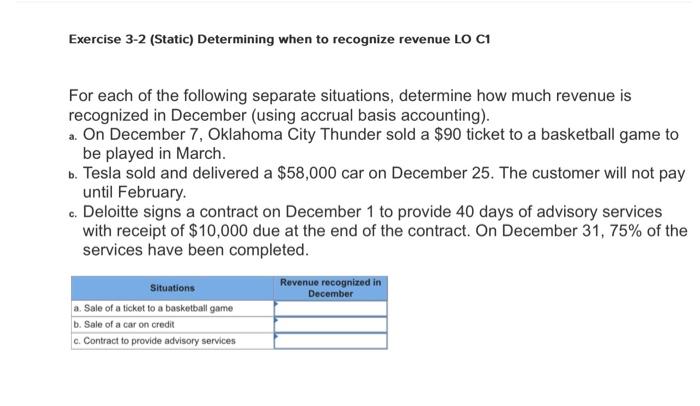

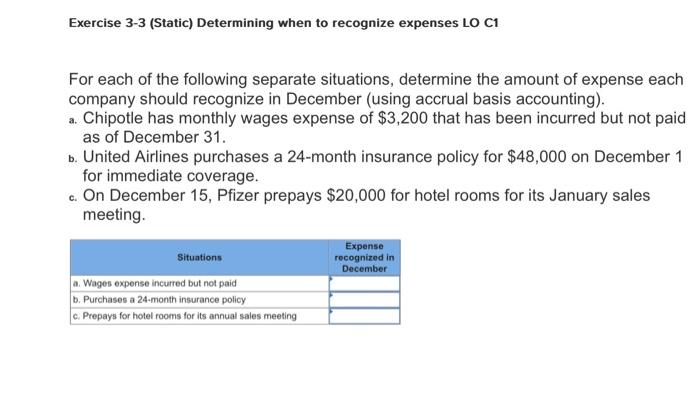

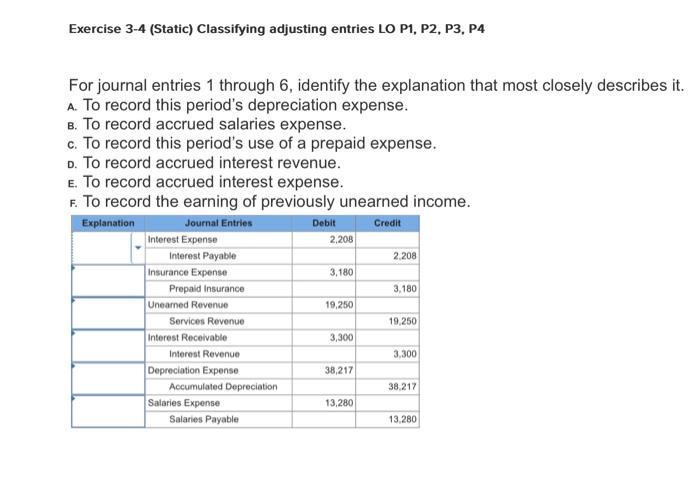

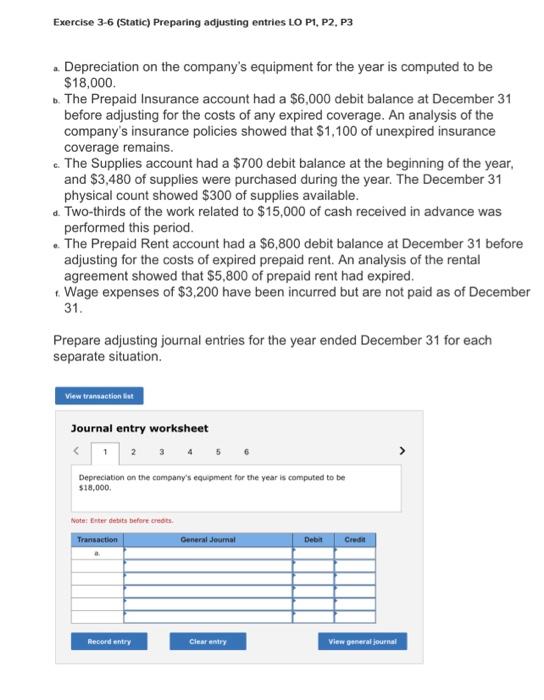

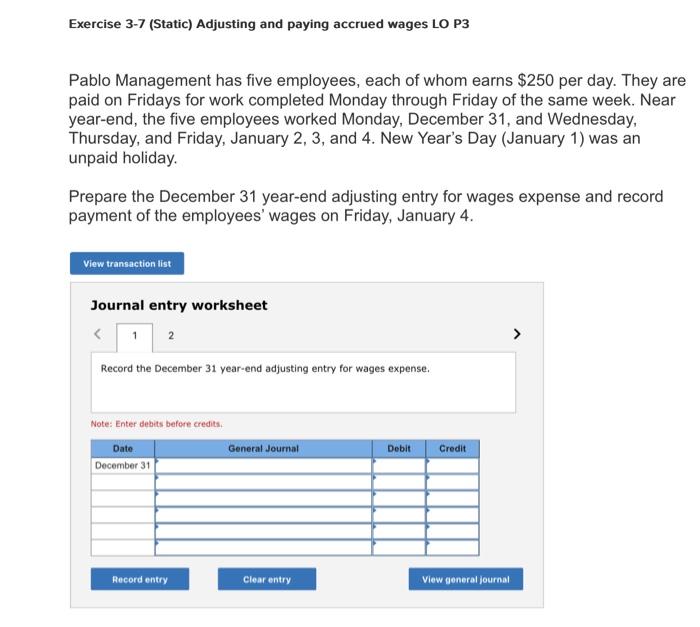

Exercise 3-2 (Static) Determining when to recognize revenue LO C1 For each of the following separate situations, determine how much revenue is recognized in December (using accrual basis accounting). a. On December 7 , Oklahoma City Thunder sold a $90 ticket to a basketball game to be played in March. b. Tesla sold and delivered a $58,000 car on December 25 . The customer will not pay until February. c. Deloitte signs a contract on December 1 to provide 40 days of advisory services with receipt of $10,000 due at the end of the contract. On December 31,75% of the services have been completed. Exercise 3-3 (Static) Determining when to recognize expenses LO C1 For each of the following separate situations, determine the amount of expense each company should recognize in December (using accrual basis accounting). a. Chipotle has monthly wages expense of $3,200 that has been incurred but not paid as of December 31. . United Airlines purchases a 24-month insurance policy for $48,000 on December 1 for immediate coverage. c. On December 15 , Pfizer prepays $20,000 for hotel rooms for its January sales meeting. For journal entries 1 through 6 , identify the explanation that most closely describes it. A. To record this period's depreciation expense. B. To record accrued salaries expense. c. To record this period's use of a prepaid expense. o. To record accrued interest revenue. E. To record accrued interest expense. F. To record the earning of previously unearned income. Exercise 3-6 (Static) Preparing