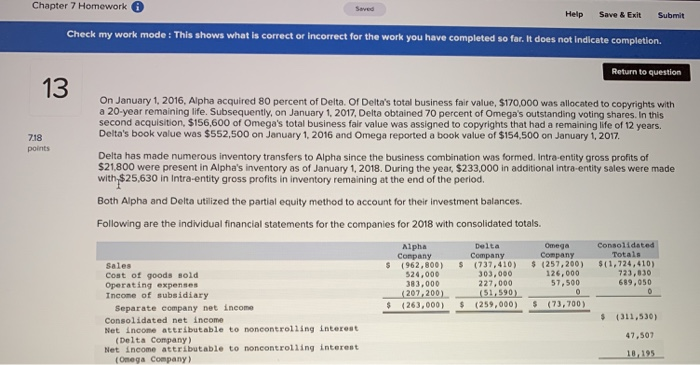

Saved Help Save & Exit Submit Chapter 7 Homework Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not Indicate completion. 13 718 points Return to question On January 1, 2016, Alpha acquired 80 percent of Delta. Of Delta's total business fair value, $170,000 was allocated to copyrights with a 20-year remaining life. Subsequently, on January 1, 2017, Delta obtained 70 percent of Omega's outstanding voting shares. In this second acquisition, $156,600 of Omega's total business fair value was assigned to copyrights that had a remaining life of 12 years. Delta's book value was $552,500 on January 1, 2016 and Omega reported a book value of $154,500 on January 1, 2017 Delta has made numerous inventory transfers to Alpha since the business combination was formed. Intra-entity gross profits of $21.800 were present in Alpha's inventory as of January 1, 2018. During the year, $233,000 in additional intra-entity sales were made with $25,630 in Intra-entity gross profits in inventory remaining at the end of the period. Both Alpha and Delta utilized the partial equity method to account for their investment balances. Following are the individual financial statements for the companies for 2018 with consolidated totals. Alpha Delta Omega Consolidated Company Company Company Totais Sales $ (962,800) $ (737,410) $ (257,200) $(1,724,410) Cost of goods sold 524,000 303,000 126,000 723,630 Operating expenses 383,000 227,000 57,500 689,050 Income of subsidiary (207, 200) (51,590) Separate company net income $ (263,000) $ (259,000) $ (73,700) Consolidated net income $ (311,530) Net income attributable to noncontrolling interest (Delta Company) 47,507 Net Income attributable to noncontrolling interest (omega company) 10,195 0 0 Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. : Return to question 13 47,507 718 points WEL LL LLL LOULOULE LU HULILLLLLL LLLL (Delta Company) Net Income attributable to noncontrolling interest (Omega Company) Net income attributable to Alpha Company Retained earnings, 1/1/18 Net income (above) Dividends declared Retained earnings, 12/31/18 Cash and receivables Ingentory Investment in Delta Company Investment in Omega Company Property, plant, and equipment Copyrights Total assets Liabilities Common stock Retained earnings, 12/31/18 Noncontrolling interest in Delta Company, 12/31/18 Noncontrolling interest in Omega Company, 12/31/18 Total liabilities and equities $ (114,500) (73,700) 50.000 $ (138,200) $ 19,200 181,000 0 $ (737,500) (263,000) 50,000 $ (950, 500) $ 248,300 350,000 777,200 0 515,000 0 $ 1,890, 500 (740,000) (200,000) (950, 500) 0 0 $(1,890,500) $ (462,500) (259,000) 40,000 $ (681,500) $ 472,640 320,000 0 276,360 320,000 0 $ 1,389,000 $ (587,500) (120,000) (681,500) 0 0 $(1,389,000) 18,195 $ (245,828) $ (699,152) (245,828) 50,000 $ (894, 980) $ 740, 140 825, 370 0 0 1,176,000 275,000 $ 3,016,510 $(1,630,500) (200,000) (894,980) (180, 420) (110,610) $(3,016,510) 341,000 0 $ 541,200 $ (303,000) (100,000) (138,200) 0 0 $ (541,200) Develop the worksheet entries necessary to derive these reported balances: (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indica 13 Answer is not complete. No Transaction Accounts Debit Credit m 1 1 > 21,800 ints Retained earnings (Delta) Cost of goods sold 21,800 2 2 Retained earnings (Delta) Investment in Omega 3 3 Retained earnings (Alpha) Investment in Delta O 4 4 Common stock (Omega) Retained earnings (Omega) Investment in Omega Noncontrolling interest in Omega 5 5 Common stock (Delta) Retained earnings (Delta) Return to 13 5 5 Common stock (Delta) Retained earnings (Delta) Investment in Delta Noncontrolling interest in Delta 718 points 6 6 Copyrights Investment in Delta Investment in Omega Noncontrolling interest in Delta Noncontrolling interest in Omega OOOOO 7 7 Income of subsidiary Investment in Delta 8 8 Income of subsidiary Investment in Omega 9 9 Investment in Delta Dividencia nerlar heltal DO Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It does not indic 13 Investment in Delta 8 8 Income of subsidiary Investment in Omega 7.18 points 9 9 Investment in Delta Dividends Declared (Delta) 10 10 Investment in Omega Dividends Declared (Omega) O 11 11 Operating expenses Copyrights 12 12 Sales Cost of goods sold O 13 13 Cost of goods sold Inventory >