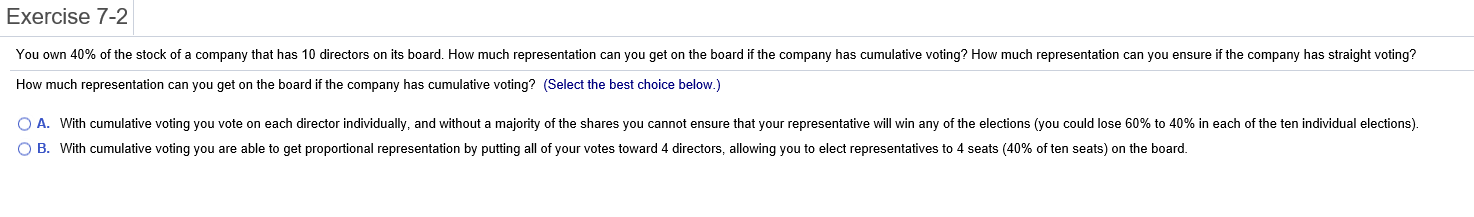

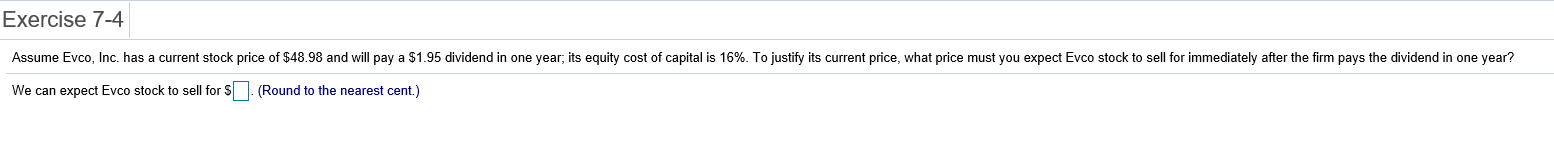

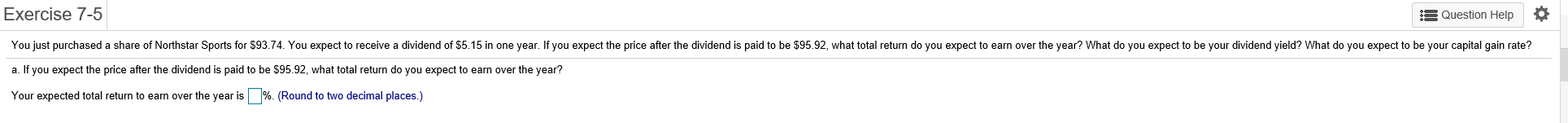

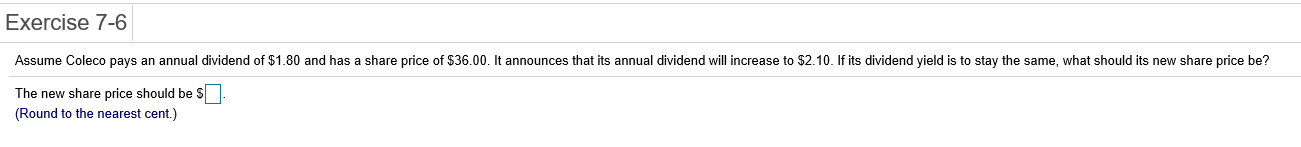

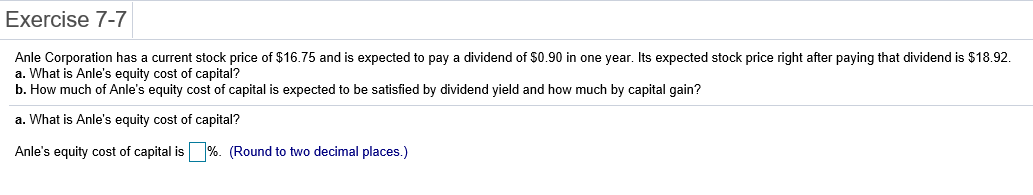

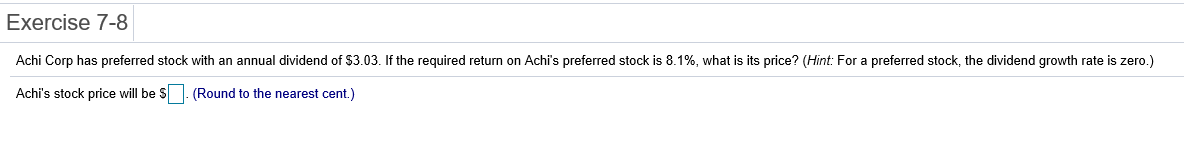

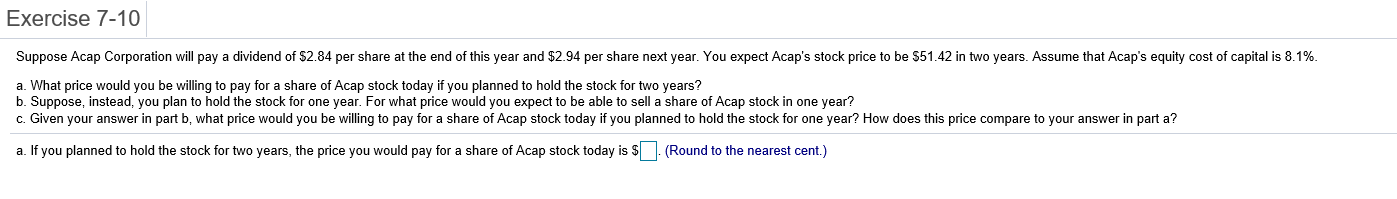

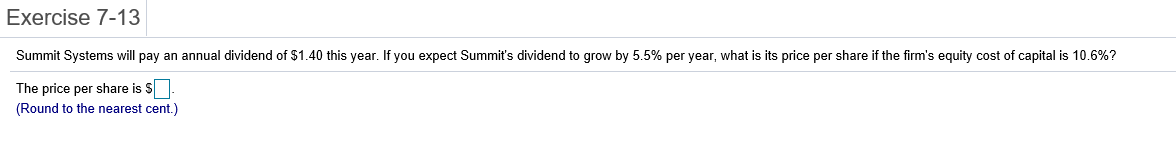

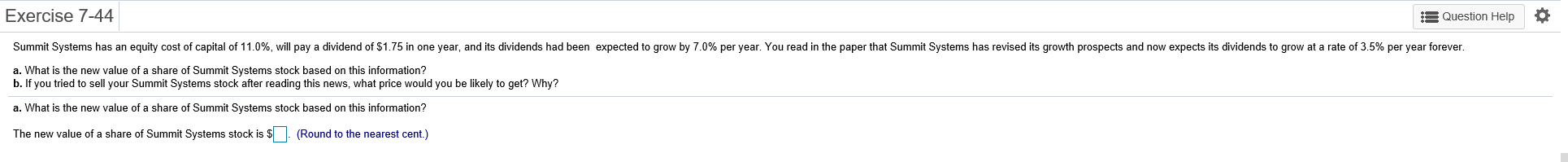

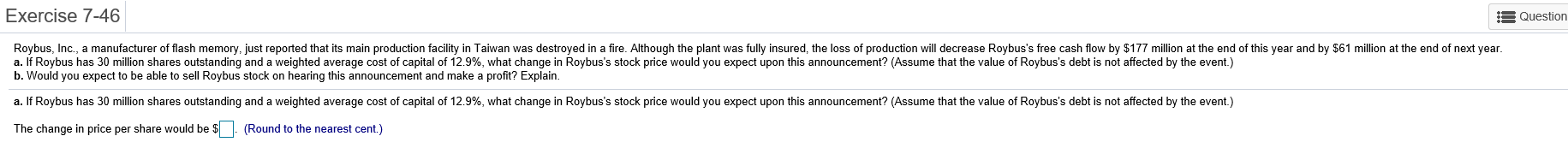

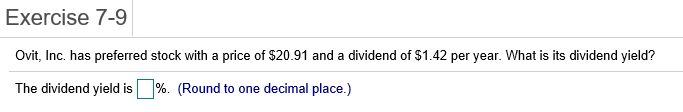

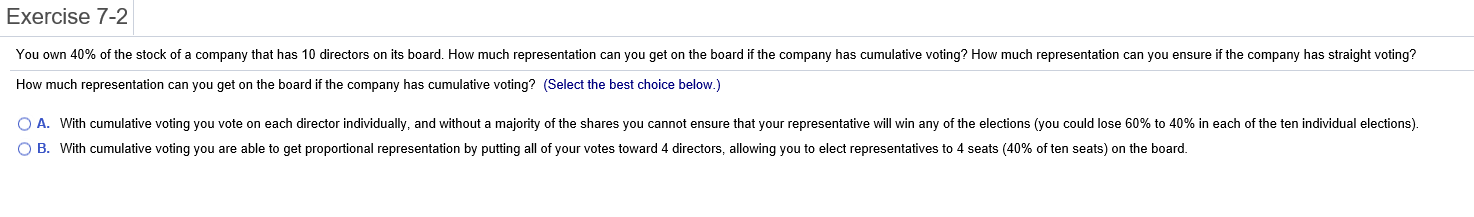

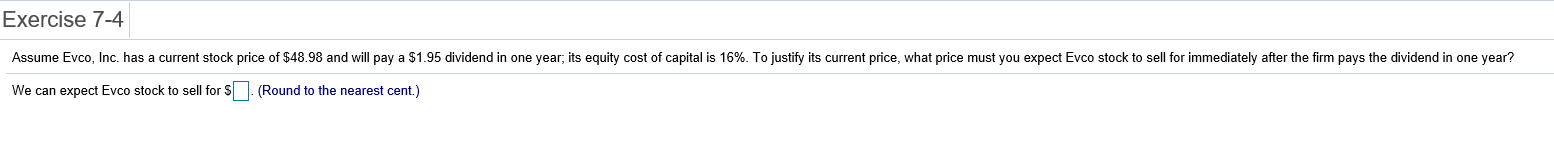

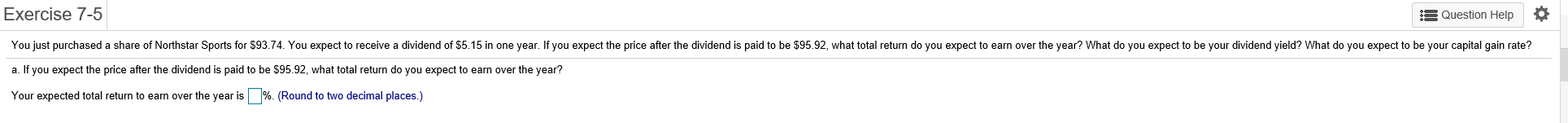

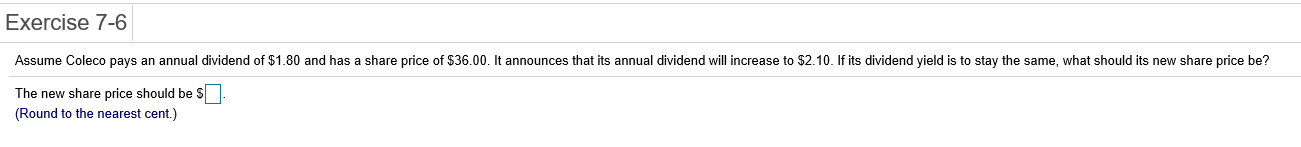

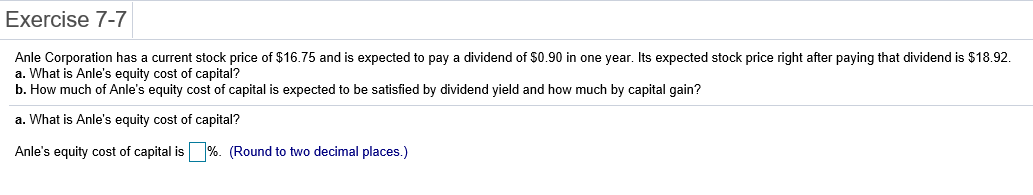

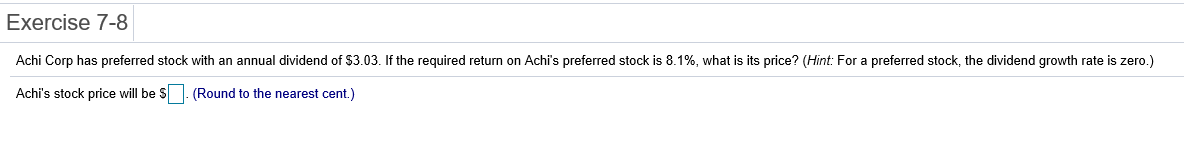

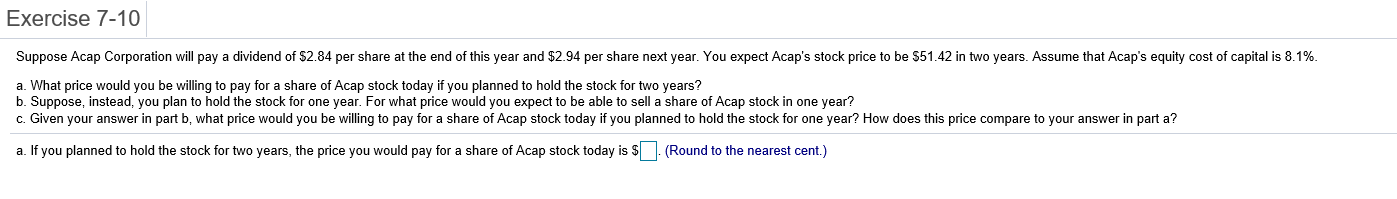

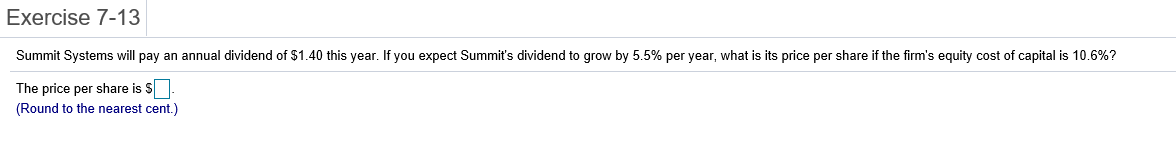

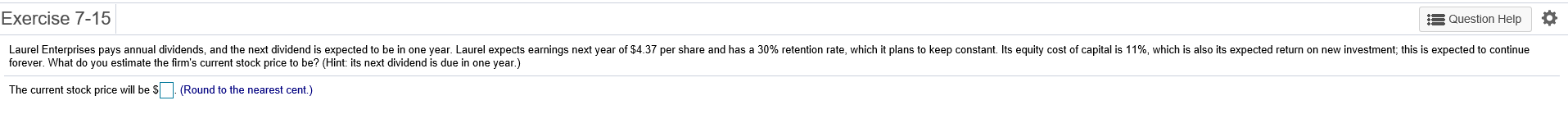

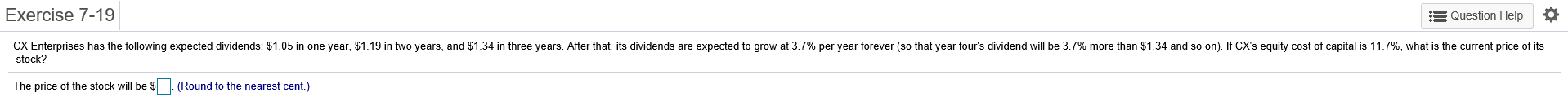

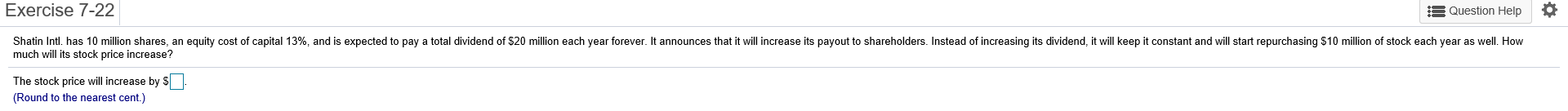

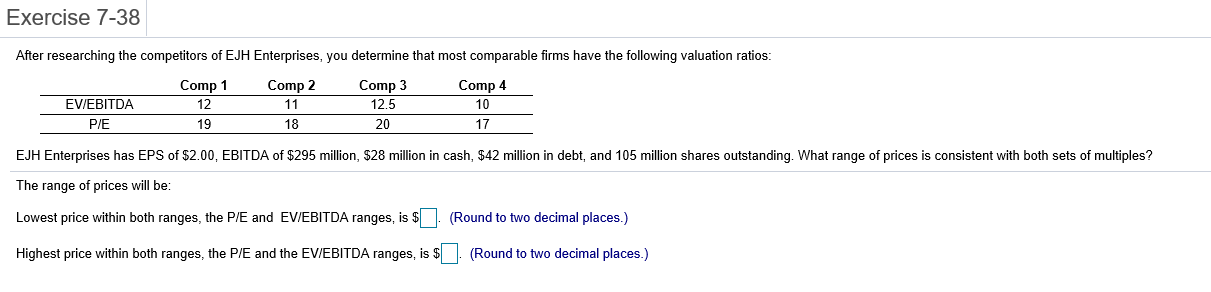

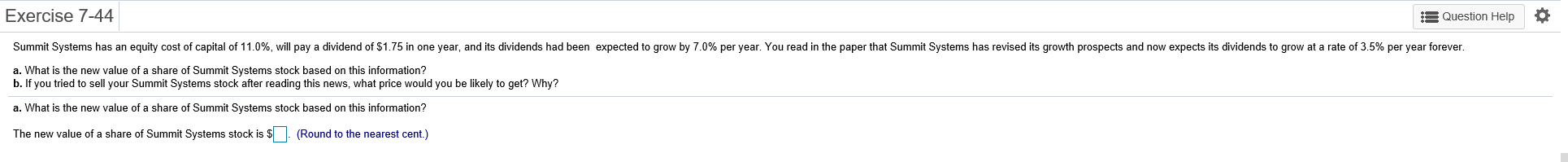

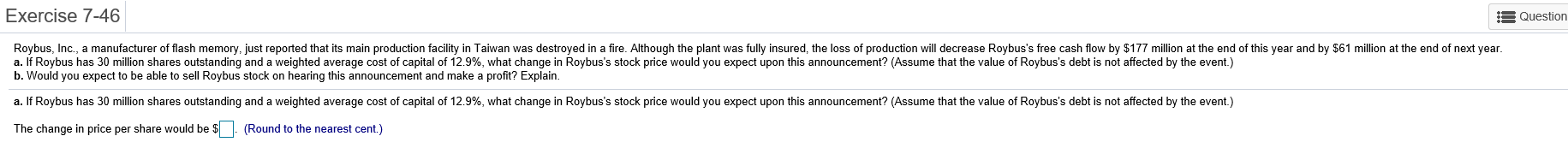

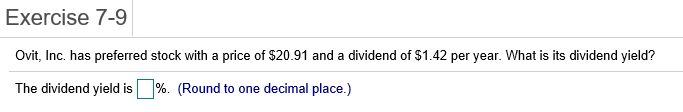

Exercise 7-2 You own 40% of the stock of a company that has 10 directors on its board. How much representation can you get on the board if the company has cumulative voting? How much representation can you ensure if the company has straight voting? How much representation can you get on the board if the company has cumulative voting? (Select the best choice below.) O A. With cumulative voting you