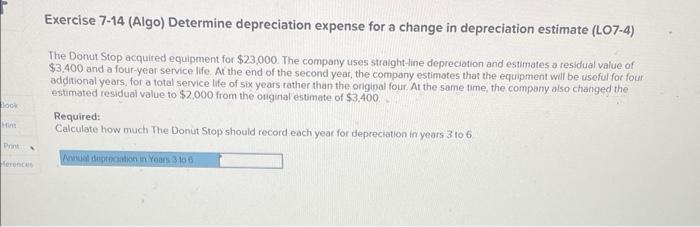

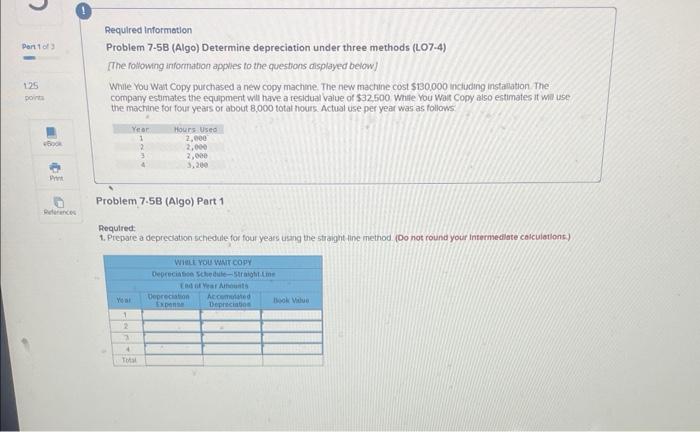

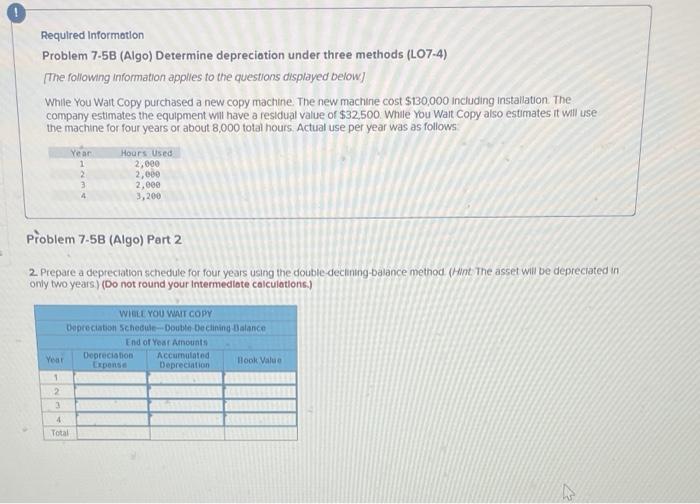

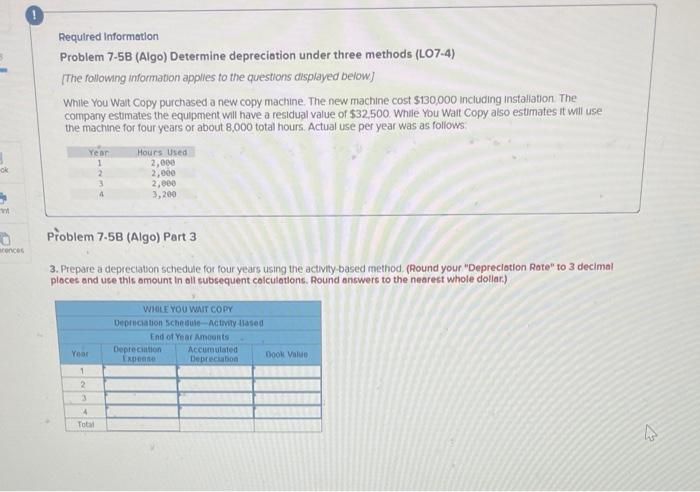

Exercise 7-14 (Algo) Determine depreciation expense for a change in depreciation estimate (LO7-4) The Donut Stop acquired equipment for $23,000. The company uses straight-line depreciation and estimates a residual value of $3.400 and a four-year service life. At the end of the second year, the company estimates that the equipment will be useful for four additional years, for a total service life of six years rather than the origigal four. At the same time, the company also changed the estimated residual value to $2,000 from the onginal estimate of $3,400 Required: Calculate how much The Donut Stop should record each year for deprectation in years 3 to 6 Required information Problem 7-5B (Algo) Determine depreciation under three methods (LO7.4) [The following information appties to the questions displayed below] While You Wat copy purchased a new copy machme. The new machine cost 5130,000 including instanation The company estimates the equipment will have a residual value of $32,500. While you Woit copy also estimates it will use the machine for four years of about 8,000 total nours. Actual use per year was as follows. Problem 7.5B (Algo) Part 1 Pequirect 1. Prepare a deprectation schedule for four years usang the straight line method. (Do not round your Intermediate caiculetions) Required information Problem 7.5B (Algo) Determine depreciotion under three methods (LO7.4) [The following information applies to the questions displayed below] While You Wart Copy purchased a new copy machine. The new machirie cost $130,000 including installation. The company estimates the equipment will have a residual value of $32,500. While You Watt Copy also estimates it will use the machine for four years or about 8,000 total hours Actual use per year was as follows: Problem 7-58 (Algo) Part 2 2. Prepare a depreciation schedule for four years using the double-declinting-balance method (Hint. The asset will be depreciated in only two years) (Do not round your intermediate calculations) Required information Problem 7-5B (Algo) Determine depreciation under three methods (LO7-4) [The following information applies to the questions displayed below] While You Watt Copy purchased a new copy machine. The new machine cost $130,000 including installation. The company estimates the equipment will have a residual value of $32.500. While You Walt copy also estimates it will use the machine for four years or about 8,000 total hours. Actual use per year was as follows: Problem 7.5B (Algo) Part 3 3. Prepare a depreclaton schedule for four years using the activity-based method. (Round your "Depreclotion Rote" to 3 decimal ploces and use this omount in all subsequent colculotions. Round onswers to the nearest whole dollar.)