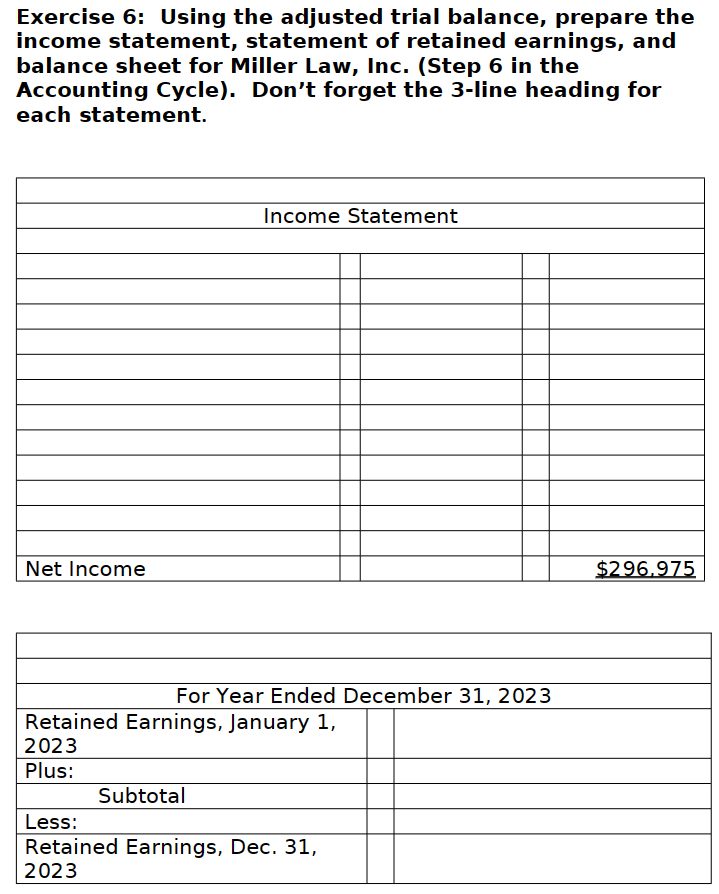

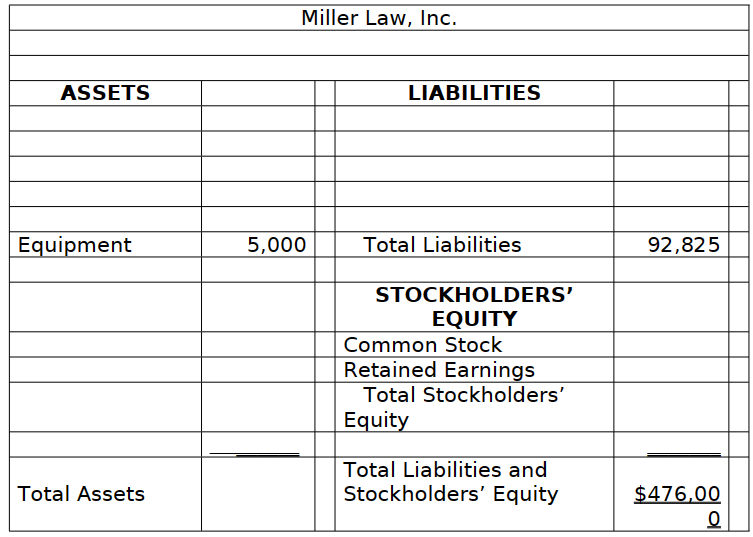

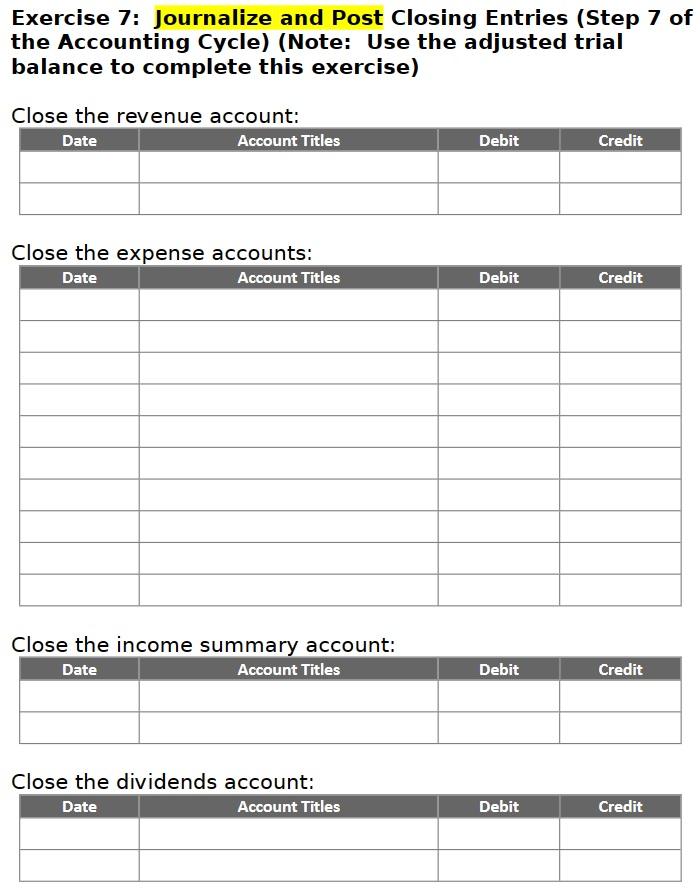

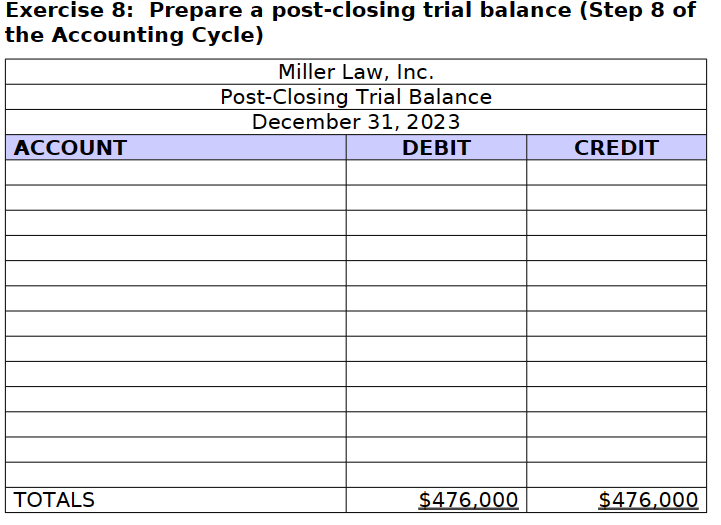

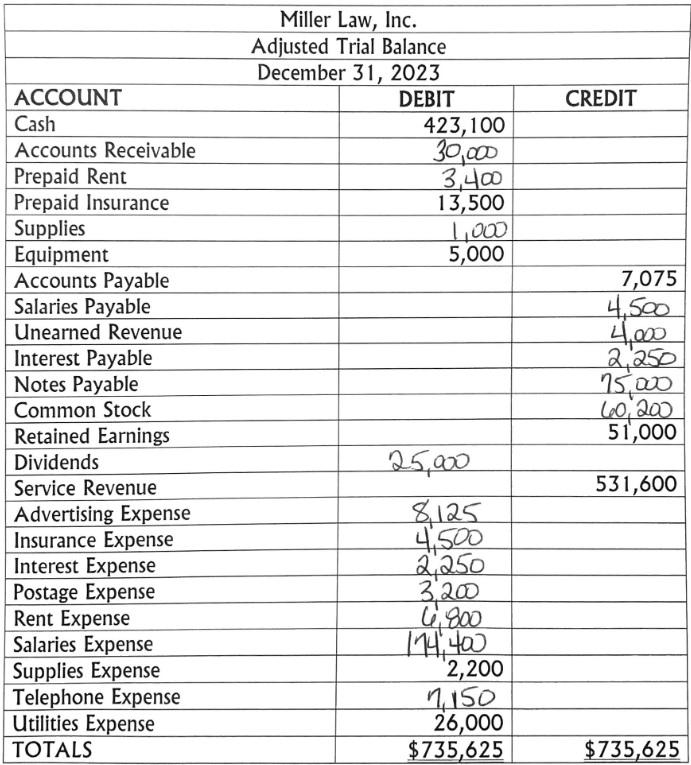

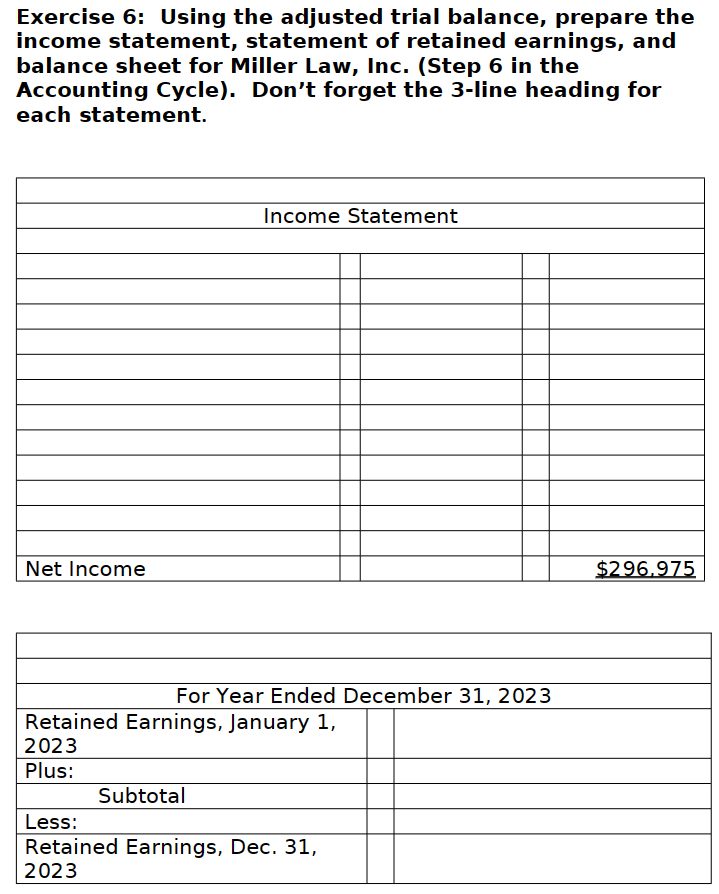

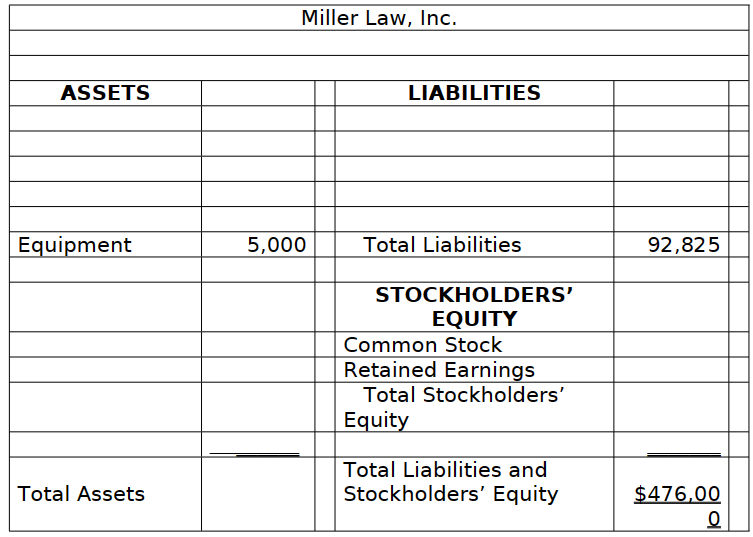

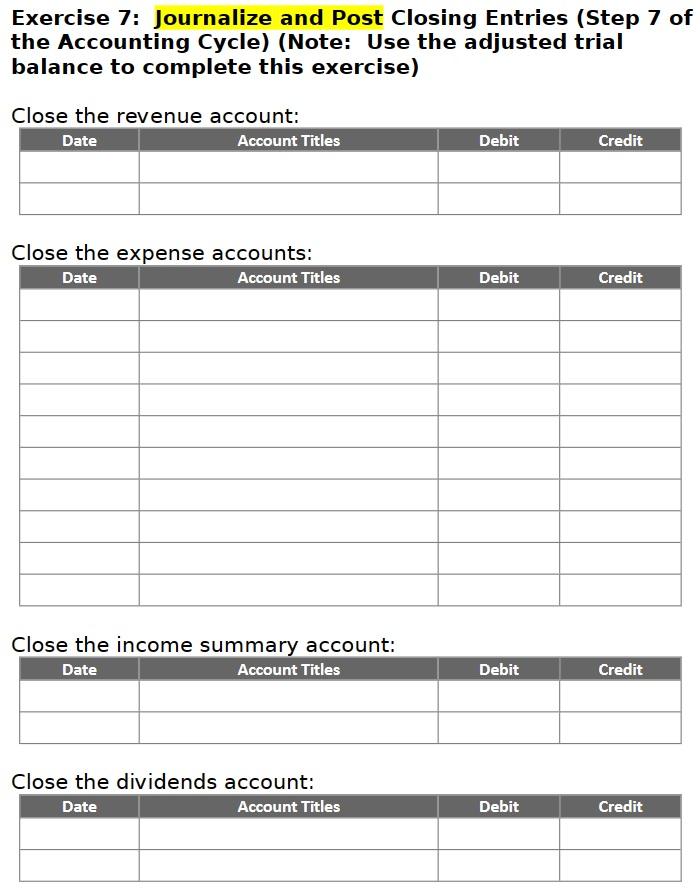

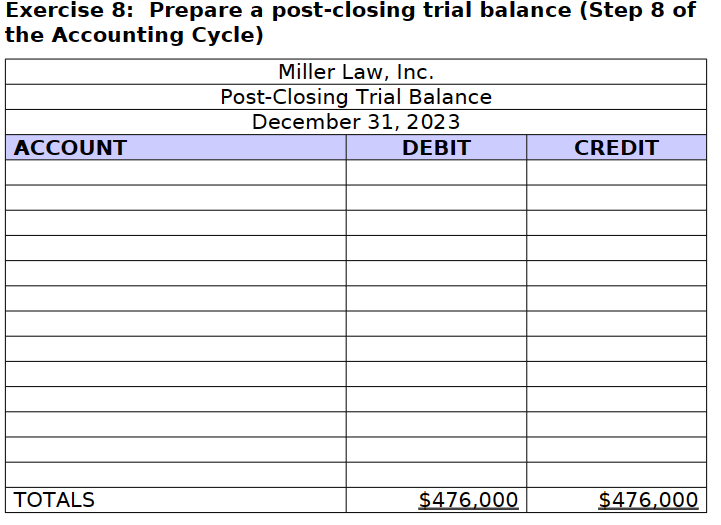

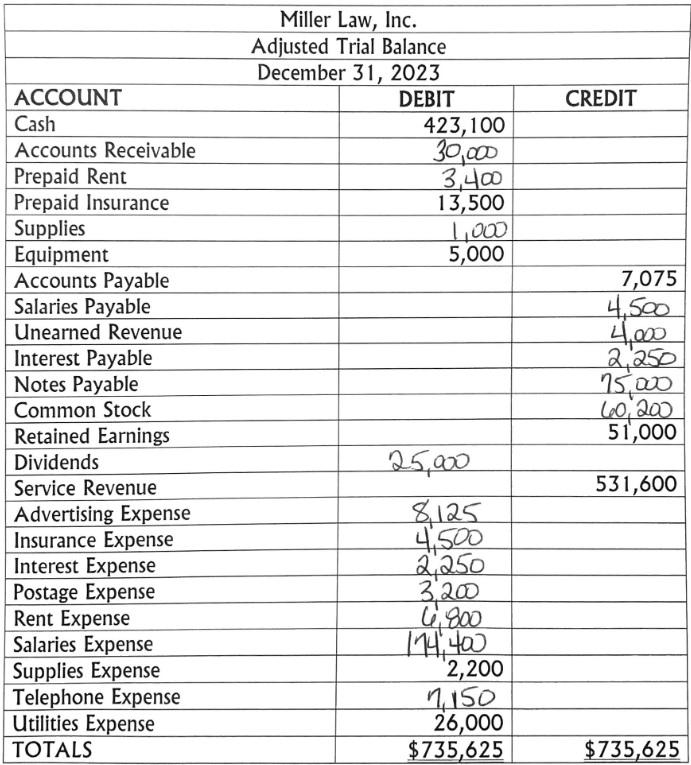

Exercise 6: Using the adjusted trial balance, prepare the income statement, statement of retained earnings, and balance sheet for Miller Law, Inc. (Step 6 in the Accounting Cycle). Don't forget the 3-line heading for each statement. Exercise 7: Journalize and Post Closing Entries (Step 7 of the Accounting