vote on each director individually, and without a majority of the shares you cannot ensure that your representative will win any of the elections (you could lose 60% to 40% in each of the ten individual elections). OB. With cumulative voting you are able to get proportional representation by putting all of your votes toward 4 directors, allowing you to elect representatives to 4 seats (40% of ten seats) on the board. Exercise 7-4 Assume Evco, Inc. has current stock price of $48.98 and will pay a $1.95 dividend in one year, its equity cost of capital is 16%. To justify its current price, what price must you expect Evco stock to sell for immediately after the firm pays the dividend in one year? We can expect Evco stock to sell for $1(Round to the nearest cent.) Exercise 7-5 A Question Help You just purchased a share of Northstar Sports for $93.74. You expect to receive a dividend of $5.15 in one year. If you expect the price after the dividend is paid to be $95.92, what total return do you expect to earn over the year? What do you expect to be your dividend yield? What do you expect to be your capital gain rate? a. If you expect the price after the dividend is paid to be $95.92, what total return do you expect to earn over the year? Your expected total return to earn over the year is % (Round to two decimal places.) Exercise 7-6 Assume Coleco pays an annual dividend of $1.80 and has a share price of $36.00. It announces that its annual dividend will increase to $2.10. If its dividend yield is to stay the same, what should its new share price be? The new share price should be s (Round to the nearest cent.) Exercise 7-7 Anle Corporation has current stock price of $16.75 and is expected to pay a dividend of $0.90 in one year. Its expected stock price right after paying that dividend is $18.92. a. What is Anle's equity cost of capital? b. How much of Anle's equity cost of capital is expected to be satisfied by dividend yield and how much by capital gain? a. What is Anle's equity cost of capital? Anle's equity cost of capital is %. (Round to two decimal places.) Exercise 7-8 Achi Corp has preferred stock with an annual dividend of $3.03. If the required return on Achi's preferred stock is 8.1%, what is its price? (Hint: For a preferred stock, the dividend growth rate is zero.) Achi's stock price will be $(Round to the nearest cent.) Exercise 7-10 Suppose Acap Corporation will pay a dividend of $2.84 per share at the end of this year and $2.94 per share next year. You expect Acap's stock price to be $51.42 in two years. Assume that Acap's equity cost of capital is 8.1%. a. What price would you be willing to pay for a share of Acap stock today if you planned to hold the stock for two years? b. Suppose, instead, you plan to hold the stock for one year. For what price would you expect to be able to sell a share of Acap stock in one year? c. Given your answer in part b, what price would you be willing to pay for a share of Acap stock today if you