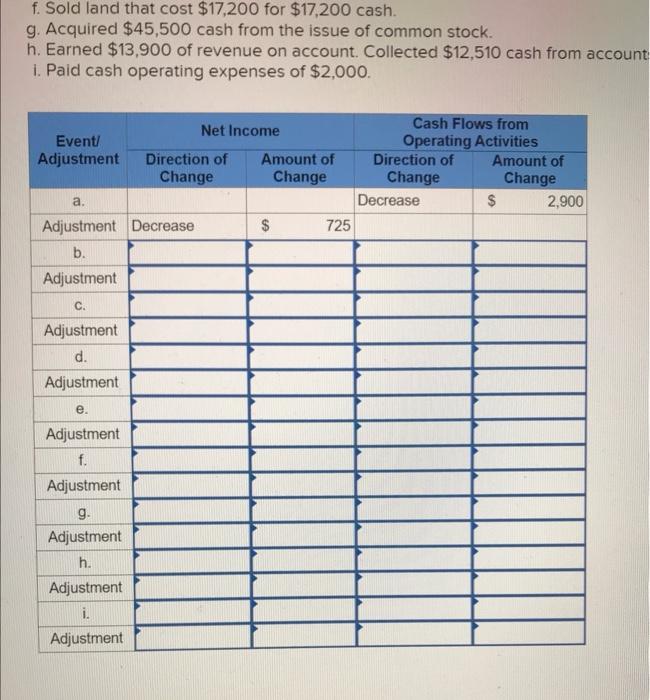

Exercise 3-14A (Algo) Effect of accounting events on the income statement and statement of cash flows LO 31,32,33 Required: Explain how each of the following events or series of events and the related adjustments will affect the amount of net income and the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change (increase, decrease) and the amount of the change. Organize your answers according to the following table. The first event is recorded as an example. If an event does not have a related adjustment, record only the effects of the event. Note: Not all cells require entry. Do not round intermediate calculations and round your final answers to nearest whole dollar amount. a. Paid $2,900 cash on October 1 to purchase a one-year insurance policy. b. Purchased $1,000 of supplies on account. Paid $750 cash on accounts payable. The ending balance in the Supplies account, after adjustment, was $300 C. Provided services for $7,500cash. d. Collected $10,500 in advance for services to be performed in the future. The contract called for services to start on May 1 and to continue for one year, e. Accrued salaries amounting to $3.400. f. Sold land that cost $17,200 for $17,200 cash. 9. Acquired $45,500 cash from the issue of common stock h. Earned $13,900 of revenue on account. Collected $12,510 cash from accounts recelvable. 1. Paid cash operating expenses of $2,000 f. Sold land that cost $17,200 for $17,200 cash. g. Acquired $45,500 cash from the issue of common stock. h. Earned $13,900 of revenue on account. Collected $12,510 cash from accour i. Paid cash operating expenses of $2,000. Exercise 3-14A (Algo) Effect of accounting events on the income statement and statement of cash flows LO 31,32,33 Required: Explain how each of the following events or series of events and the related adjustments will affect the amount of net income and the amount of cash flow from operating activities reported on the year-end financial statements. Identify the direction of change (increase, decrease) and the amount of the change. Organize your answers according to the following table. The first event is recorded as an example. If an event does not have a related adjustment, record only the effects of the event. Note: Not all cells require entry. Do not round intermediate calculations and round your final answers to nearest whole dollar amount. a. Paid $2,900 cash on October 1 to purchase a one-year insurance policy. b. Purchased $1,000 of supplies on account. Paid $750 cash on accounts payable. The ending balance in the Supplies account, after adjustment, was $300 C. Provided services for $7,500cash. d. Collected $10,500 in advance for services to be performed in the future. The contract called for services to start on May 1 and to continue for one year, e. Accrued salaries amounting to $3.400. f. Sold land that cost $17,200 for $17,200 cash. 9. Acquired $45,500 cash from the issue of common stock h. Earned $13,900 of revenue on account. Collected $12,510 cash from accounts recelvable. 1. Paid cash operating expenses of $2,000 f. Sold land that cost $17,200 for $17,200 cash. g. Acquired $45,500 cash from the issue of common stock. h. Earned $13,900 of revenue on account. Collected $12,510 cash from accour i. Paid cash operating expenses of $2,000