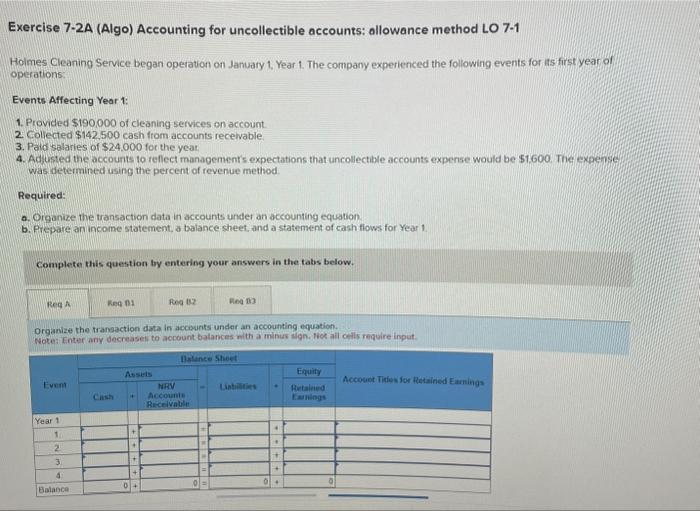

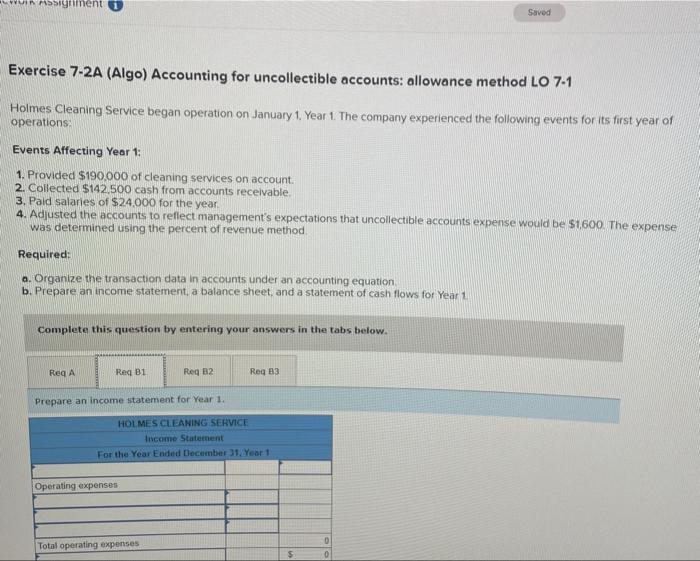

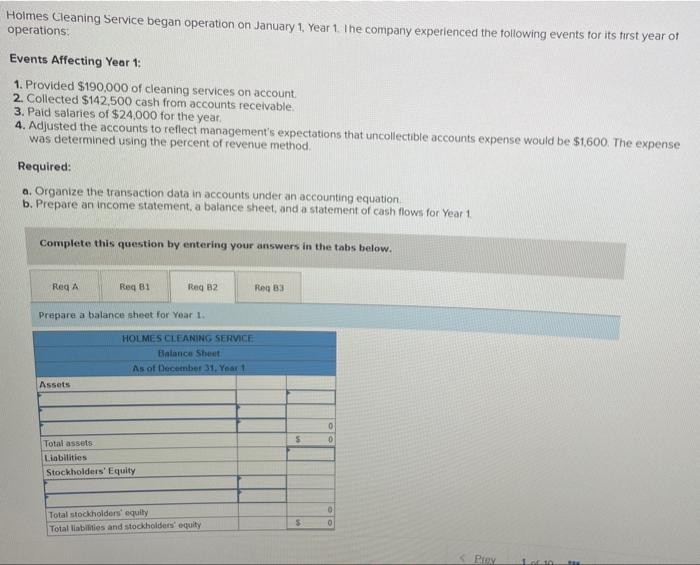

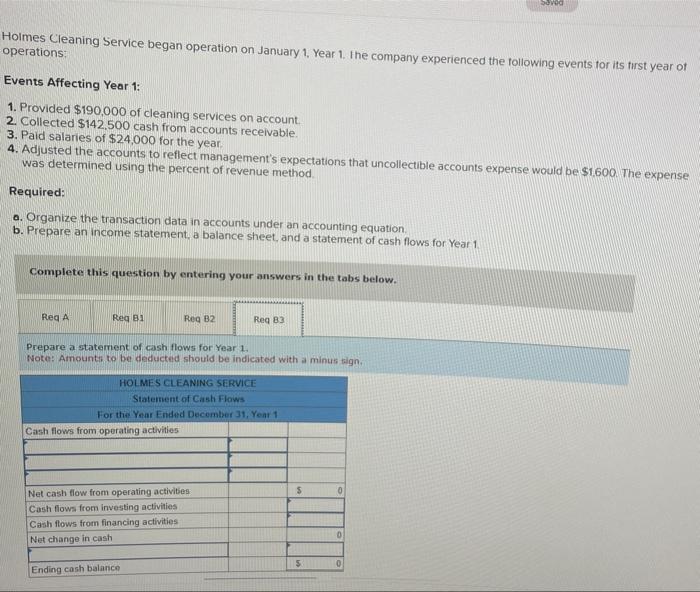

Exercise 7-2A (Algo) Accounting for uncollectible accounts: allowance method LO 7-1 Holmes Cleaning Service began operation on January 1 , Year 1 . The company experienced the following events for its first year of operations: Events Affecting Year 1: 1. Provided $190,000 of cleaning services on account. 2. Collected $142,500 cash from accounts receivable. 3. Padi salaries of $24,000 for the yeat 4. Adusted the accounts to reflect managements expectations that uncollectible accounts expense would be \$1,600. The expense was determined using the percent of revenue method. Required: a. Organize the transaction data in accounts under an accounting equation b. Prepare an income statement, a balance sheet, and a statement of cash flows for Year 1. Complete this question by entering your answers in the tabs below. Organize the trameaction data in accourits under an accounting equation. Note: Enter any decreasei to account balances mith a minus Agn. Nod all cells require input. Exercise 7-2A (Algo) Accounting for uncollectible accounts: allowance method LO 7-1 Holmes Cleaning Service began operation on January 1. Year 1. The company experienced the following events for its first year of operations: Events Affecting Year 1: 1. Provided $190,000 of cleaning services on account 2. Collected $142,500 cash from accounts receivable 3. Pald salaries of $24,000 for the year. 4. Adjusted the accounts to reflect management's expectations that uncollectible accounts expense would be \$1,600. The expense was determined using the percent of revenue method Required: a. Organize the transaction data in accounts under an accounting equation