planned to hold the stock for one year? How does this price compare to your answer in part a? a. If you planned to hold the stock for two years, the price you would pay for a share of Acap stock today is $(Round to the nearest cent.) Exercise 7-13 Summit Systems will pay an annual dividend of $1.40 this year. If you expect Summit's dividend to grow by 5.5% per year, what is its price per share if the firm's equity cost of capital is 10.6%? The price per share is $0 (Round to the nearest cent.) Exercise 7-15 Question Help 0 Laurel Enterprises pays annual dividends, and the next dividend is expected to be in one year. Laurel expects earnings next year of $4.37 per share and has a 30% retention rate, which it plans to keep constant. Its equity cost of capital is 11%, which is also its expected return on new investment; this is expected to continue forever. What do you estimate the firm's current stock price to be? (Hint: its next dividend is due in one year.) The current stock price will be $(Round to the nearest cent.) Exercise 7-19 A Question Help CX Enterprises has the following expected dividends: $1.05 in one year, $1.19 in two years, and $1.34 in three years. After that, its dividends are expected to grow at 3.7% per year forever (so that year four's dividend will be 3.7% more than $1.34 and so on). If CX's equity cost of capital is 11.7%, what is the current price of its stock? The price of the stock will be $ (Round to the nearest cent.) Exercise 7-22 A Question