Answered step by step

Verified Expert Solution

Question

1 Approved Answer

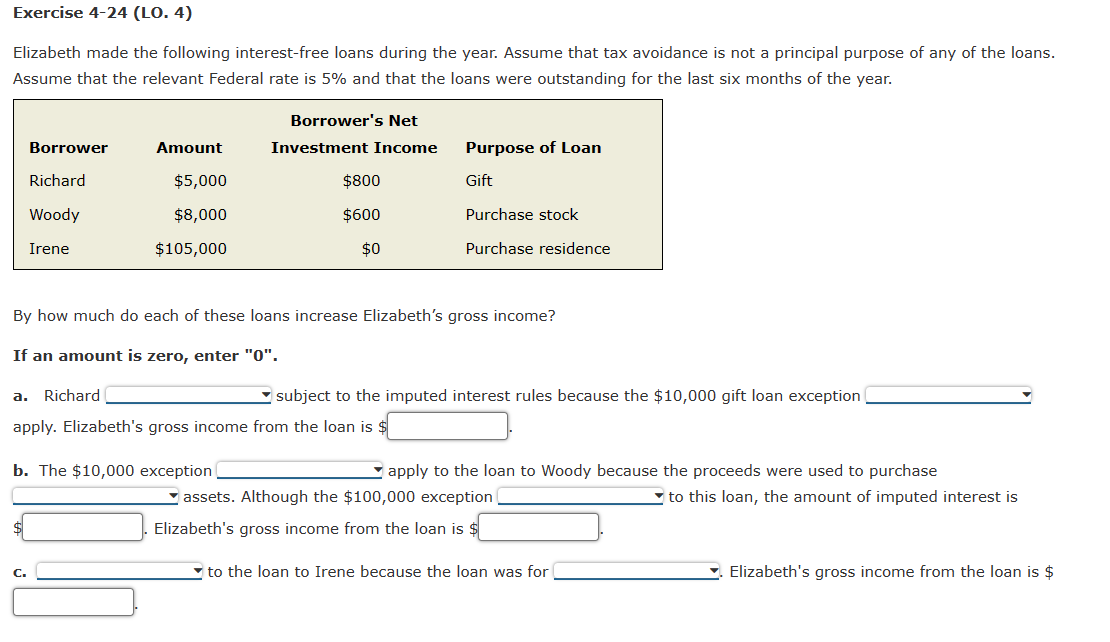

Exercise 4 - 2 4 ( LO . 4 ) Elizabeth made the following interest - free loans during the year. Assume that tax avoidance

Exercise LO

Elizabeth made the following interestfree loans during the year. Assume that tax avoidance is not a principal purpose of any of the loans.

Assume that the relevant Federal rate is and that the loans were outstanding for the last six months of the year.

By how much do each of these loans increase Elizabeth's gross income?

If an amount is zero, enter

a Richard

subject to the imputed interest rules because the $ gift loan exception

apply. Elizabeth's gross income from the loan is $

b The $ exception

; apply to the loan to Woody because the proceeds were used to purchase

assets. Although the $ exception

to this loan, the amount of imputed interest is

Elizabeth's gross income from the loan is &

C

to the loan to Irene because the loan was for

Elizabeth's gross income from the loan is $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started