Question

Exercise 4-18 Adjusting Journal Entries Mikato Company's annual accounting period ends on June 30, 2012. Mikato makes adjusting journal entries semiannually, and the following information

Exercise 4-18

Adjusting Journal Entries

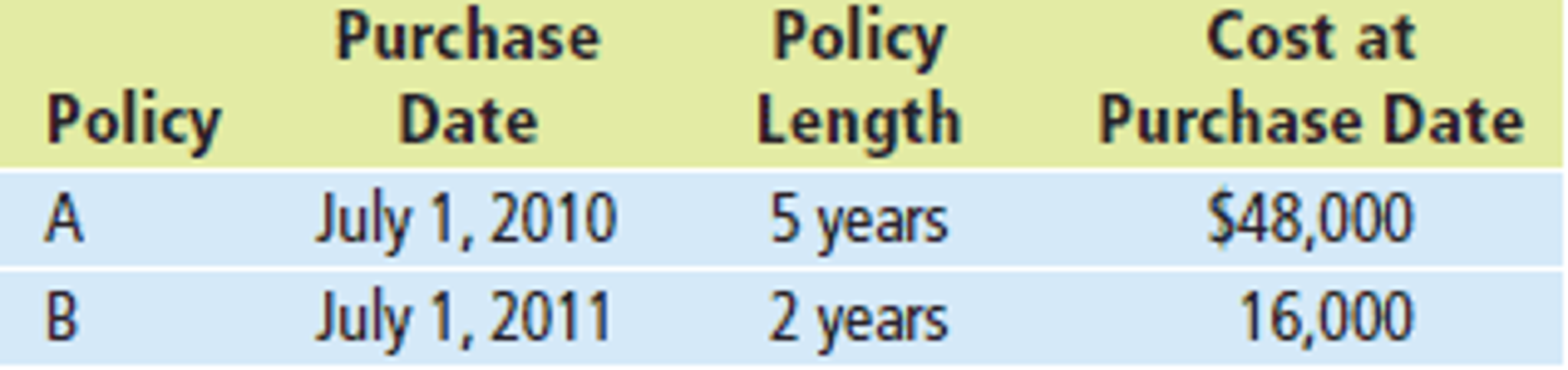

Mikato Company's annual accounting period ends on June 30, 2012. Mikato makes adjusting journal entries semiannually, and the following information applies to all necessary adjusting journal entries at June 30, 2012: Mikato carries the following two insurance policies:

At January 1, 2012, office supplies totaled $1,800. In the past six months, additional supplies of $2,700 were purchased, and a count revealed $2,150 available supplies at June 30, 2012.

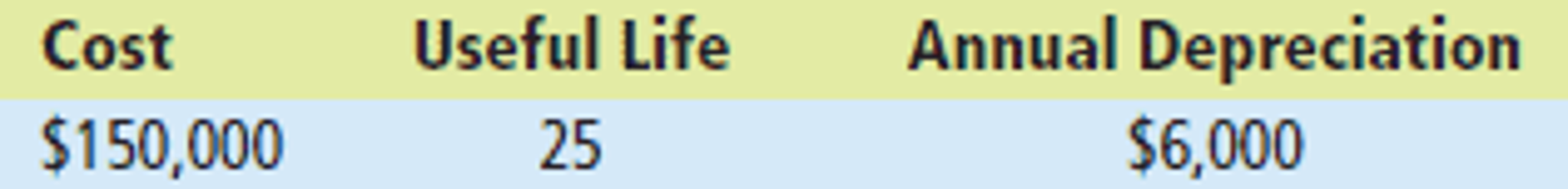

Mikato owns one building:

Mikato decides to rent out a portion of its building. On June 1, 2012, Mikato received a prepayment of $5,700 for rent for the months of June, July, and August.

The Mikato staff consists of seven employees. Each employee earns a total of $1,200 a week and is paid each Monday for the previous week's work. June 30, 2012, falls on Thursday.

Required: Prepare all necessary adjusting entries at June 30, 2012.

Indicate whether each entry relates to a deferred revenue, deferred expense, accrued revenue, or accrued expense.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started