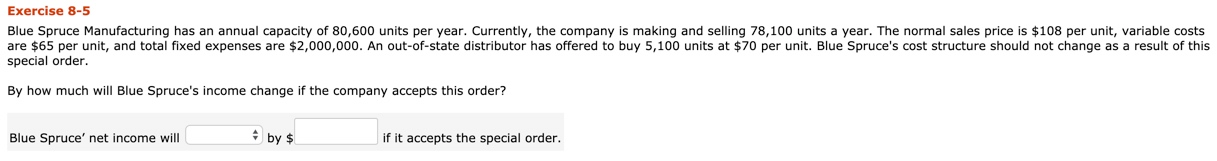

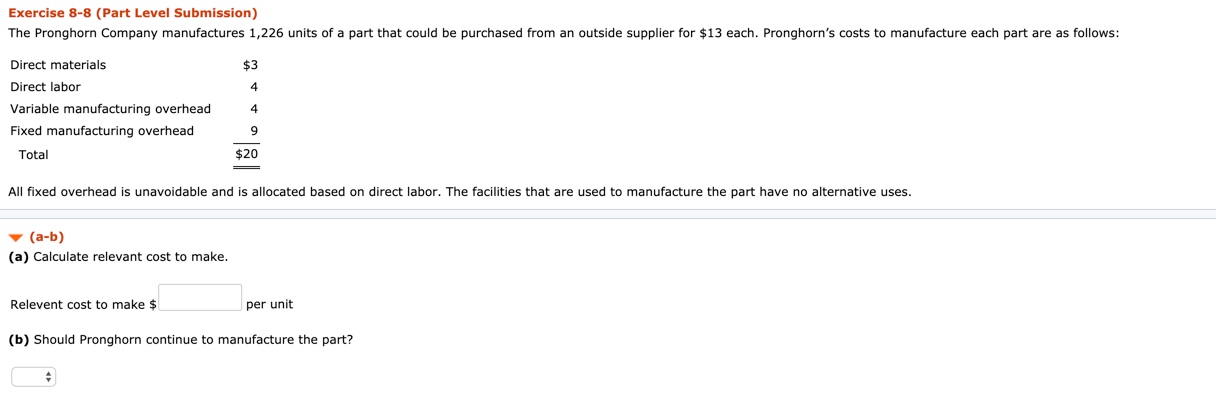

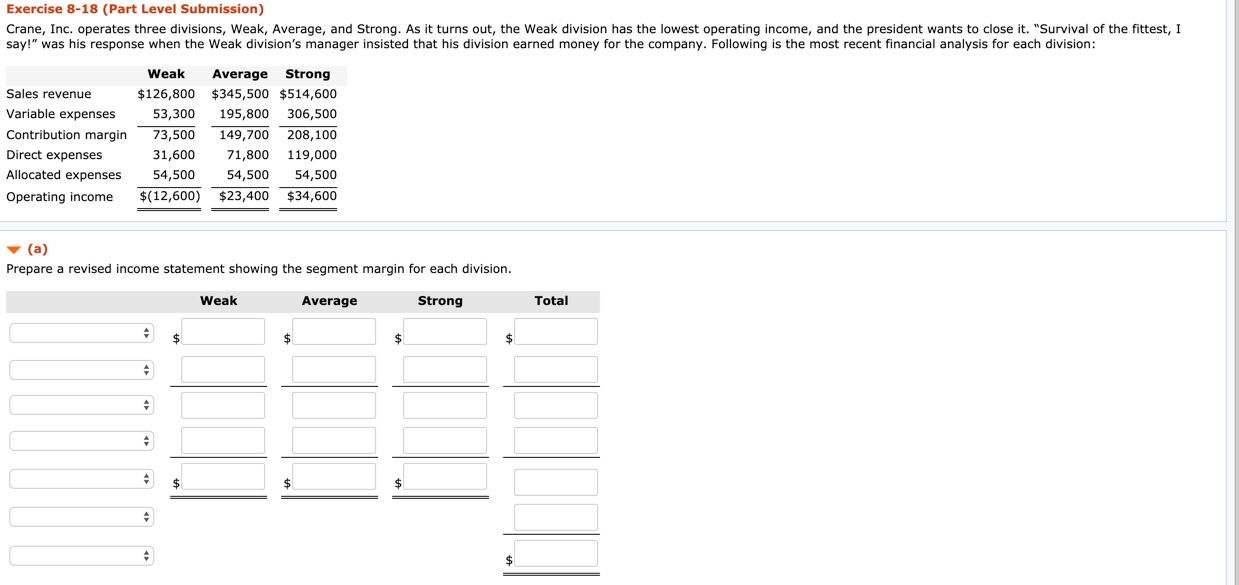

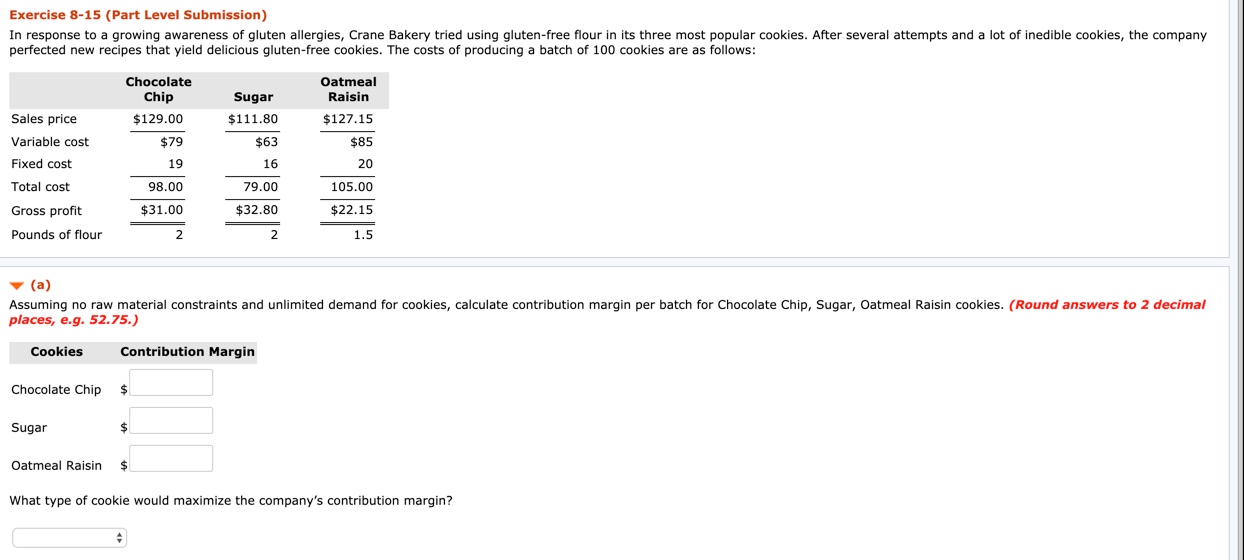

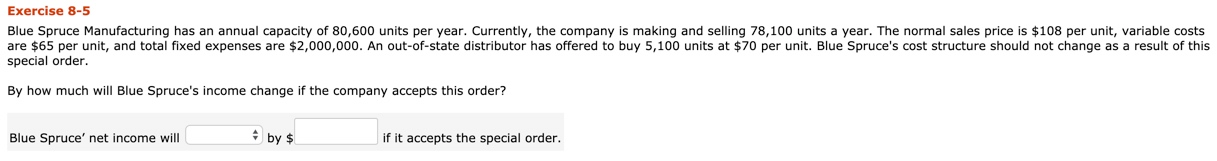

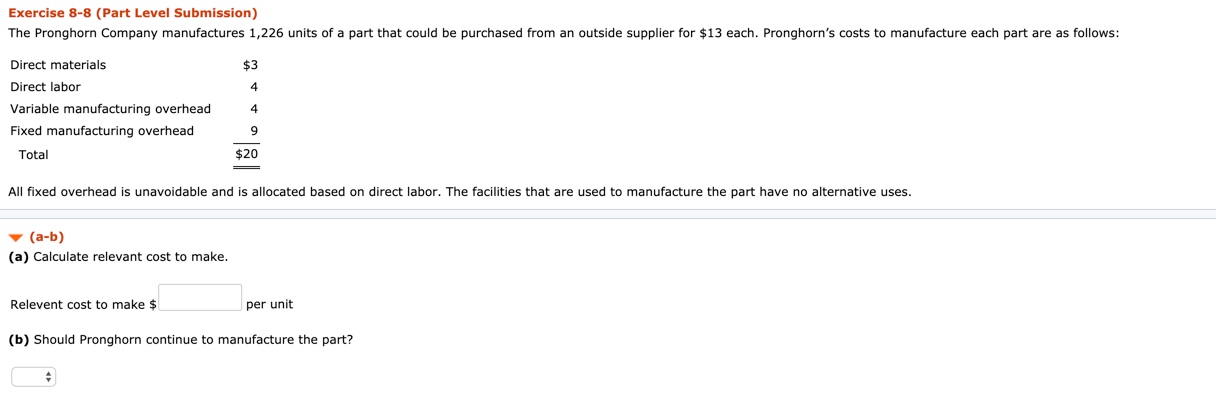

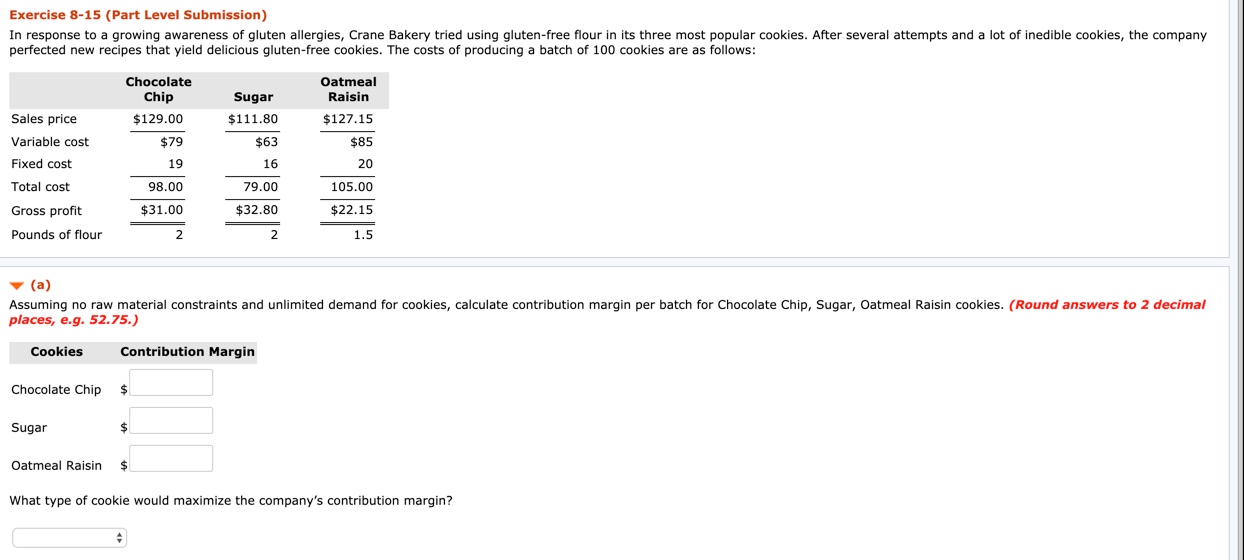

Exercise 8-5 Blue Spruce Manufacturing has an annual capacity of 80,600 units per year. Currently, the company is making and selling 78,100 units a year. The normal sales price is $108 per unit, variable costs are $65 per unit, and total fixed expenses are $2,000,000. An out-of-state distributor has offered to buy 5,100 units at $70 per unit. Blue Spruce's cost structure should not change as a result of this special order. By how much will Blue Spruce's income change if the company accepts this order? Blue Spruce' net income will by $ if it accepts the special order. Exercise 8-8 (Part Level Submission) The Pronghorn Company manufactures 1,226 units of a part that could be purchased from an outside supplier for $13 each. Pronghorn's costs to