adjusting entries LO P1, P2, P3 a. Depreciation on the company's equipment for the year is computed to be $18,000. b. The Prepaid Insurance account had a $6,000 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $1,100 of unexpired insurance coverage remains. c. The Supplies account had a $700 debit balance at the beginning of the year, and $3,480 of supplies were purchased during the year. The December 31 physical count showed $300 of supplies available. d. Two-thirds of the work related to $15,000 of cash received in advance was performed this period. e. The Prepaid Rent account had a $6,800 debit balance at December 31 before adjusting for the costs of expired prepaid rent. An analysis of the rental agreement showed that $5,800 of prepaid rent had expired. . Wage expenses of $3,200 have been incurred but are not paid as of December 31. Prepare adjusting journal entries for the year ended December 31 for each separate situation. Journal entry worksheet Depreciation on the company's equipment for the year is computed to be 518,000. Avote: Eriter debits befort oreots. Exercise 3-7 (Static) Adjusting and paying accrued wages LO P3 Pablo Management has five employees, each of whom earns $250 per day. They are paid on Fridays for work completed Monday through Friday of the same week. Near year-end, the five employees worked Monday, December 31, and Wednesday, Thursday, and Friday, January 2, 3, and 4. New Year's Day (January 1) was an unpaid holiday. Prepare the December 31 year-end adjusting entry for wages expense and record payment of the employees' wages on Friday, January 4. Journal entry worksheet Record the December 31 year-end adjusting entry for wages expense. Note: Enter debits before credits