Answered step by step

Verified Expert Solution

Question

1 Approved Answer

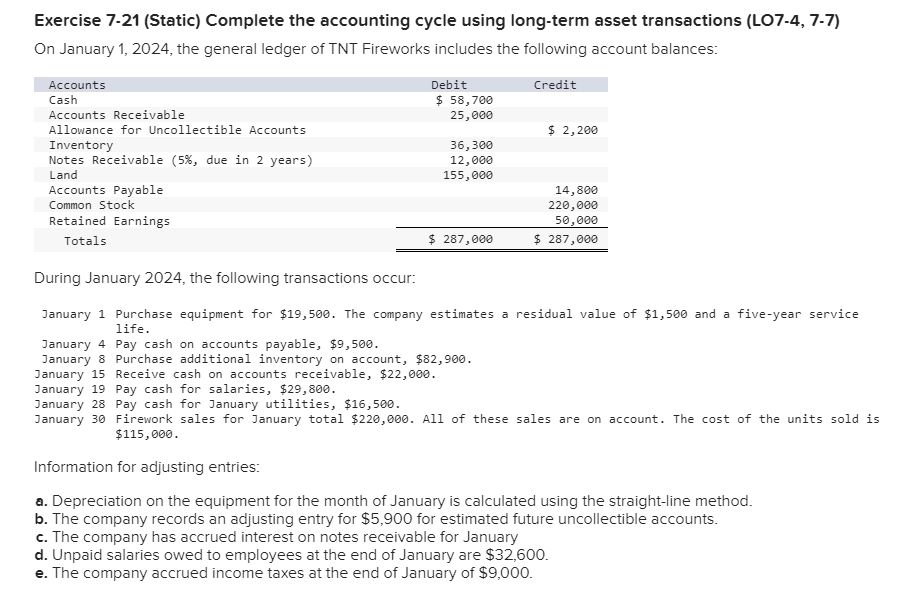

Exercise 7.21 (Static) Complete the accounting cycle using long-term asset transactions (LO7-4, 7-7) On January 1, 2024, the general ledger of TNT Fireworks includes the

