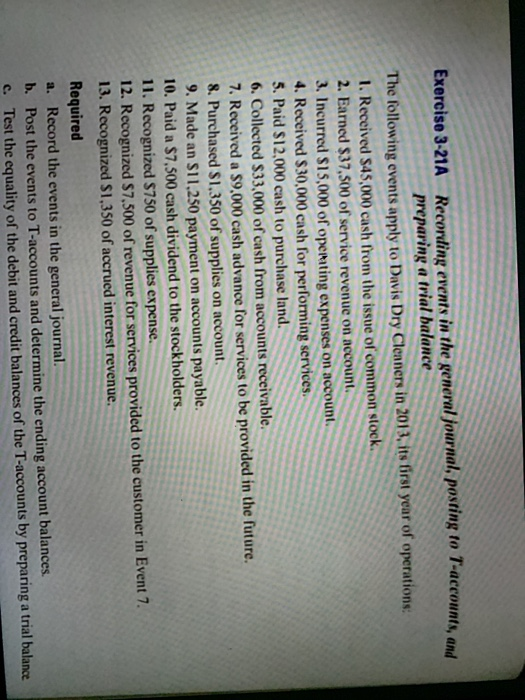

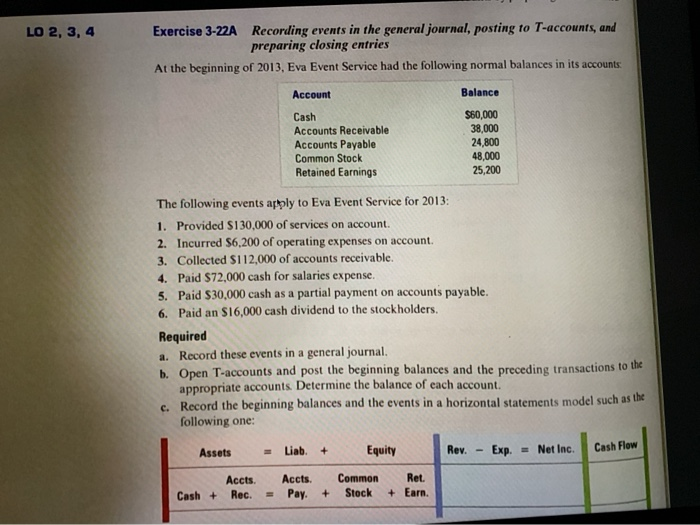

Exercise 3-21A Recording events in the general journal, posting to T-accounts, and preparing a trial balance The following events apply to Davis Dry Cleaners in 2013, its first year of operations: 1. Received $45,000 cash from the issue of common stock. 2. Earned $37,500 of service revenue on account. 3. Incurred $15,000 of operating expenses on account. 4. Received $30,000 cash for performing services. 5. Paid $12,000 cash to purchase land. 6. Collected $33,000 of cash from accounts receivable. 7. Received a $9.000 cash advance for services to be provided in the future. 8. Purchased $1,350 of supplies on account 9. Made an $11,250 payment on accounts payable. 10. Paid a $7,500 cash dividend to the stockholders. 11. Recognized $750 of supplies expense. 12. Recognized $7,500 of revenue for services provided to the customer in Event 7. 13. Recognized S1,350 of accrued interest revenue. Required a. Record the events in the general journal. b. Post the events to T-accounts and determine the ending account balances. c. Test the equality of the debit and credit balances of the T-accounts by preparing a trial balance LO 2, 3, 4 Exercise 3-22A Recording events in the general journal, posting to T-accounts, and preparing closing entries At the beginning of 2013, Eva Event Service had the following normal balances in its accounts: Account Balance Cash Accounts Receivable Accounts Payable Common Stock Retained Earnings $60,000 38,000 24,800 48,000 25,200 The following events apply to Eva Event Service for 2013: 1. Provided $130,000 of services on account. 2. Incurred $6.200 of operating expenses on account. 3. Collected $112,000 of accounts receivable. 4. Paid $72,000 cash for salaries expense. 5. Paid $30,000 cash as a partial payment on accounts payable. 6. Paid an $16,000 cash dividend to the stockholders. Required a. Record these events in a general journal. b. Open T-accounts and post the beginning balances and the preceding transactions to the appropriate accounts. Determine the balance of each account. c. Record the beginning balances and the events in a horizontal statements model such as the following one: Assets Liab. + Equity Rev. Exp. = Net Inc. Cash Flow Accts. Rec. Accts. Pay Common Stock Ret. + Earn. Cash + +