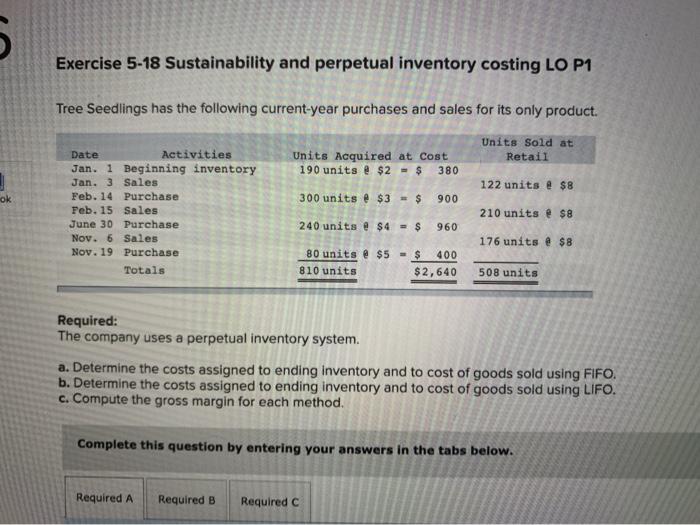

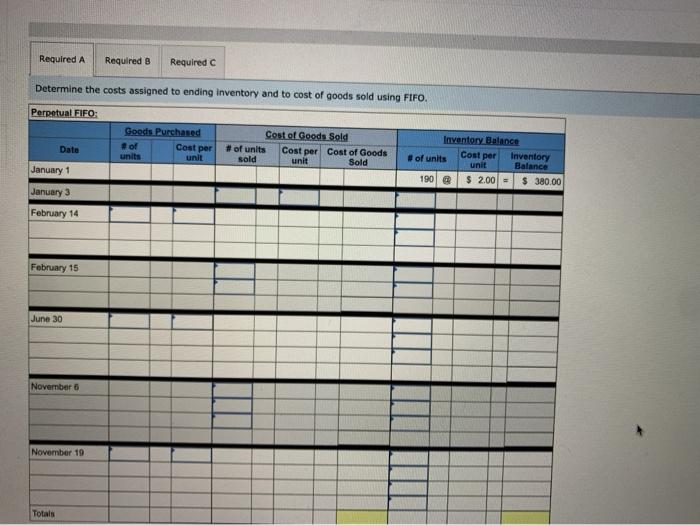

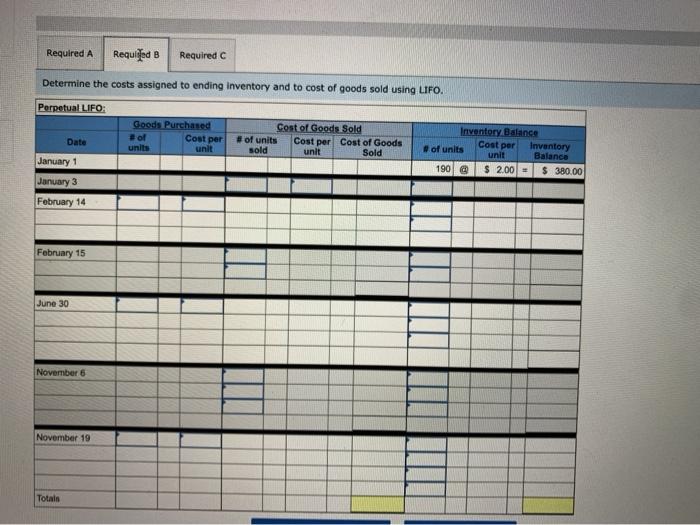

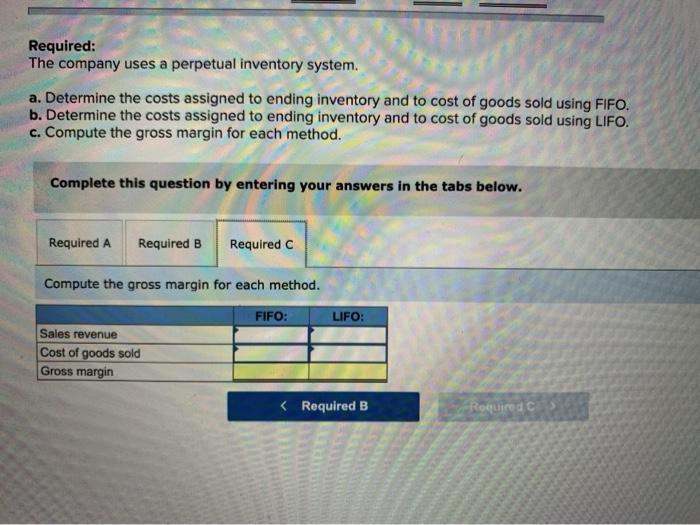

Exercise 5-18 Sustainability and perpetual inventory costing LO P1 Tree Seedlings has the following current-year purchases and sales for its only product. Units Sold at Retail Units Acquired at Cost 190 units @ $2 - $ 380 300 units @ $3 = $ 900 122 units @ $8 ok Date Activities Jan. 1 Beginning inventory Jan. 3 Sales Feb. 14 Purchase Feb. 15 Sales June 30 Purchase Nov. 6 Sales Nov. 19 Purchase Totals 210 units @ $8 240 units @ $4 = $ 960 176 units @ $8 80 units @ $5 810 units = $ 400 $2,640 508 units Required: The company uses a perpetual inventory system. a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. c. Compute the gross margin for each method. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required A Required 8 Required Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. Perpetual FIFO Goods Purchased #of Cost per units unit Data Cost of Goods Sold # of units Cost per Cost of Goods sold unit Sold Inventory Balance Cost per of units Inventory unit Balance 190 $ 2.00 - $ 380.00 January 1 January 3 February 14 February 15 June 30 November 6 November 19 Totals Required A Requised B Required C Determine the costs assigned to ending Inventory and to cost of goods sold using LIFO. Perpetual LIFO Goods Purchased #o Cost per units unit Date Cost of Goods Sold # of units Cost per Cost of Goods sold unit Sold Inventory Balance Cost per Inventory of units unit Balance 190 $ 2.00 $ 380,00 January 1 January 3 February 14 February 15 June 30 November 6 November 19 Total Required: The company uses a perpetual inventory system. a. Determine the costs assigned to ending inventory and to cost of goods sold using FIFO. b. Determine the costs assigned to ending inventory and to cost of goods sold using LIFO. c. Compute the gross margin for each method. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute the gross margin for each method. FIFO: LIFO: Sales revenue Cost of goods sold Gross margin