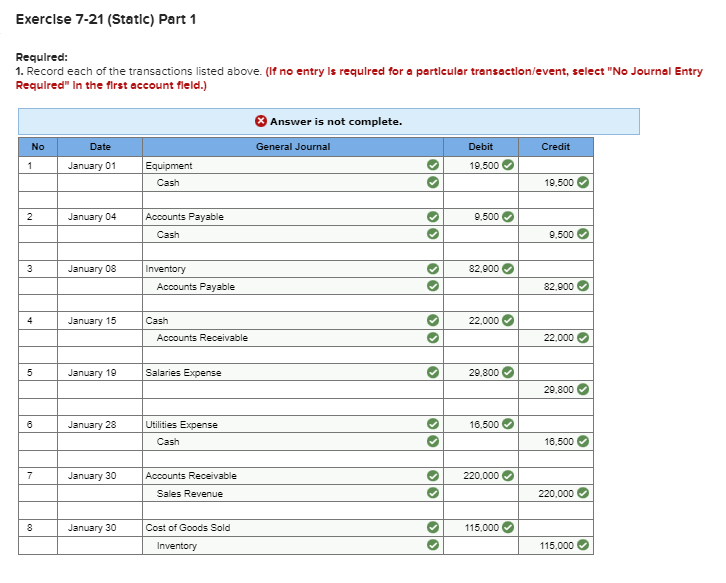

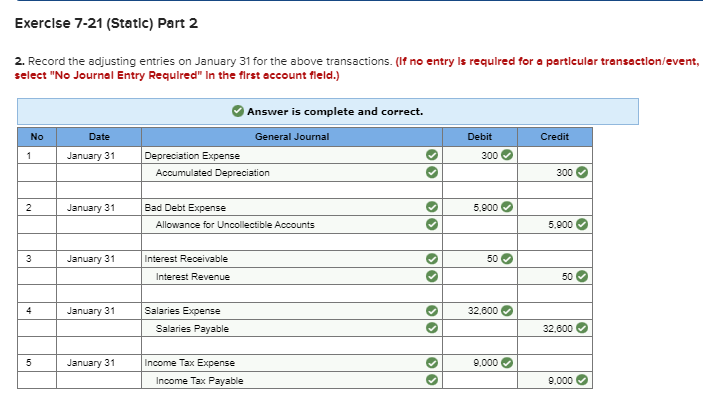

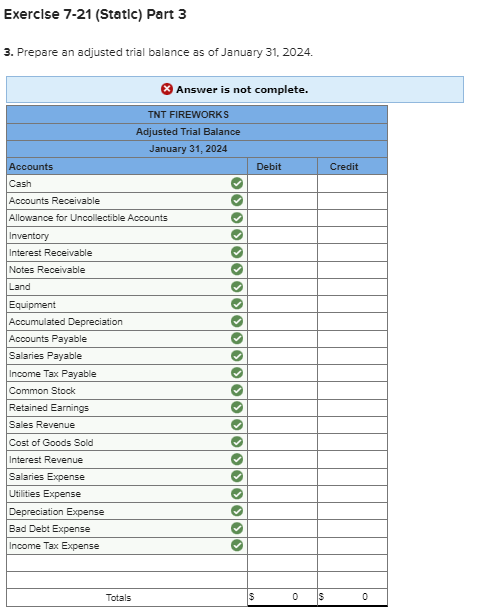

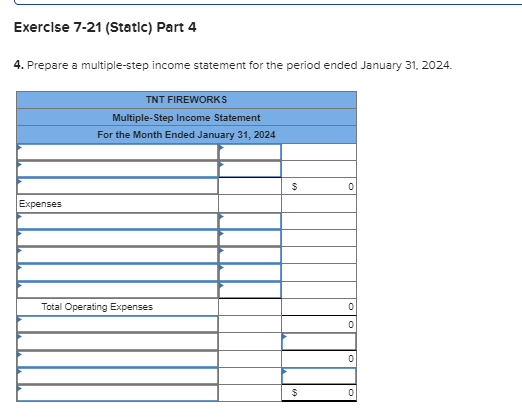

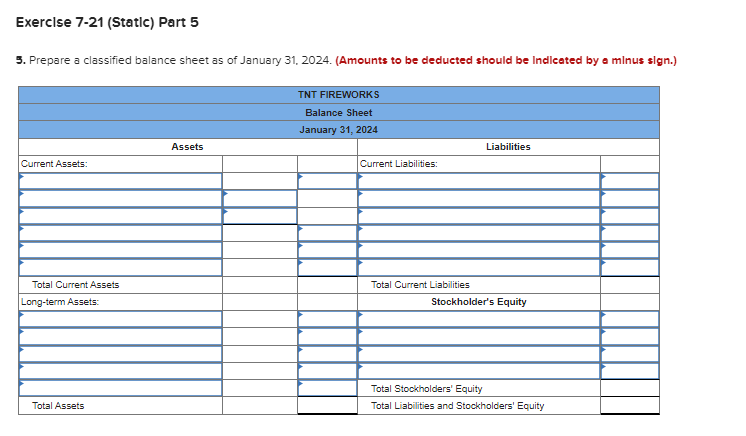

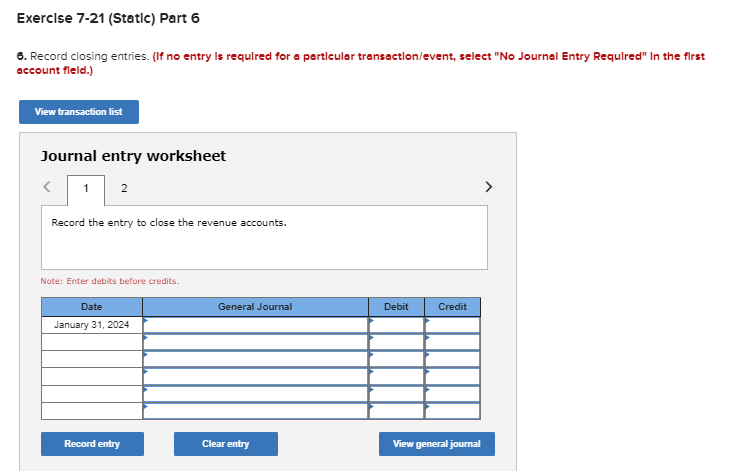

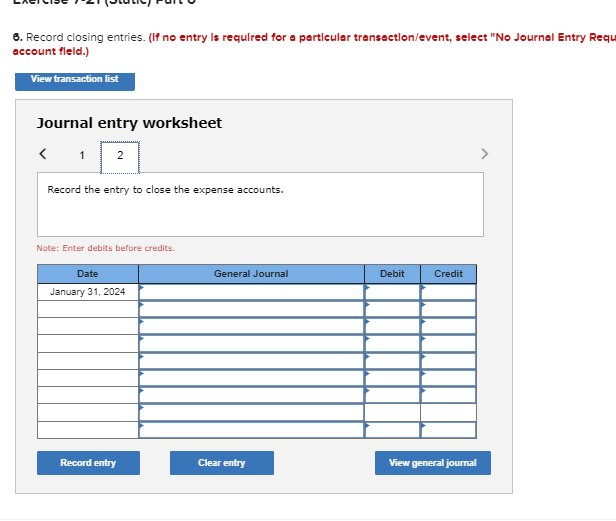

Exercise 7.21 (Static) Complete the accounting cycle using long-term asset transactions (LO7-4, 7-7) On January 1, 2024, the general ledger of TNT Fireworks includes the following account balances: During January 2024, the following transactions occur: January 1 Purchase equipment for $19,500. The company estimates a residual value of $1,500 and a five-year service life. January 4 Pay cash on accounts payable, $9,500. January 8 Purchase additional inventory on account, $82,900. January 15 Receive cash on accounts receivable, $22,000. January 19 Pay cash for salaries, $29,800. January 28 Pay cash for January utilities, $16,500. January 30 Firework sales for January total $220,000. All of these sales are on account. The cost of the units sold is $115,000. Information for adjusting entries: a. Depreciation on the equipment for the month of January is calculated using the straight-line method. b. The company records an adjusting entry for $5,900 for estimated future uncollectible accounts. c. The company has accrued interest on notes receivable for January d. Unpaid salaries owed to employees at the end of January are $32,600. e. The company accrued income taxes at the end of January of $9,000. Requlred: 1. Record each of the transactions listed above. (If no entry ls requlred for a pertleuler transactlon/event, select "No Journol Entry Requlred" In the flrst account fleld.) 2. Record the adjusting entries on January 31 for the above transactions. (If no entry Is requlred for a pertleular transactlon/event, select "No Journal Entry Requlred" In the flrst occount fleld.) 3. Prepare an adjusted trial balance as of January 31, 2024. 4. Prepare a multiple-step income statement for the period ended January 31, 2024. 3. Prepare a classified balance sheet as of January 31,2024 . (Amounts to be deducted should be Indleated by a minus sign.) 6. Record closing entries. (If no entry is requlred for a partleular transaction/event, select "No Journal Entry Requlred" In the flrst occount fleld.) Journal entry worksheet Record the entry to close the revenue accounts. Note: Enter debits before credits. 6. Record closing entries. (If no entry Is requlred for a pertlculer transectlon/event, select "No Journal Entry Requ occount fleld.) Journal entry worksheet Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started