Cycle) (Note: Use the adjusted trial balance to complete this exercise) Close the revenue account: Close the exbense accounts: Close the income summary account: Close the dividends account: Exercise 8: Prepare a post-closing trial balance (Step 8 of Miller Law, Inc. Adjusted Trial Balance December 31, 2023 \begin{tabular}{|l|r|r|} \hline ACCOUNT & DEBIT & CREDIT \\ \hline Cash & 423,100 & \\ \hline Accounts Receivable & 30,000 & \\ \hline Prepaid Rent & 3,400 & \\ \hline Prepaid Insurance & 13,500 & \\ \hline Supplies & 1,000 & \\ \hline Equipment & 5,000 & \\ \hline Accounts Payable & & 7,075 \\ \hline Salaries Payable & & 4,500 \\ \hline Unearned Revenue & & 4,000 \\ \hline Interest Payable & & 2,250 \\ \hline Notes Payable & & 75,000 \\ \hline Common Stock & & 60,200 \\ \hline Retained Earnings & & 51,000 \\ \hline Dividends & 25,000 & \\ \hline Service Revenue & 8,125 & 531,600 \\ \hline Advertising Expense & 4,500 & \\ \hline Insurance Expense & 2,250 & \\ \hline Interest Expense & 3,200 & \\ \hline Postage Expense & 6,800 & \\ \hline Rent Expense & 14,400 & \\ \hline Salaries Expense & 2,200 & \\ \hline Supplies Expense & 7,150 & \\ \hline Telephone Expense & 26,000 & \\ \hline Utilities Expense & $735,625 & $735,625 \\ \hline TOTALS & & \\ \hline \end{tabular} Exercise 6: Using the adjusted trial balance, prepare the income statement, statement of retained earnings, and balance sheet for Miller Law, Inc. (Step 