Answered step by step

Verified Expert Solution

Question

1 Approved Answer

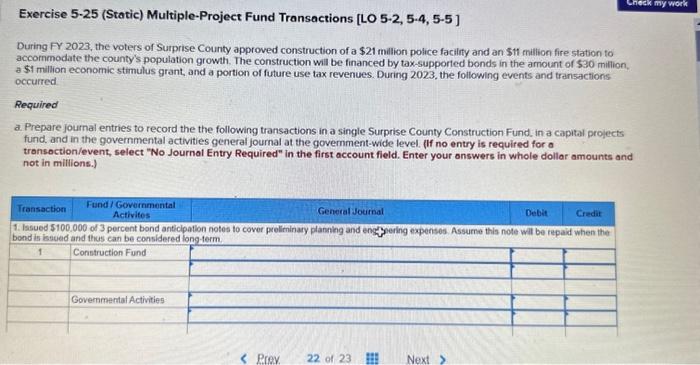

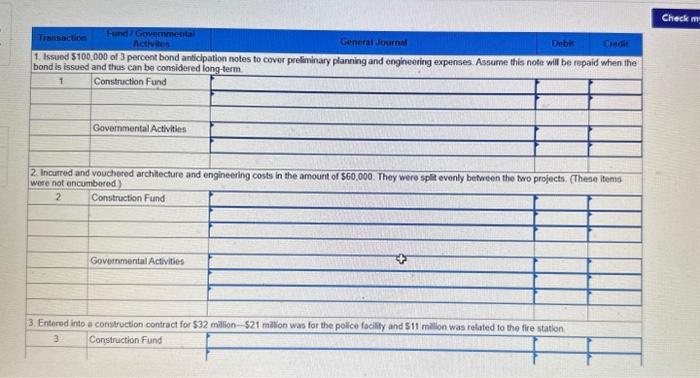

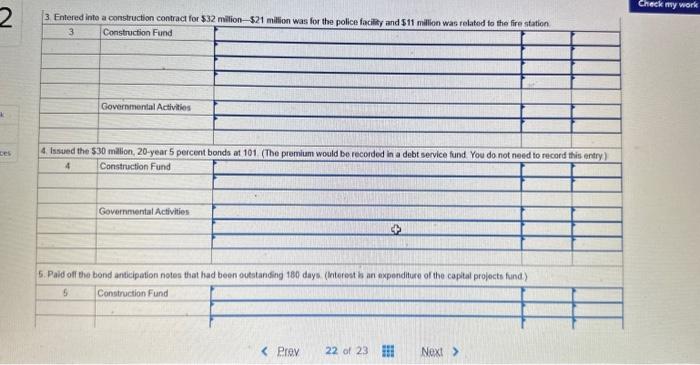

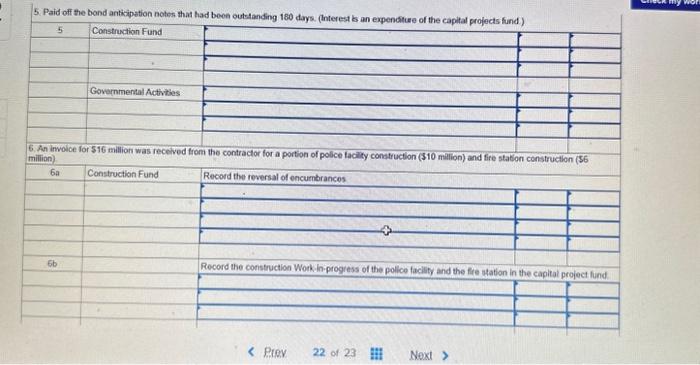

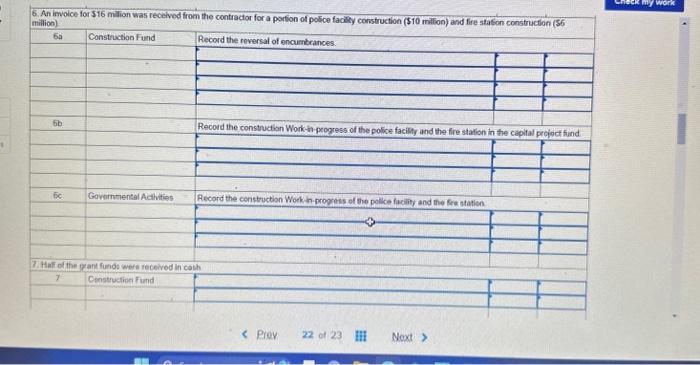

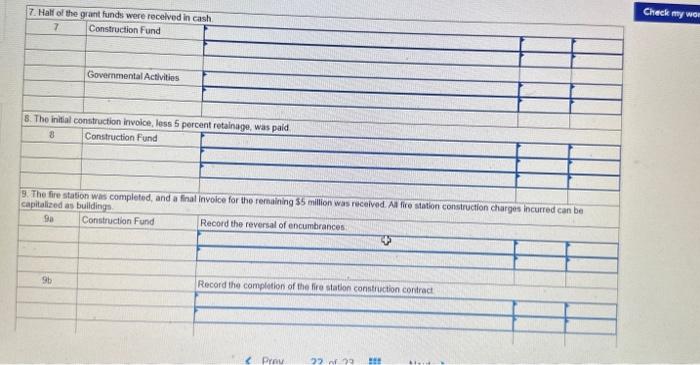

