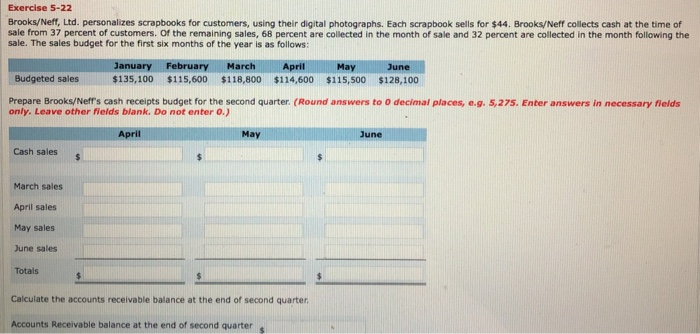

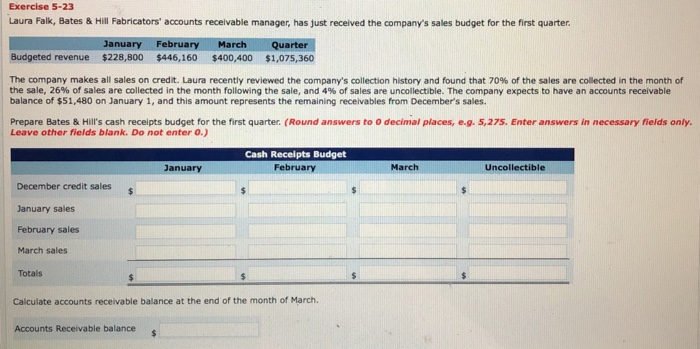

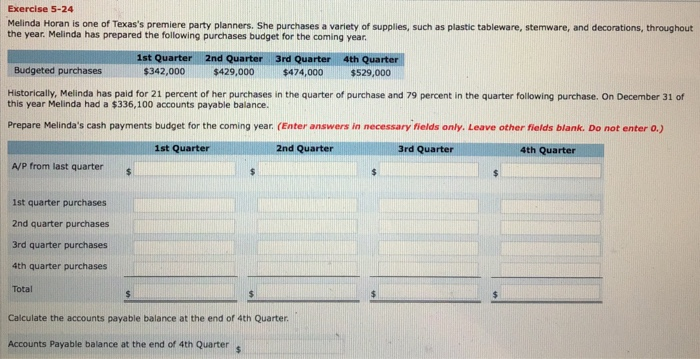

Exercise 5-22 Brooks/Neff, Ltd. personalizes scrapbooks for customers, using their digital photographs. Each scrapbook sells for $44. Brooks/Neff collects cash at the time of sale from 37 percent of customers. Of the remaining sales, 68 percent are collected in the month of sale and 32 percent are collected in the month following the sale. The sales budget for the first six months of the year is as follows: January February March April May June Budgeted sales$135,100 $115,600 $118,800 $114,600 $115,500 $128,100 Prepare Brooks/Neff's cash receipts budget for the second quarter. (Round answers to O decimal places, e.g. 5,275. Enter answers in necessary flelds only. Leave other fields blank. Do not enter o.) April May June Cash sales March sales April sales May sales June sales Totals Calculate the accounts receivable balance at the end of second quarter Accounts Receivable balance at the end of second quarters Exercise 5-23 Laura Falk, Bates & Hill Fabricators' accounts receivable manager, has just received the company's sales budget for the first quarter January February March Quarter Budgeted revenue $228,800 $446,160 $400,400 $1,075,360 The company makes all sales on credit-Laura recently reviewed the company's collection history and found that 70% of the sales are collected in the month of the sale, 26% of sales are collected in the month following the sale, and 4% of sales are uncollectible. The company expects to have an accounts receivable balance of $51,480 on January 1, and this amount represents the remaining receivables from December's sales Prepare Bates & Hill's cash receipts budget for the first quarter. (Round answers to o decimal places, e.g. 5,275. Enter answers in necessary fields only Leave other fields blank. Do not enter o.) Cash Receipts Budget February January March Uncollectible December credit sales January sales February sales March sales Totals Calculate accounts receivable balance at the end of the month of March. Accounts Receivable balance Exercise 5-24 Melinda Horan is one of Texas's premiere party planners. She purchases a variety of supplies, such as plastic tableware, stemware, and decorations, throughout the year. Melinda has prepared the following purchases budget for the coming year 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter $342,000$429,000$474,000 $529,000 Budgeted purchases Historically, Melinda has paid for 21 percent of her purchases in the quarter of purchase and 79 percent in the quarter following purchase. On December 31 of this year Melinda had a $336,100 accounts payable balance. Prepare Melinda's cash payments budget for the coming year. (Enter answers in necessary fields only. Leave other fields blank. Do not enter o.) 1st Quarter d Quarter 3rd Quarter 4th Quarter A/P from last quarters 1st quarter purchases 2nd quarter purchases 3rd quarter purchases 4th quarter purchases Total Calculate the accounts payable balance at the end of 4th Quarter Accounts Payable balance at the end of 4th Quarter s