manufacture each part are as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Total 4 $20 All fixed overhead is unavoidable and is allocated based on direct labor. The facilities that are used to manufacture the part have no alternative uses. (a-b) (a) Calculate relevant cost to make. Relevent cost to make $ per unit (b) Should Pronghorn continue to manufacture the part? Exercise 8-18 (Part Level Submission) Crane, Inc. operates three divisions, Weak, Average, and Strong. As it turns out, the weak division has the lowest operating income, and the president wants to close it. "Survival of the fittest, I say!" was his response when the Weak division's manager insisted that his division earned money for the company. Following is the most recent financial analysis for each division: Sales revenue Variable expenses Contribution margin Direct expenses Allocated expenses Operating income Weak $126,800 53,300 73,500 31,600 54,500 $(12,600) Average Strong $345,500 $514,600 195,800 306,500 149,700 208,100 71,800 119,000 54,500 54,500 $23,400 $34,600 (a) Prepare a revised income statement showing the segment margin for each division. Weak Average Strong Total Exercise 8-15 (Part Level Submission) In response to a growing awareness of gluten allergies, Crane Bakery tried using gluten-free flour in its three most popular cookies. After several attempts and a lot of inedible cookies, the company perfected new recipes that yield delicious gluten-free cookies. The costs of producing a batch of 100 cookies are as follows: Chocolate Chip $129.00 Oatmeal Raisin $79 Sales price Variable cost Fixed cost Total cost Gross profit Pounds of flour Sugar $111.80 $63 16 79.00 $32.80 19 98.00 $31.00 $127.15 $85 20 105.00 $22.15 1.5 (a) Assuming no raw material constraints and unlimited demand for cookies, calculate contribution margin per batch for Chocolate Chip, Sugar, Oatmeal Raisin cookies. (Round answers to 2 decimal places, e.g. 52.75.) Cookies Contribution Margin Chocolate Chip $ Sugar $ Oatmeal Raisin $ What type of cookie would maximize the company's contribution margin