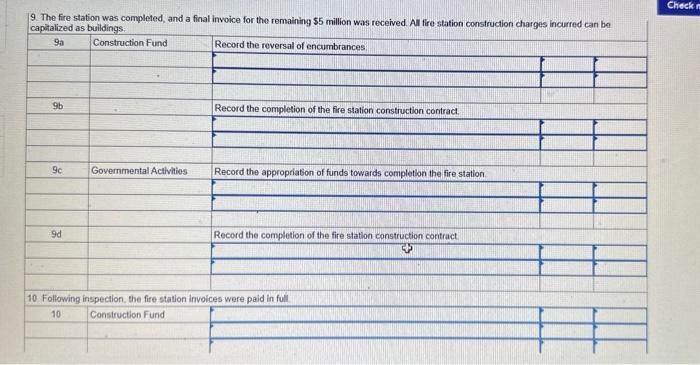

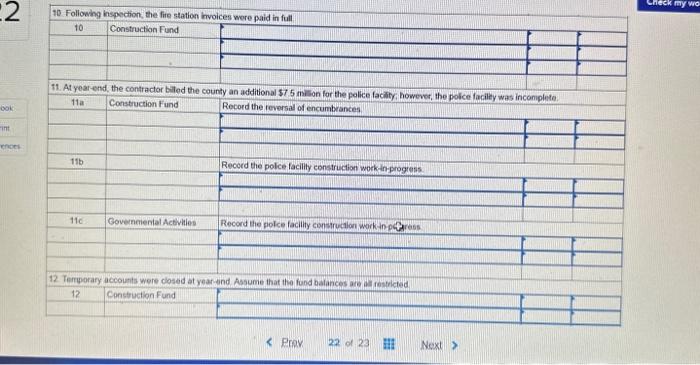

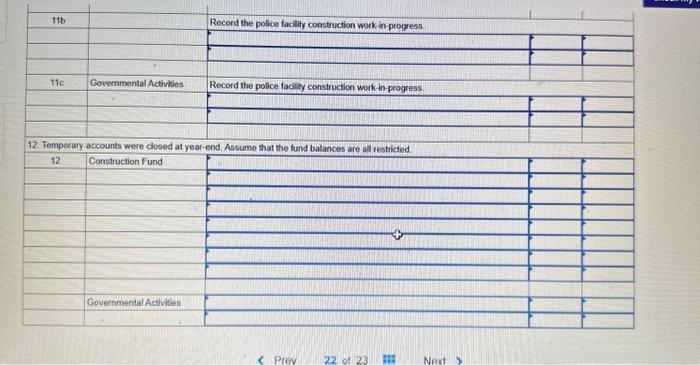

Exercise 5-25 (Static) Multiple-Project Fund Transactions [LO 5-2, 5-4, 5-5 ] During FY 2023 , the voters of Surprise County approved construction of a $21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started