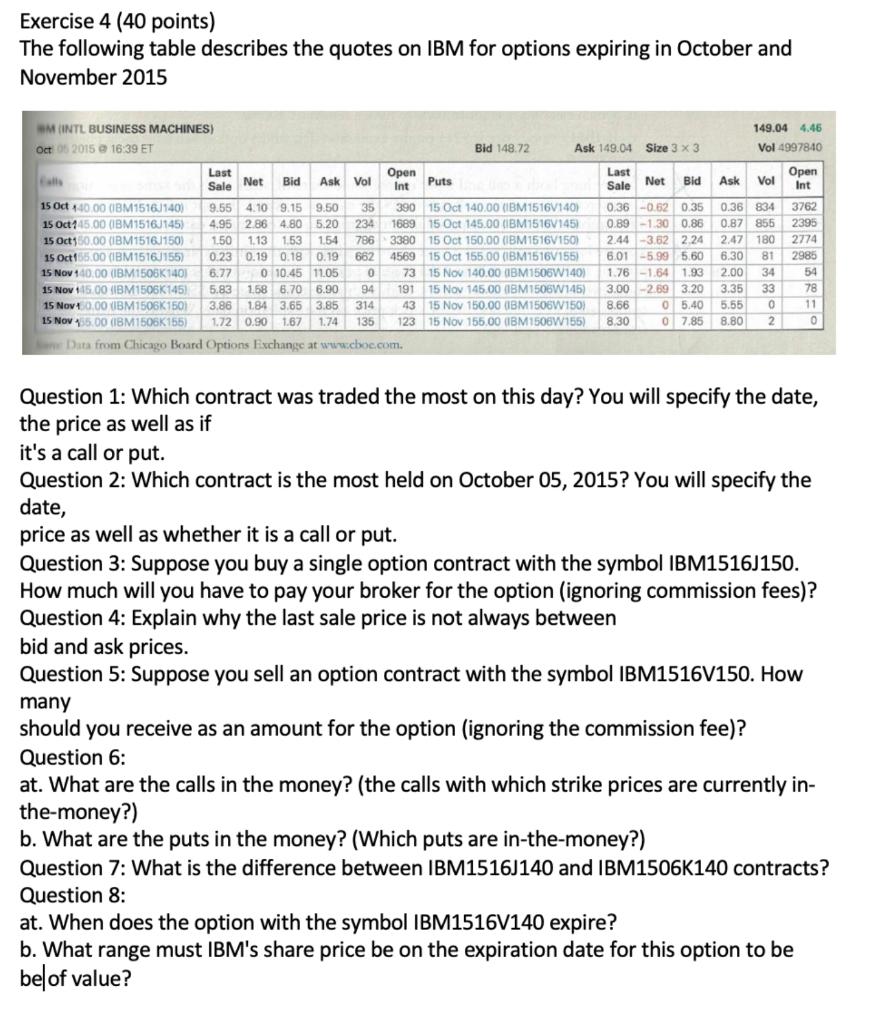

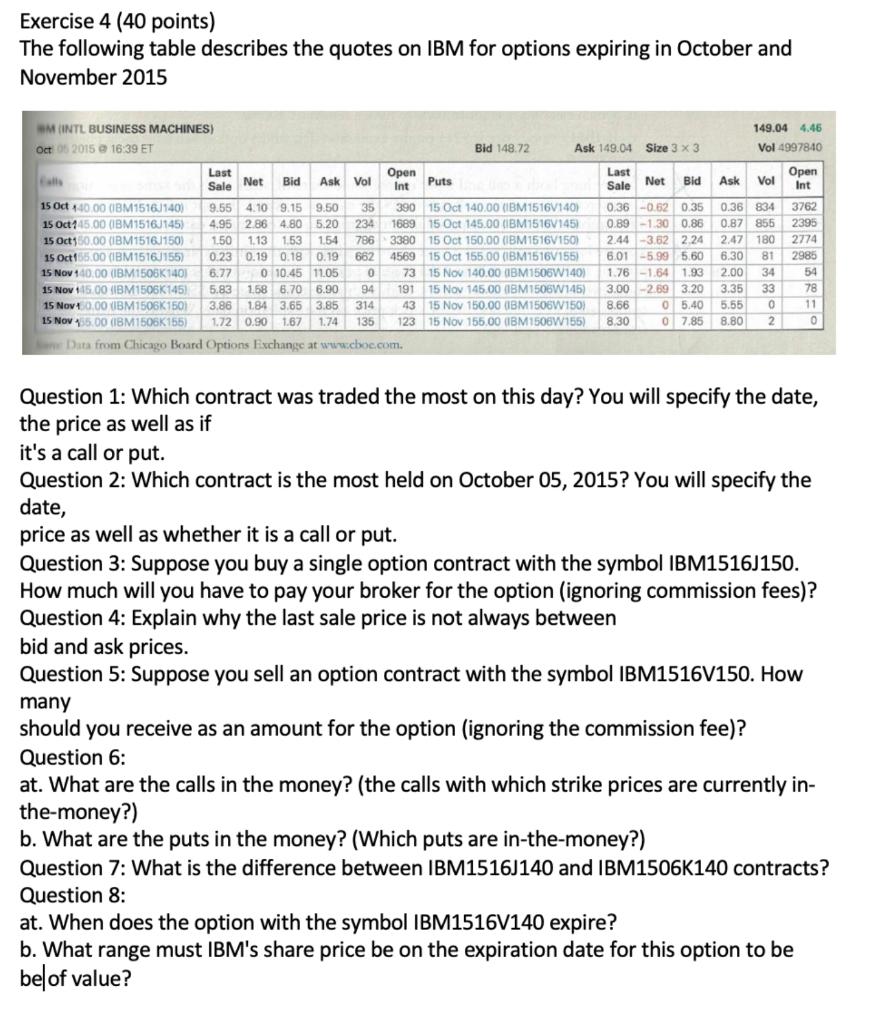

Exercise 4 (40 points) The following table describes the quotes on IBM for options expiring in October and November 2015 149.04 4.46 Vol 4997840 Open Int Sale Net Ask Vol MINTL BUSINESS MACHINES) Oct 2015 @ 16:39 ET Bid 148.72 Ask 149.04 Size 3 x 3 Last Open Last Sale Net Bid Ask Vol Int Puts Bid 15 Oct 10 00 (BM1516140) 9.55 4.10 9.15 9.50 35 390 15 Oct 140.00 (BM1516V140) 0.36 -0.52 0.35 15 Oct145.00 (BM1516145) 4.95 2.86 4.80 5.20 234 1689 15 Oct 145.00 (BM1516V145) 0.89 -1.30 0.86 15 Oct150.00 (BM1516150) 1.50 1.13 1.53 1.54 786 3380 15 Oct 150.00 (BM1516V150) 2.44 -3.52 2.24 4.44 15 Oct155.00 (BM1516J155) 0.23 0.19 0.18 0.19 662 4569 15 Oct 155,00 (BM1516V155) 6.01 -5.99 5.60 15 Nov 140.00 (BM1506K1401 6.77 0 10.45 11.05 0 73 15 Nov 140,00 (BM1506W140) 1.76 1.93 15 Nov 115.00 (BM1506K145) 5.83 158 6.70 6.90 94 191 15 Nov 145,00 18M1506W145) 3.00 -2.69 3.20 15 Nov 10,00 (IBM1506K1501 3,86 1.84 3.65 3.85 314 43 15 Nov 150.00 IBM1506W150) 8.66 0 5.40 15 Nov 15.00 (BM1506K155) 172 0.90 167 1.74 135 123 15 Nov 155,00 (BM1506W155) 8.30 o 7.85 Data from Chicago Board Options Exchange at www.boe.com 0.36 0.87 2.47 6.30 2.00 3.35 5.55 8.80 -1.64 834 855 180 81 34 33 O 2 3762 2395 2774 2985 54 28 18 11 Question 1: Which contract was traded the most on this day? You will specify the date, the price as well as if it's a call or put. Question 2: Which contract is the most held on October 05, 2015? You will specify the date, price as well as whether it is a call or put. Question 3: Suppose you buy a single option contract with the symbol IBM1516J150. How much will you have to pay your broker for the option (ignoring commission fees)? Question 4: Explain why the last sale price is not always between bid and ask prices. Question 5: Suppose you sell an option contract with the symbol IBM1516V150. How many should you receive as an amount for the option (ignoring the commission fee)? Question 6: at. What are the calls in the money? (the calls with which strike prices are currently in- the-money?) b. What are the puts in the money? (Which puts are in-the-money?) Question 7: What is the difference between IBM1516J140 and IBM1506K140 contracts? Question 8: at. When does the option with the symbol IBM1516V140 expire? b. What range must IBM's share price be on the expiration date for this option to be belof value? Exercise 4 (40 points) The following table describes the quotes on IBM for options expiring in October and November 2015 149.04 4.46 Vol 4997840 Open Int Sale Net Ask Vol MINTL BUSINESS MACHINES) Oct 2015 @ 16:39 ET Bid 148.72 Ask 149.04 Size 3 x 3 Last Open Last Sale Net Bid Ask Vol Int Puts Bid 15 Oct 10 00 (BM1516140) 9.55 4.10 9.15 9.50 35 390 15 Oct 140.00 (BM1516V140) 0.36 -0.52 0.35 15 Oct145.00 (BM1516145) 4.95 2.86 4.80 5.20 234 1689 15 Oct 145.00 (BM1516V145) 0.89 -1.30 0.86 15 Oct150.00 (BM1516150) 1.50 1.13 1.53 1.54 786 3380 15 Oct 150.00 (BM1516V150) 2.44 -3.52 2.24 4.44 15 Oct155.00 (BM1516J155) 0.23 0.19 0.18 0.19 662 4569 15 Oct 155,00 (BM1516V155) 6.01 -5.99 5.60 15 Nov 140.00 (BM1506K1401 6.77 0 10.45 11.05 0 73 15 Nov 