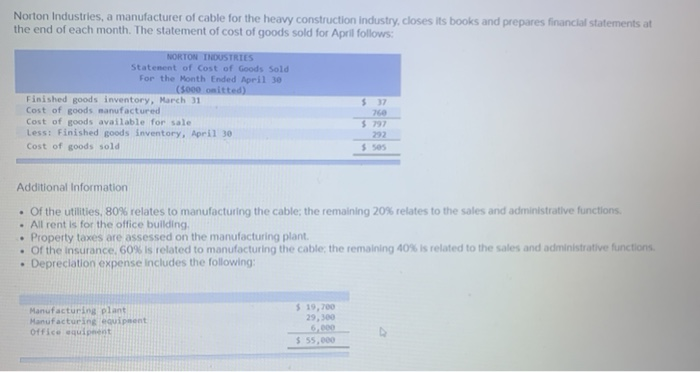

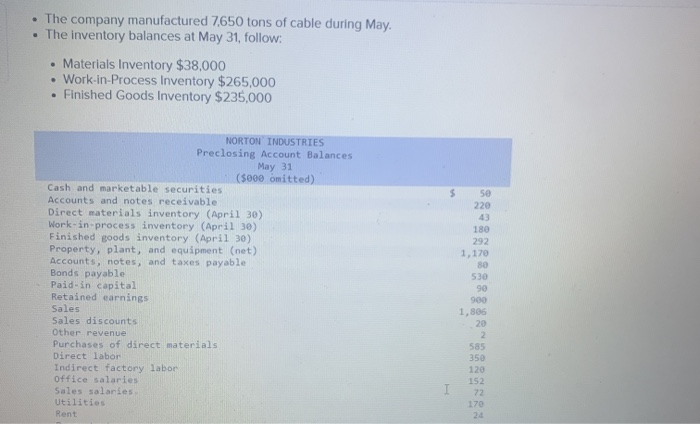

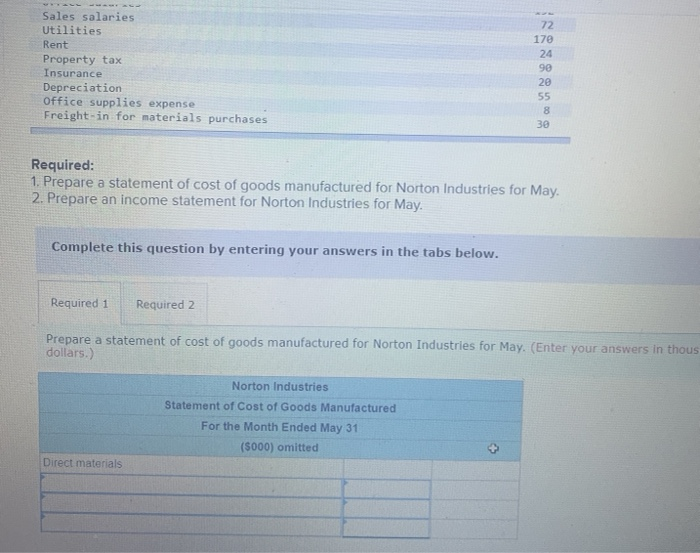

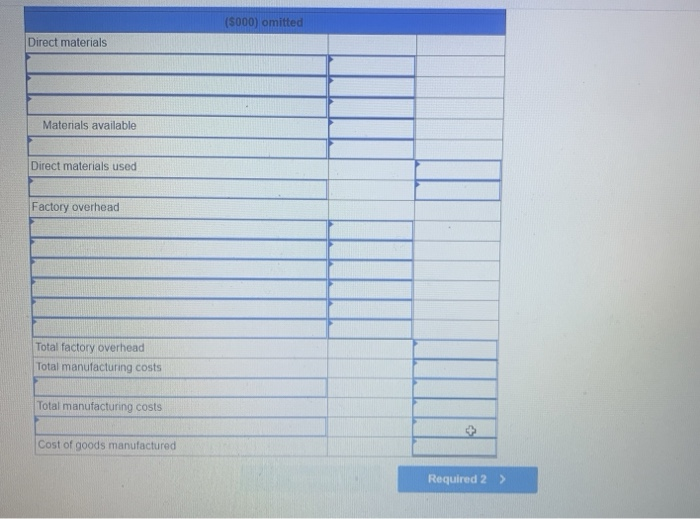

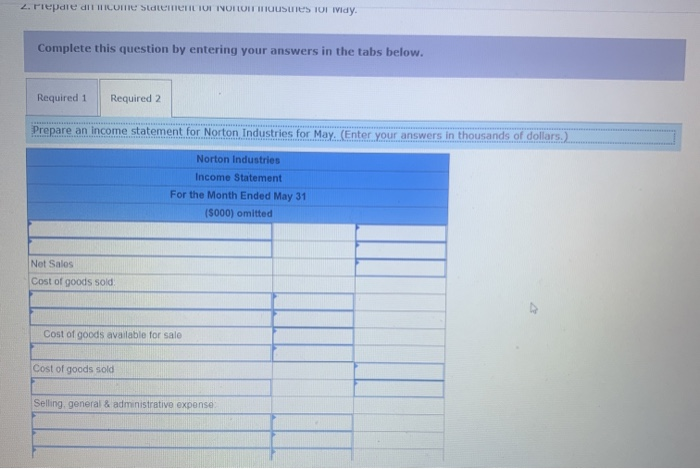

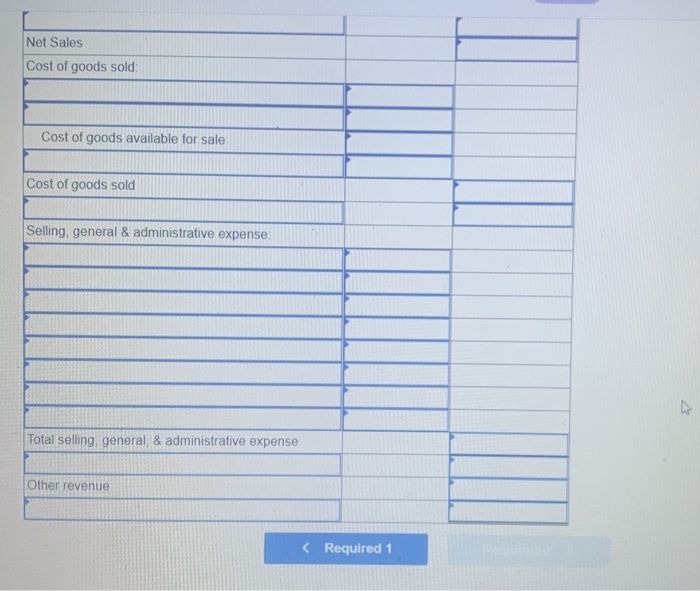

Norton Industries, a manufacturer of cable for the heavy construction industry, closes its books and prepares financial statements at the end of each month. The statement of cost of goods sold for April follows: NORTON TNDUSTRIES Statement of Cost of Goods Sold For the Month Ended April 30 (5000 omitted) Finished goods inventory, March 31 Cost of goods manufactured Cost of goods available for sale Less: Finished goods inventory, April 30 Cost of goods sold $ 37 260 292 $50s Additional Information Of the utilities, 80% relates to manufacturing the cable; the remaining 20% relates to the sales and administrative functions. All rent is for the office building, Property taxes are assessed on the manufacturing plant. or the insurance, 60% is related to manufacturing the cable; the remaining 40% is related to the sales and administrative functions. Depreciation expense includes the following: Manufacturing plant Manufacturing equipment Office equipment $ 19,700 29,300 $ 55,000 The company manufactured 7,650 tons of cable during May. The inventory balances at May 31, follow: Materials Inventory $38,000 Work-in-Process Inventory $265,000 Finished Goods Inventory $235,000 NORTON INDUSTRIES Preclosing Account Balances May 31 (5000 omitted) Cash and marketable securities Accounts and notes receivable Direct materials inventory (April 30) Work-in-process inventory (April 30) Finished goods inventory (April 30) Property, plant, and equipment (net) Accounts, notes, and taxes payable Bonds payable Paid-in capital Retained earnings Sales Sales discounts Other revenue Purchases of direct materials Direct labor Indirect factory labor Office salaries Sales salaries Utilities Rent 50 220 43 180 292 1,170 80 530 90 900 1,806 20 2 585 350 120 152 72 170 24 Sales salaries Utilities Rent Property tax Insurance Depreciation Office supplies expense Freight-in for materials purchases 72 170 24 90 20 55 8 30 Required: 1. Prepare a statement of cost of goods manufactured for Norton Industries for May. 2. Prepare an income statement for Norton Industries for May. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a statement of cost of goods manufactured for Norton Industries for May. (Enter your answers in thous dollars.) Norton Industries Statement of Cost of Goods Manufactured For the Month Ended May 31 (5000) omitted Direct materials (5000) omitted Direct materials Materials available Direct materials used Factory overhead Total factory overhead Total manufacturing costs Total manufacturing costs Cost of goods manufactured Required 2 > 2. Prepare di come Statement TO NOOIT HOUSue's 101 Ividy. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare an income statement for Norton Industries for May. (Enter your answers in thousands of dollars. Norton Industries Income Statement For the Month Ended May 31 (5000) omitted Net Salos Cost of goods sold Cost of goods available for sale Cost of goods sold Selling, general & administrative expense Net Sales Cost of goods sold Cost of goods available for sale Cost of goods sold Selling, general & administrative expense Total selling general, & administrative expense Other revenue