b. Prepare an income statement, a balance sheet, and a statement of cash flows for Year 1 Complete this question by entering your answers in the tabs below. Prepare an income statement for Year 1. Hoimes Cleaning Service began operation on January 1, Year 1 . The company experienced the following events tor its tirst year of operations: Events Affecting Year 1: 1. Provided $190,000 of cleaning services on account. 2. Collected $142,500 cash from accounts receivable 3. Paid salaries of $24,000 for the year. 4. Adjusted the accounts to reflect management's expectations that uncollectible accounts expense would be $1,600. The expense was determined using the percent of revenue method. Required: a. Organize the transaction data in accounts under an accounting equation b. Prepare an income statement, a balance sheet, and a statement of cash flows for Year 1 Complete this question by entering your answers in the tabs below. Prepare a balance sheet for Yoar 1. Holmes Cleaning Service began operation on January 1, Year 1. The company experienced the following events tor its first year of operations: Events Affecting Year 1: 1. Provided $190,000 of cleaning services on account. 2. Collected $142,500 cash from accounts receivable. 3. Paid salaries of $24,000 for the year. 4. Adjusted the accounts to reflect management's expectations that uncollectible accounts expense would be $1.600. The expense was determined using the percent of revenue method Required: a. Organize the transaction data in accounts under an accounting equation b. Prepare an income statement, a balance sheet, and a statement of cash flows for Year 1 Complete this question by entering your answers in the tabs below. Prepare a statement of cash flows for Year 1. Note: Amounti to be deducted should be indicated with a minus tign