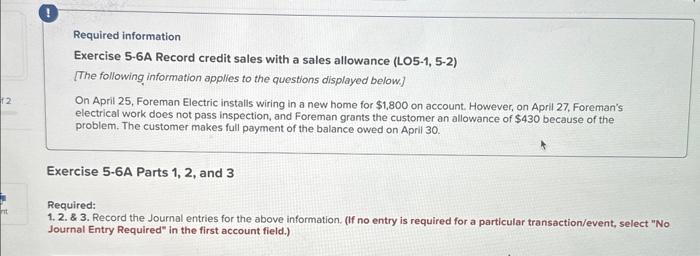

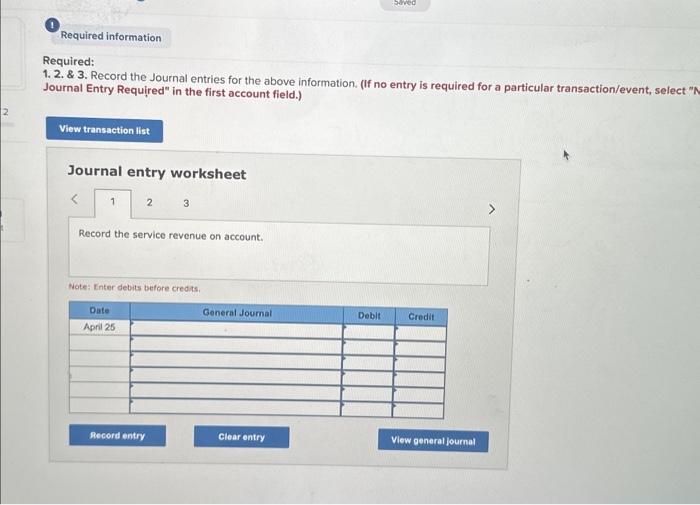

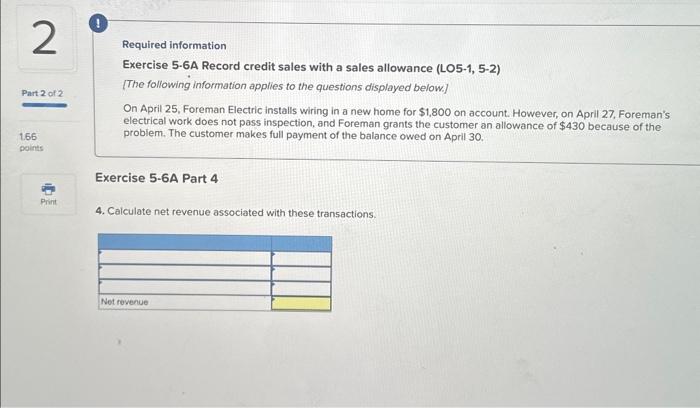

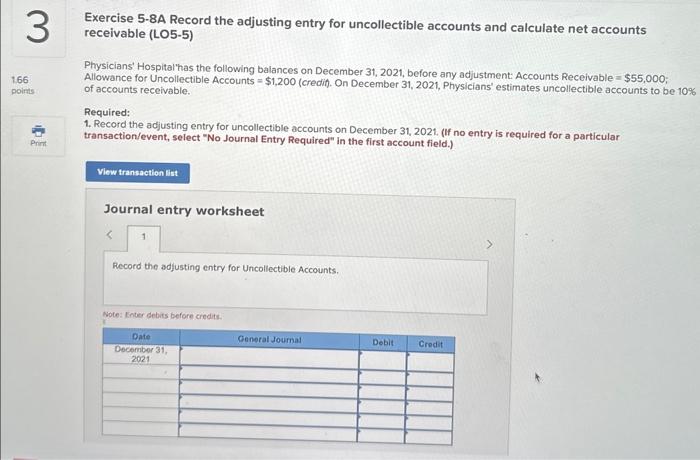

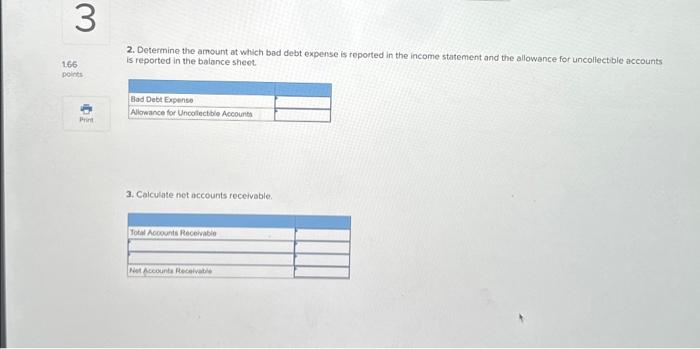

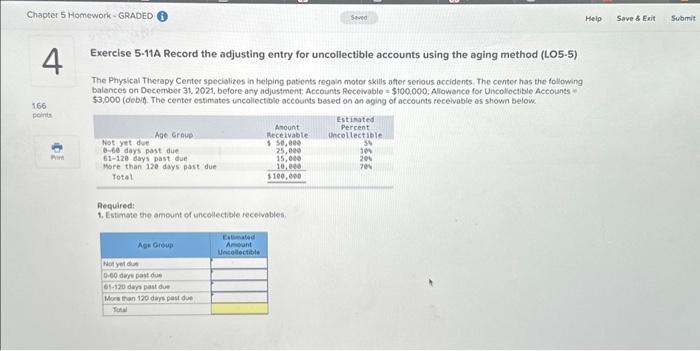

Exercise 5-8A Record the adjusting entry for uncollectible accounts and calculate net accounts receivable (LO5-5) Physicians' Hospital'has the following balances on December 31, 2021, before any adjustment: Accounts Receivable =$55,000; Allowance for Uncollectible Accounts =$1,200 (credit). On December 31,2021 , Physicians' estimates uncollectible accounts to be 10\%: of accounts receivable. Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet Record the adjusting entry for Uncollectible Accounts. required: 1. 2. \& 3. Record the Journal entries for the above information. (If no entry is required for a particular transaction/event, select " Journal Entry Required" in the first account field.) Journal entry worksheet Exercise 5-11A Record the adjusting entry for uncollectible accounts using the aging method (LO5-5) The Physical Therapy Center specializes in helping patients regain motor skills atter serious accidents. The center has the following balances on December 31, 2021, before any adjustment: Accounts feceivable =$100,000, Allowance for Uncolloctible Accounts $3,000 (debih. The center estimates uncoliectiblo accounts based on an aging of accounts receivable as shown below: Required: 1. Estimate the amount of uncellectible receivables: 2. Determine the amount at which bed debt expense is reported in the income statement and the allowance for uncollectible accounts is reported in the balance sheet. 3. Calculate net accounts receivable. Required information Exercise 5.6A Record credit sales with a sales allowance (LO5-1, 5-2) [The following information applies to the questions displayed below] On April 25, Foreman Electric installs wiring in a new home for $1,800 on account. However, on April 27, Foreman's electrical work does not pass inspection, and Foreman grants the customer an allowance of $430 because of the problem. The customer makes full payment of the balance owed on April 30. Exercise 5-6A Part 4 4. Calculate net revenue associated with these transactions. Required information Exercise 5-6A Record credit sales with a sales allowance (LO5-1, 5-2) [The following information applies to the questions displayed below] On April 25, Foreman Electric instalis wiring in a new home for $1,800 on account. However, on April 27, Foreman's electrical work does not pass inspection, and Foreman grants the customer an allowance of $430 because of the problem. The customer makes full payment of the balance owed on April 30. Exercise 5-6A Parts 1, 2, and 3 required: 2. \& 3. Record the Journal entries for the above information. (If no entry is required for a particular transaction/event, select "No lournal Entry Required" in the first account field.)