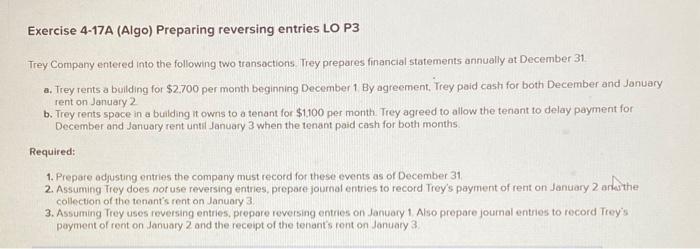

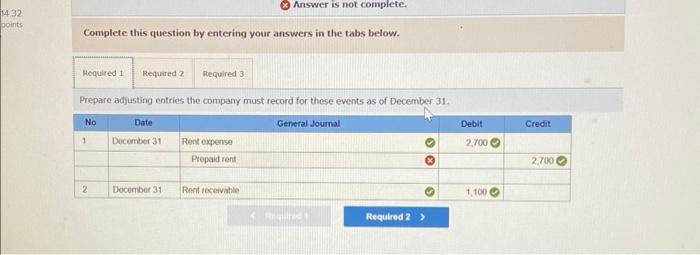

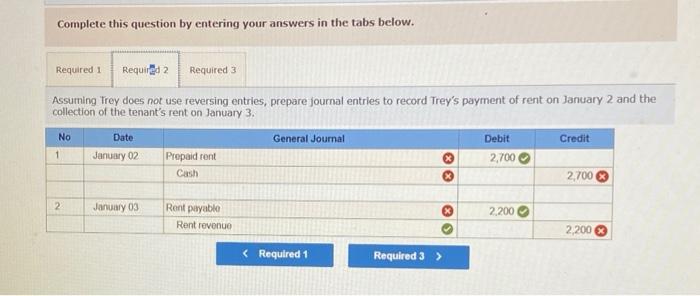

Exercise 4-17A (Algo) Preparing reversing entries LO P3 Trey Company entered into the following two transactions. Trey prepares financial statements annually at -December 31 a. Trey rents a building for $2.700 per month beginning December 1 By agreement. Trey paid cash for both December and January rent on January 2 b. Trey rents space in a bualding it owns to a tenant for $1,100 per month. Trey agreed to allow the tenant to delay payment for December and January rent until January 3 when the tenant paid cash for both months. Required: 1. Prepare adjusting entries the company must record for these events as of December 31 2. Assuming Trey does nor use reversing entries, prepare journal entries to record Trey's payment of rent on January 2 anduthe collection of the tenant's rent on January 3. 3. Assuming Trey uses reversing entries, prepore reversing entries on January 1. Also prepare journal entries to record Trey's payment of rent on January 2 and the receipt of the tenant's rent on Januaty 3 Complete this question by entering your answers in the tabs below. Prepare adjusting entries the company must record for these events as of December 31 . Complete this question by entering your answers in the tabs below. Assuming Trey does not use reversing entries, prepare journal entries to record Trey's payment of rent on January 2 and the collection of the tenant's rent on January 3 . Assuming Trey uses reversing entries, prepare reversing entries on lanuary 1. Also prepare journal entries to record Trey's payment of rent on January 2 and the receipt of the tenant's rent on January 3. Exercise 4-17A (Algo) Preparing reversing entries LO P3 Trey Company entered into the following two transactions. Trey prepares financial statements annually at -December 31 a. Trey rents a building for $2.700 per month beginning December 1 By agreement. Trey paid cash for both December and January rent on January 2 b. Trey rents space in a bualding it owns to a tenant for $1,100 per month. Trey agreed to allow the tenant to delay payment for December and January rent until January 3 when the tenant paid cash for both months. Required: 1. Prepare adjusting entries the company must record for these events as of December 31 2. Assuming Trey does nor use reversing entries, prepare journal entries to record Trey's payment of rent on January 2 anduthe collection of the tenant's rent on January 3. 3. Assuming Trey uses reversing entries, prepore reversing entries on January 1. Also prepare journal entries to record Trey's payment of rent on January 2 and the receipt of the tenant's rent on Januaty 3 Complete this question by entering your answers in the tabs below. Prepare adjusting entries the company must record for these events as of December 31 . Complete this question by entering your answers in the tabs below. Assuming Trey does not use reversing entries, prepare journal entries to record Trey's payment of rent on January 2 and the collection of the tenant's rent on January 3 . Assuming Trey uses reversing entries, prepare reversing entries on lanuary 1. Also prepare journal entries to record Trey's payment of rent on January 2 and the receipt of the tenant's rent on January 3