Question

Selected accounts from the ledger of Company A for the fiscal year ended December 31, 2016 are as follows: Based on this information, which of

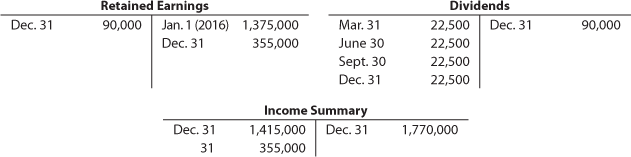

Selected accounts from the ledger of Company A for the fiscal year ended December 31, 2016 are as follows:

Based on this information, which of the following statements are true? (There are multiple correct answers, you must select all the correct answers in order to get full credit for the problem.)

Based on this information, which of the following statements are true? (There are multiple correct answers, you must select all the correct answers in order to get full credit for the problem.)

The increase in Retained Earnings for the year ended December 31, 2016 is greater than $300,000.

Retained Earnings at January 1, 2016 is equal to $1,275,000.

Retained Earnings at December 31, 2016 is equal to $1,540,000.

The increase in Retained Earnings for the year ended December 31, 2016 is equal to $300,000.

Retained Earnings at December 31, 2016 is less than $1,500,000.

Retained Earnings at January 1, 2016 is less than $1,200,000.

The increase in Retained Earnings for the year ended December 31, 2016 is less than $300,000.

Retained Earnings at December 31, 2016 is greater than $1,500,000.

Retained Earnings at January 1, 2016 is greater than $1,200,000.

2.

Consider the following data: Asset Cost = $80,000 Estimated Useful Life = 3 Years Estimated Salvage Value = $7,000 Using the double-declining-balance method, the depreciation in the first year would be:

$54,333.33

None of these answers are correct

$24,333.33

$48,666.67

$36,666.67

$26,666,67

3.

Consider the following data: Silicon Valley Company purchased a truck on January 2 at a cost of $60,000. It is expected to be used for 5 years and to have a salvage value of $5,000 after 120,000 miles of service. The truck was driven 23,000 miles the first year and 25,000 miles the second year. Under the double-declining-balance method, the depreciation expense for the 2nd year would be:

$10,541.67

$11,000.00

None of these answers are correct

$14,400.00

$11,458.33

$18,333.33

$24,000.00

$14,666.67

Dec. 31 Retained Earnings Dividends 90,000 Jan. 1 (2016) 1,375,000 Mar. 31 22,500 Dec. 31 355,000 June 30 22,500 Dec. 31 Sept. 30 22,500 Dec. 31 22,500 Income Summary Dec. 31 1,415,000 Dec. 31 1,770,000 31 355,000 90,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started