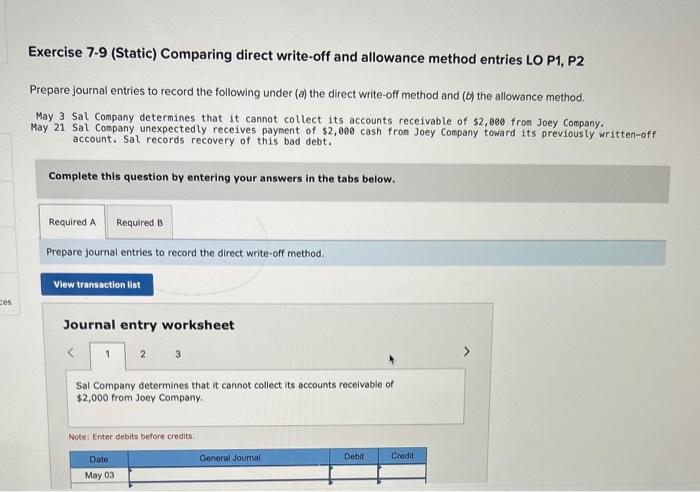

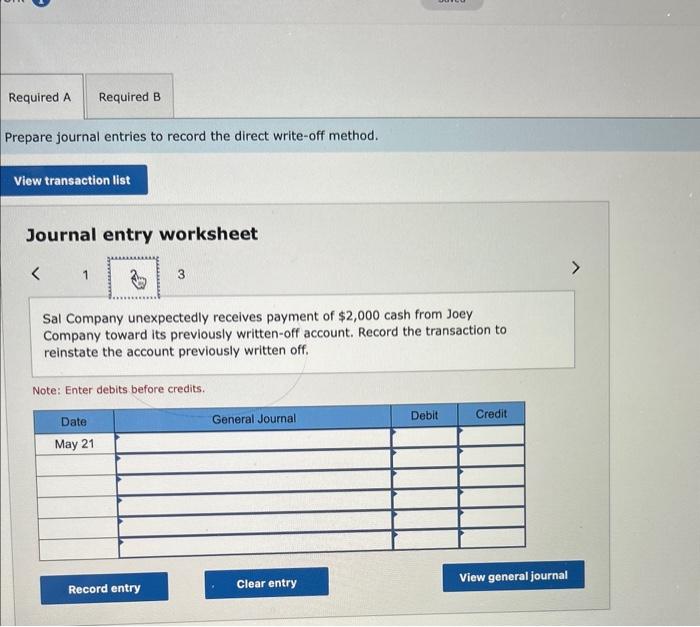

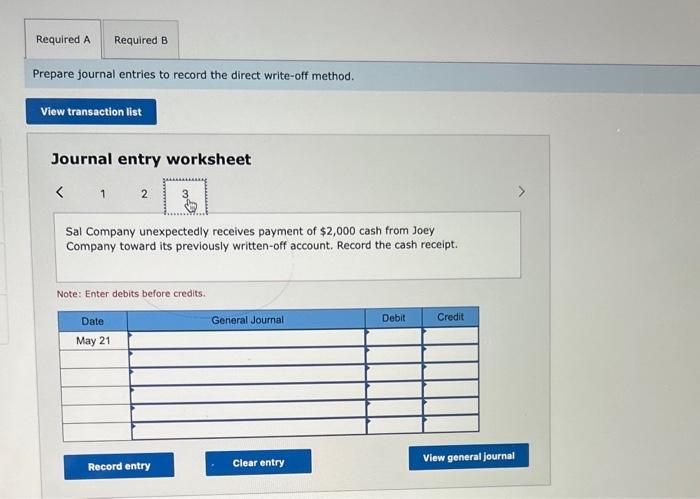

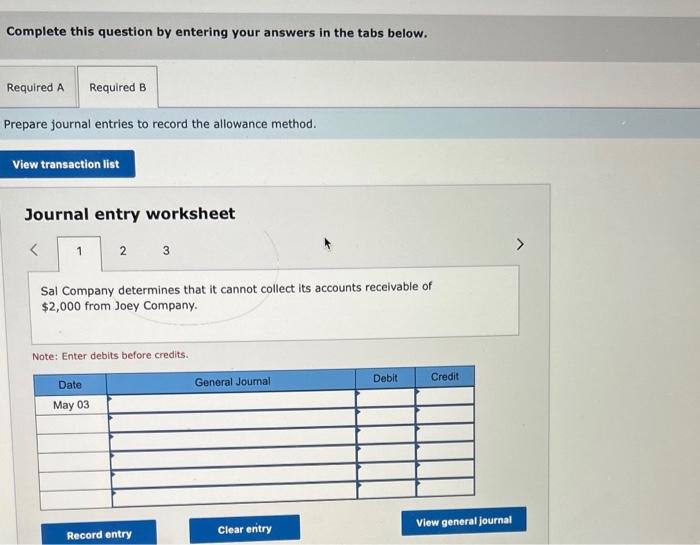

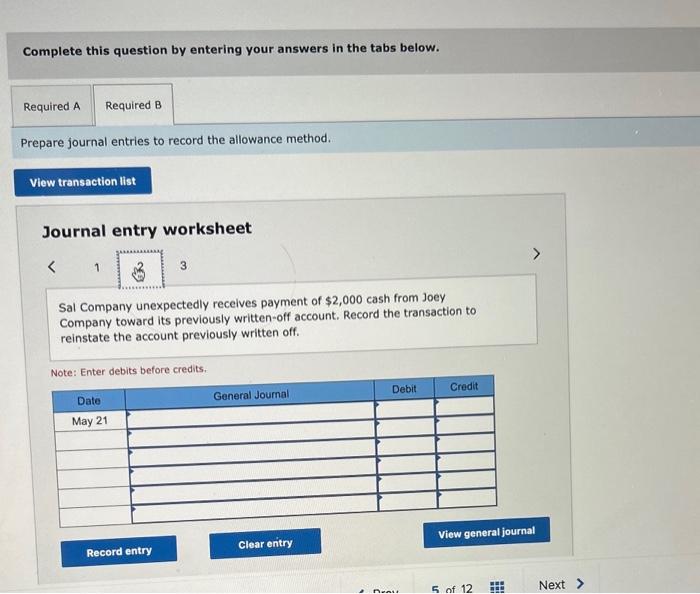

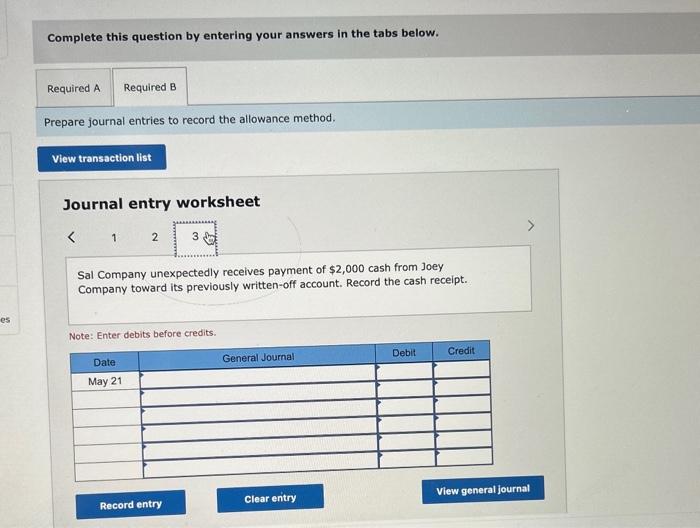

Exercise 7-9 (Static) Comparing direct write-off and allowance method entries LO P1, P2 Prepare journal entries to record the following under (a) the direct write-off method and (b) the allowance method. May 3Sal Company determines that it cannot collect its accounts receivable of $2,06 fron Joey Company. May 21 Sal Company unexpectedly receives payment of $2,000 cash fron Joey Company toward its previousty written-off account. Sal records recovery of this bad debt. Complete this question by entering your answers in the tabs below. Prepare journal entries to record the direct write-off method. Journal entry worksheet Sal Company determines that it cannot collect its accounts receivable of $2,000 from Joey Company. Note: Enter debits before credits. Prepare journal entries to record the direct write-off method. Journal entry worksheet Sal Company unexpectedly receives payment of $2,000 cash from Joey Company toward its previously written-off account. Record the transaction to reinstate the account previously written off. Note: Enter debits before credits. Prepare journal entries to record the direct write-off method. Journal entry worksheet Sal Company unexpectedly receives payment of $2,000 cash from Joey Company toward its previously written-off account. Record the cash receipt. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare journal entries to record the allowance method. Journal entry worksheet Sal Company determines that it cannot collect its accounts receivable of $2,000 from Joey Company. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare journal entries to record the allowance method. Journal entry worksheet Sal Company unexpectedly receives payment of $2,000 cash from Joey Company toward its previously written-off account. Record the transaction to reinstate the account previously written off. Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare journal entries to record the allowance method. Journal entry worksheet Sal Company unexpectedly receives payment of $2,000 cash from Joey Company toward its previously written-off account. Record the cash receipt. Note: Enter debits before credits