Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 5 - 6 Recording merchandise transactions: purchase and sale discounts - perpetual LO 3 Chad Funk is a hair stylist who opened a business

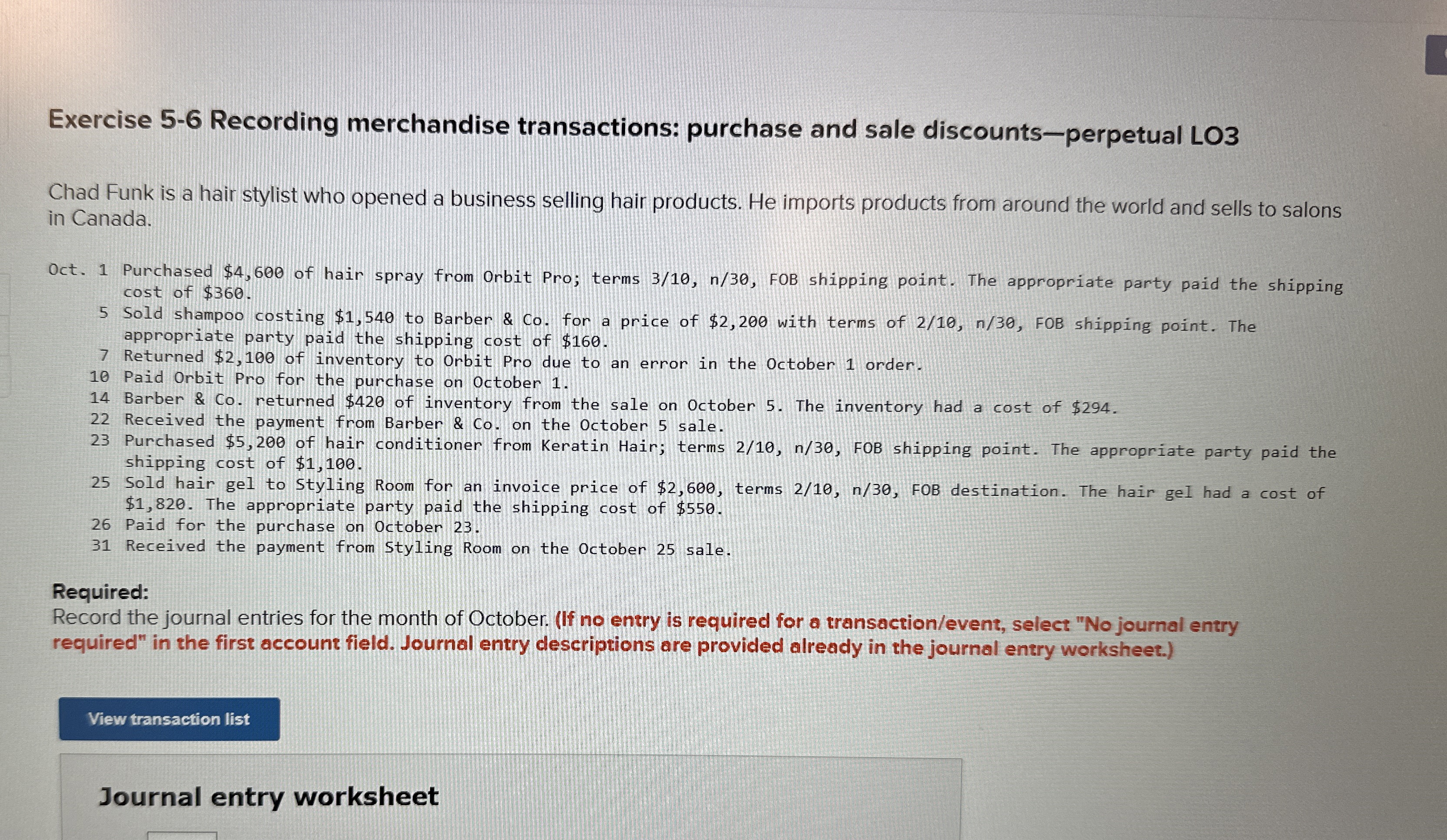

Exercise Recording merchandise transactions: purchase and sale discountsperpetual LO

Chad Funk is a hair stylist who opened a business selling hair products. He imports products from around the world and sells to salons in Canada.

Oct. Purchased $ of hair spray from Orbit Pro; terms FOB shipping point. The appropriate party paid the shipping cost of $

Sold shampoo costing $ to Barber & Co for a price of $ with terms of FOB shipping point. The appropriate party paid the shipping cost of $

Returned $ of inventory to Orbit Pro due to an error in the October order.

Paid Orbit Pro for the purchase on October

Barber & Co returned $ of inventory from the sale on October The inventory had a cost of $

Received the payment from Barber & Co on the October sale.

Purchased $ of hair conditioner from Keratin Hair; terms FOB shipping point. The appropriate party paid the shipping cost of $

Sold hair gel to Styling Room for an invoice price of $ terms FOB destination. The hair gel had a cost of $ The appropriate party paid the shipping cost of $

Paid for the purchase on October

Received the payment from Styling Room on the October sale.

Required:

Record the journal entries for the month of October. If no entry is required for a transactionevent select No journal entry required" in the first account field. Journal entry descriptions are provided already in the journal entry worksheet.

Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started