Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 4 (LO 4) Approaches to the allocation of profits and losses. Medina, Har- ris, and Anderson are partners in Entertainment Systems. The partnership earned

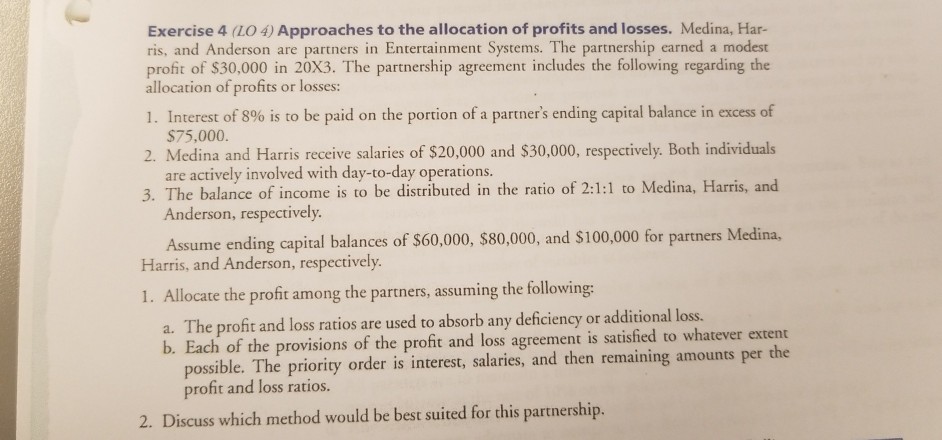

Exercise 4 (LO 4) Approaches to the allocation of profits and losses. Medina, Har- ris, and Anderson are partners in Entertainment Systems. The partnership earned a modest profit of S30,000 in 20X3. The partnership agreement includes the following regarding the allocation of profits or losses: 1. Interest of 8% is to be paid on the portion of a partner's ending capital balance in excess of $75,000 are actively involved with day-to-day operations. Anderson, respectively. Assume ending capital balances of $60,000, $80,000, and $100,000 for partners Medina. 2. Medina and Harris receive salaries of $20,000 and $30,000, respectively. Both individuals 3. The balance of income is to be distributed in the ratio of 2:1:1 to Medina, Harris, and Harris, and Anderson, respectively. 1. Allocate the profit among the partners, assuming the following a. The profit and loss ratios are used to absorb any deficiency or additional loss. b. Each of the provisions of the profit and loss agreement is satisfied to whatever extent possible. The priority order is interest, salaries, and then remaining amounts per the profit and loss ratios. 2. Discuss which method would be best suited for this partnership

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started