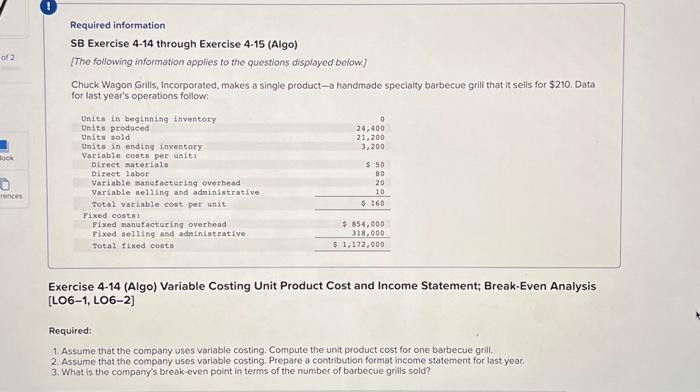

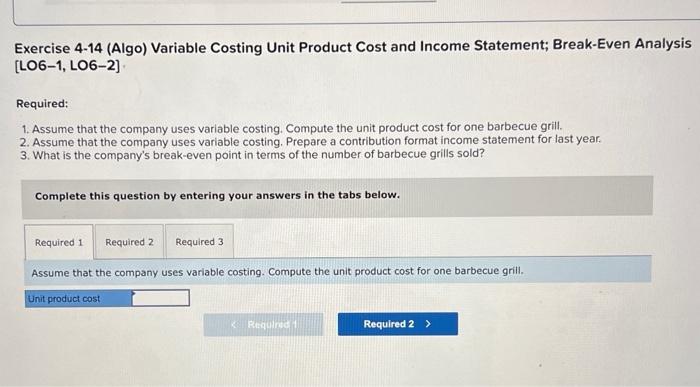

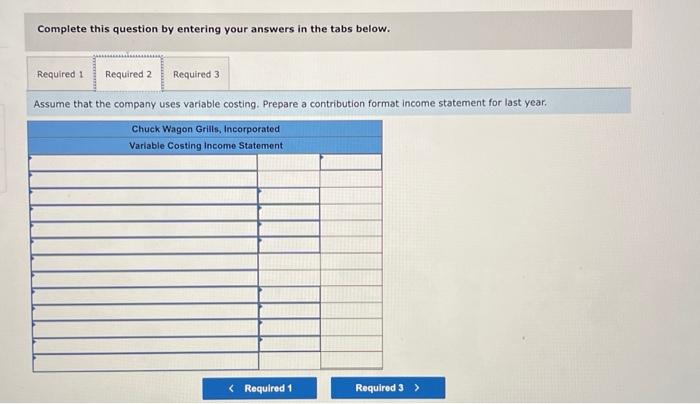

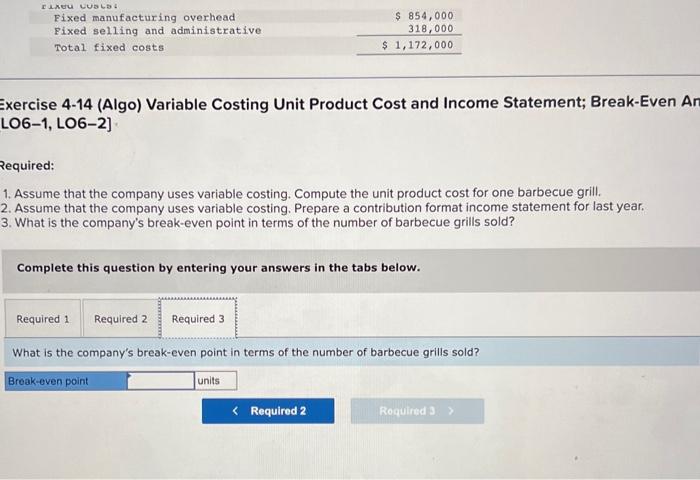

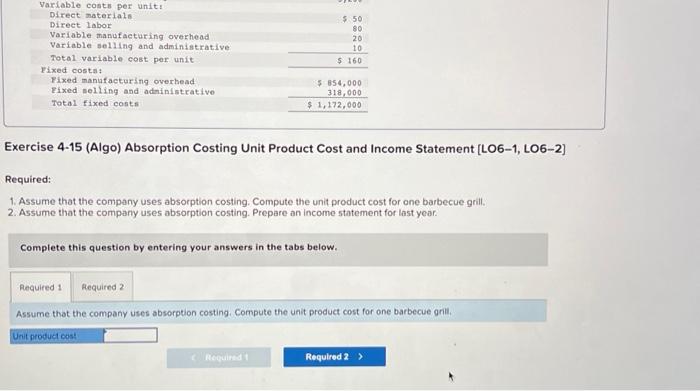

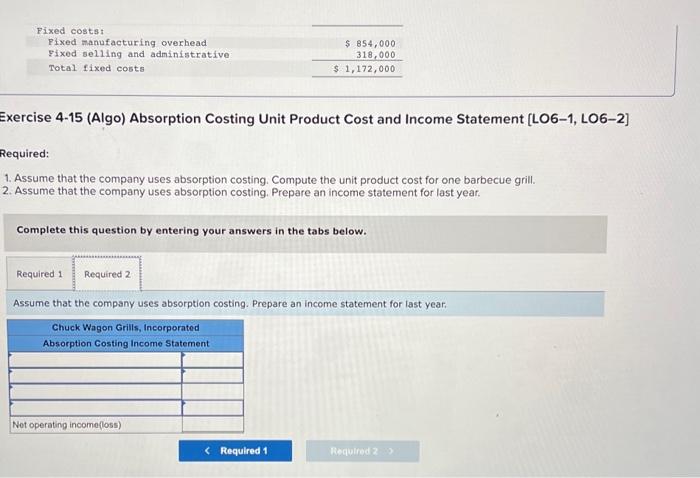

Exercise 4-14 (Algo) Variable Costing Unit Product Cost and Income Statement; Break-Even Analysi [LO6-1, LO6-2] Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill. 2. Assume that the company uses variable costing. Prepare a contribution format income statement for last year. 3. What is the company's break-even point in terms of the number of barbecue grills sold? Complete this question by entering your answers in the tabs below. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill. Exercise 4-15 (Algo) Absorption Costing Unit Product Cost and Income Statement [LO6-1, LO6-2] Required: 1. Assume that the company uses absorption costing. Compute the unit product cost for one barbecue grill. 2. Assume that the company uses absorption costing. Prepare an income statement for last year. Complete this question by entering your answers in the tabs below. Assume that the company uses absorption costing. Compute the unit product cost for one barbecue grill. Exercise 4-14 (Algo) Variable Costing Unit Product Cost and Income Statement; Break-Even A LO6-1, LO6-2] Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill. 2. Assume that the company uses variable costing. Prepare a contribution format income statement for last year. 3. What is the company's break-even point in terms