Help Shatin Intl. has 10 million shares, an equity cost of capital 13%, and is expected to pay a total dividend of $20 million each year forever. It announces that it will increase its payout to shareholders. Instead of increasing its dividend, it will keep it constant and will start repurchasing $10 million of stock each year as well. How much will its stock price increase? The stock price will increase by $ (Round to the nearest cent.) Exercise 7-38 After researching the competitors of EJH Enterprises, you determine that most comparable firms have the following valuation ratios: Comp 1 Comp 2 Comp 3 Comp 4 EV/EBITDA 12 11 12.5 10 P/E 19 18 20 17 EJH Enterprises has EPS of $2.00, EBITDA of $295 million, $28 million in cash, $42 million in debt, and 105 million shares outstanding. What range prices is consistent with both sets of multiples? The range of prices will be: Lowest price within both ranges, the P/E and EV/EBITDA ranges, is $. (Round to two decimal places.) Highest price within both ranges, the P/E and the EV/EBITDA ranges, is $. (Round to two decimal places.) Exercise 7-44 A Question Help Summit Systems has an equity cost of capital of 11.0%, will pay a dividend of $1.75 in one year, and its dividends had been expected to grow by 7.0% per year. You read in the paper that Summit Systems has revised its growth prospects and now expects its dividends to grow at a rate of 3.5% per year forever. a. What is the new value of a share of Summit Systems stock based on this information? b. If you tried to sell your Summit Systems stock after reading this news, what price would you be likely to get? Why? a. What is the new value of a share of Summit Systems stock based on this information? The new value of a share of Summit Systems stock is $ (Round to the nearest cent.) Exercise 7-46 A Question Roybus, Inc., a manufacturer of flash memory, just reported that its main production facility in Taiwan was destroyed in a fire. Although the plant was fully insured, the loss of production will decrease Roybus's free cash flow by $177 million at the end of this year and by $61 million at the end of next year. a. If Roybus has 30 million shares outstanding and a weighted average cost of capital of 12.9%, what change in Roybus's stock price would you expect upon this announcement? (Assume that the value of Roybus's debt is not affected by the event.) b. Would you expect to be able to sell Roybus stock on hearing this announcement and make a profit? Explain. a. If Roybus has 30 million shares outstanding and a weighted average cost of capital of 12.9%, what change in Roybus's stock price would you expect upon this announcement? (Assume that the value of Roybus's debt is not affected by the event.) The change in price per share would be $1. (Round to the nearest cent.) Exercise 7-9 Ovit, Inc. has preferred stock with a price of $20.91 and a dividend of $1.42 per year. What is its dividend yield? The dividend yield is %. (Round to one decimal place.)