6 in the Accounting Cycle). Don't forget the 3-line heading for each statement. Exercise 7: Journalize and Post Closing Entries (Step 7 of the Accounting Cycle) (Note: Use the adjusted trial balance to complete this exercise) Close the revenue account: Close the exbense accounts: Close the income summary account: Close the dividends account: Exercise 8: Prepare a post-closing trial balance (Step 8 of Miller Law, Inc. Adjusted Trial Balance December 31, 2023 \begin{tabular}{|l|r|r|} \hline ACCOUNT & DEBIT & CREDIT \\ \hline Cash & 423,100 & \\ \hline Accounts Receivable & 30,000 & \\ \hline Prepaid Rent & 3,400 & \\ \hline Prepaid Insurance & 13,500 & \\ \hline Supplies & 1,000 & \\ \hline Equipment & 5,000 & \\ \hline Accounts Payable & & 7,075 \\ \hline Salaries Payable & & 4,500 \\ \hline Unearned Revenue & & 4,000 \\ \hline Interest Payable & & 2,250 \\ \hline Notes Payable & & 75,000 \\ \hline Common Stock & & 60,200 \\ \hline Retained Earnings & & 51,000 \\ \hline Dividends & 25,000 & \\ \hline Service Revenue & 8,125 & 531,600 \\ \hline Advertising Expense & 4,500 & \\ \hline Insurance Expense & 2,250 & \\ \hline Interest Expense & 3,200 & \\ \hline Postage Expense & 6,800 & \\ \hline Rent Expense & 14,400 & \\ \hline Salaries Expense & 2,200 & \\ \hline Supplies Expense & 7,150 & \\ \hline Telephone Expense & 26,000 & \\ \hline Utilities Expense & $735,625 & $735,625 \\ \hline TOTALS & & \\ \hline \end{tabular}