of the number of barbecue grills sold? Complete this question by entering your answers in the tabs below. What is the company's break-even point in terms of the number of barbecue grills sold? Required information SB Exercise 4-14 through Exercise 4-15 (Algo) [The following information applies to the questions displayed below] Chuck Wagon Grills, Incorporated, makes a single product-a handmade specialty barbecue grill that it sells for $210. Data for last year's operations follow: Exercise 4-14 (Algo) Variable Costing Unit Product Cost and Income Statement; Break-Even Analysis [LO6-1, LO6-2] Required: 1. Assume that the company uses variable costing. Compute the unit product cost for one barbecue grill. 2. Assume that the company uses varlable costing. Prepare a contribution format income statement for last yeat. 3. What is the company's break-even point in terms of the number of barbecue grills sold? xercise 4-15 (Algo) Absorption Costing Unit Product Cost and Income Statement [LO6-1, LO6-2] equired: 1. Assume that the company uses absorption costing. Compute the unit product cost for one barbecue grill. . Assume that the company uses absorption costing. Prepare an income statement for last year. Complete this question by entering your answers in the tabs below. Assume that the company uses absorption costing. Prepare an income statement for last year. Complete this question by entering your answers in the tabs below. Assume that the company uses variable costing. Prepare a contribution format income statement for last year