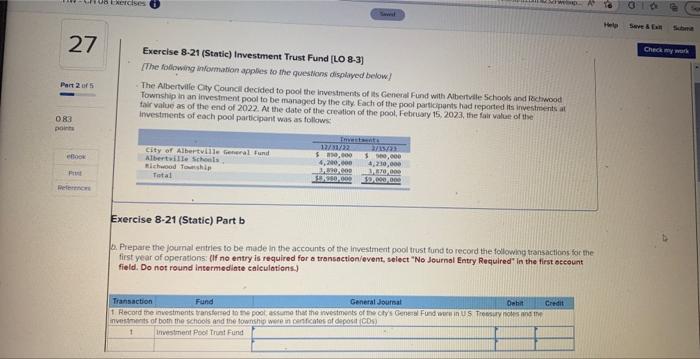

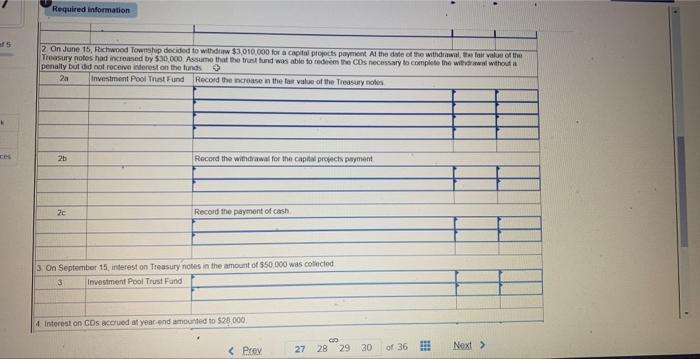

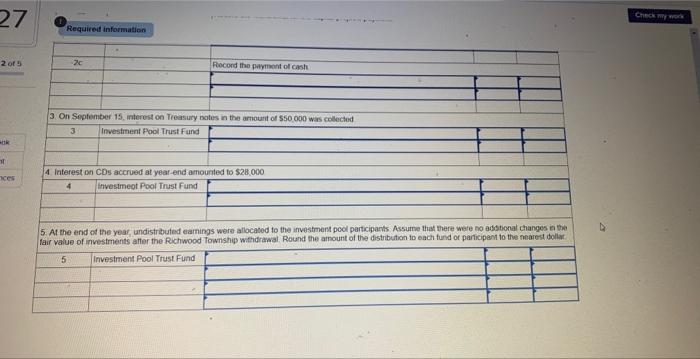

Exercise 8-21 (Static) Investment Trust Fund [LO 8-3] (The fodowing intormation apples to the questions displayed below] The Abertvilfe City Council decided to pool the inveitments of its Genesal Fund with Albertille Schooks and Coctwood Township in an investment pool to be managed by the eity. Each of the pool participants had repaded its inveriments at falr value an of the end of 2022. An the date of the creation of the pool, Fehruary 15,2023 , the fair value of the imvestments of each pool participant was as follows: Exercise 821 (Static) Part b 6. Prepare the foumal entries to be made in the accounts of the investment pool tust fund to record the following transactlons for the first year of operations: (If no entry is required for a transoction/event, select " No Journal Entry Required" in the first oceount field. Do not round intermediate calculationsi) Pequireit information 4 Interest on CDs accrued at year-end amounted to $28,000 5. At the end of the year, undistributed eamings were allocated to the investment pool participants Assume that there were no addtional changes ia the 5. At valu end of ine year, undistrituted eamings were allocased to the investments after the Ruchwood Township withdrawal. Round the amount of the distribution to each fund of participant to the nearest dollat Exercise 8-21 (Static) Investment Trust Fund [LO 8-3] (The fodowing intormation apples to the questions displayed below] The Abertvilfe City Council decided to pool the inveitments of its Genesal Fund with Albertille Schooks and Coctwood Township in an investment pool to be managed by the eity. Each of the pool participants had repaded its inveriments at falr value an of the end of 2022. An the date of the creation of the pool, Fehruary 15,2023 , the fair value of the imvestments of each pool participant was as follows: Exercise 821 (Static) Part b 6. Prepare the foumal entries to be made in the accounts of the investment pool tust fund to record the following transactlons for the first year of operations: (If no entry is required for a transoction/event, select " No Journal Entry Required" in the first oceount field. Do not round intermediate calculationsi) Pequireit information 4 Interest on CDs accrued at year-end amounted to $28,000 5. At the end of the year, undistributed eamings were allocated to the investment pool participants Assume that there were no addtional changes ia the 5. At valu end of ine year, undistrituted eamings were allocased to the investments after the Ruchwood Township withdrawal. Round the amount of the distribution to each fund of participant to the nearest dollat