140,00 (BM1506W140) 1.76 1.93 15 Nov 115.00 (BM1506K145) 5.83 158 6.70 6.90 94 191 15 Nov 145,00 18M1506W145) 3.00 -2.69 3.20 15 Nov 10,00 (IBM1506K1501 3,86 1.84 3.65 3.85 314 43 15 Nov 150.00 IBM1506W150) 8.66 0 5.40 15 Nov 15.00 (BM1506K155) 172 0.90 167 1.74 135 123 15 Nov 155,00 (BM1506W155) 8.30 o 7.85 Data from Chicago Board Options Exchange at www.boe.com 0.36 0.87 2.47 6.30 2.00 3.35 5.55 8.80 -1.64 834 855 180 81 34 33 O 2 3762 2395 2774 2985 54 28 18 11 Question 1: Which contract was traded the most on this day? You will specify the date, the price as well as if it's a call or put. Question 2: Which contract is the most held on October 05, 2015? You will specify the date, price as well as whether it is a call or put. Question 3: Suppose you buy a single option contract with the symbol IBM1516J150. How much will you have to pay your broker for the option (ignoring commission fees)? Question 4: Explain why the last sale price is not always between bid and ask prices. Question 5: Suppose you sell an option contract with the symbol IBM1516V150. How many should you receive as an amount for the option (ignoring the commission fee)? Question 6: at. What are the calls in the money? (the calls with which strike prices are currently in- the-money?) b. What are the puts in the money? (Which puts are in-the-money?) Question 7: What is the difference between IBM1516J140 and IBM1506K140 contracts? Question 8: at. When does the option with the symbol IBM1516V140 expire? b. What range must IBM's share price be on the expiration date for this option to be belof value