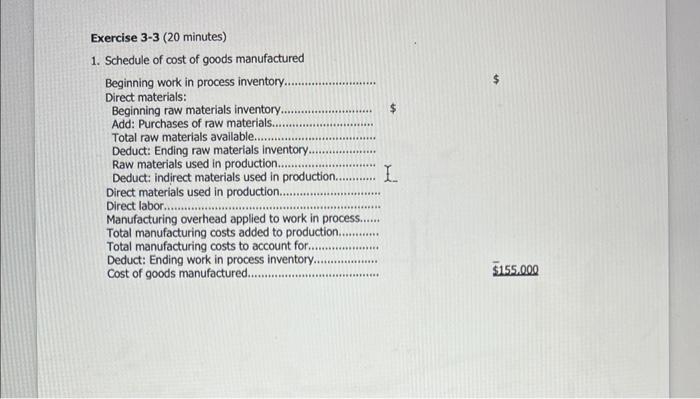

Exercise 3-5 (30 minutes) 1. a. b. c. d. e. f. 30,000MH$8perMH=$240,000. g. h. 1 1. Schedule of cost of goods manufactured Beginning work in process inventory Direct materials: Beginning raw materials inventory. Add: Purchases of raw materials Total raw materials avallable. Deduct: Ending raw materials inventory. Raw materials used in production Deduct: indirect materials used in production. Direct materials used in production. Direct labor. Manufacturing overhead applied to work in process. Total manufacturing costs added to production. Total manufacturing costs to account for. Deduct: Ending work in process inventory. cost of goods manufactured. Exercise 3-3 (continued) 2. Schedule of Cost of Goods Sold: Beginning finished goods inventory. Add: Cost of goods manufactured. Cost of goods available for sale. Deduct: Ending finished goods inventory. Unadjusted cost of goods sold. Add: Underapplied overhead. Adjusted cost of goods sold. $152000 Becinning finiehed goods imventory Add: Cost of oocds manufactured. Cost of goods avalable for sale. Deduct: Ending firished ooods imventory Unadjusted cost of goods sold. Add: Underapolied overhead. Adjusted cost of goods soild. $152.000 Buerclse 3-5 (30 minutes) 1. a. b. c. d. e. f. 30,000MH$8perMH=$240,000. 9. h. Exercise 3-5 (30 minutes) 1. a. b. c. d. e. f. 30,000MH$8perMH=$240,000. g. h. 1 1. Schedule of cost of goods manufactured Beginning work in process inventory Direct materials: Beginning raw materials inventory. Add: Purchases of raw materials Total raw materials avallable. Deduct: Ending raw materials inventory. Raw materials used in production Deduct: indirect materials used in production. Direct materials used in production. Direct labor. Manufacturing overhead applied to work in process. Total manufacturing costs added to production. Total manufacturing costs to account for. Deduct: Ending work in process inventory. cost of goods manufactured. Exercise 3-3 (continued) 2. Schedule of Cost of Goods Sold: Beginning finished goods inventory. Add: Cost of goods manufactured. Cost of goods available for sale. Deduct: Ending finished goods inventory. Unadjusted cost of goods sold. Add: Underapplied overhead. Adjusted cost of goods sold. $152000 Becinning finiehed goods imventory Add: Cost of oocds manufactured. Cost of goods avalable for sale. Deduct: Ending firished ooods imventory Unadjusted cost of goods sold. Add: Underapolied overhead. Adjusted cost of goods soild. $152.000 Buerclse 3-5 (30 minutes) 1. a. b. c. d. e. f. 30,000MH$8perMH=$240,000. 9. h