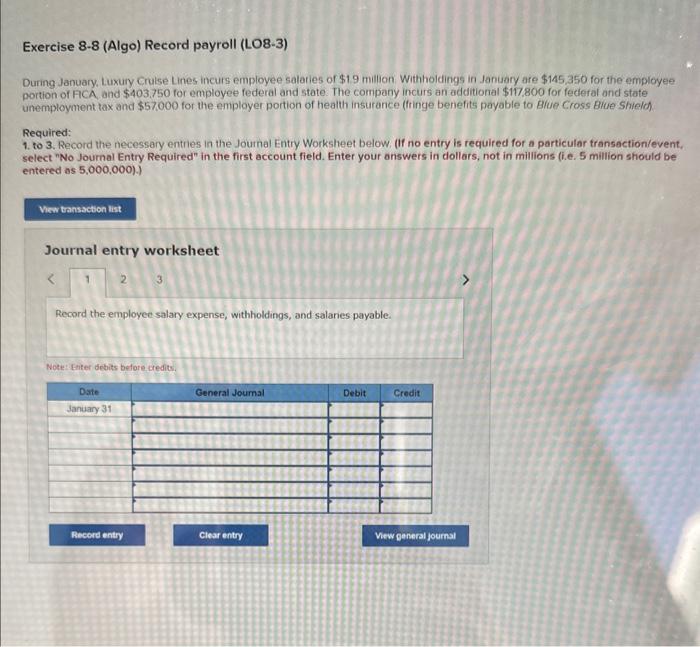

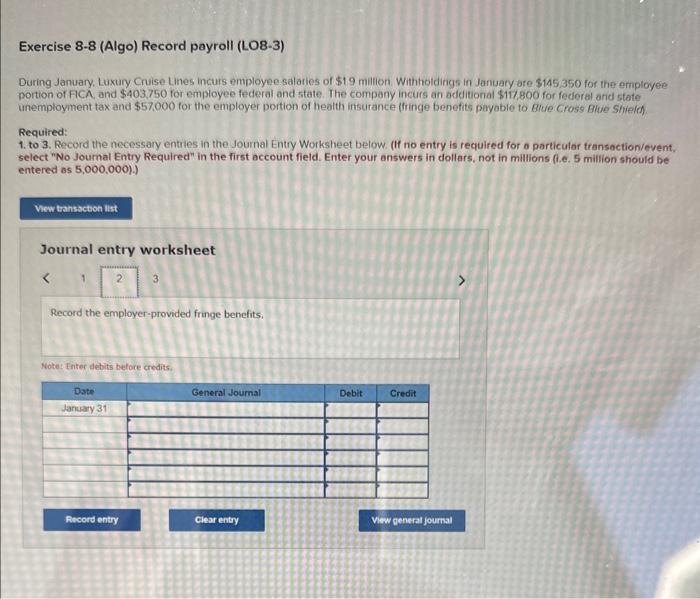

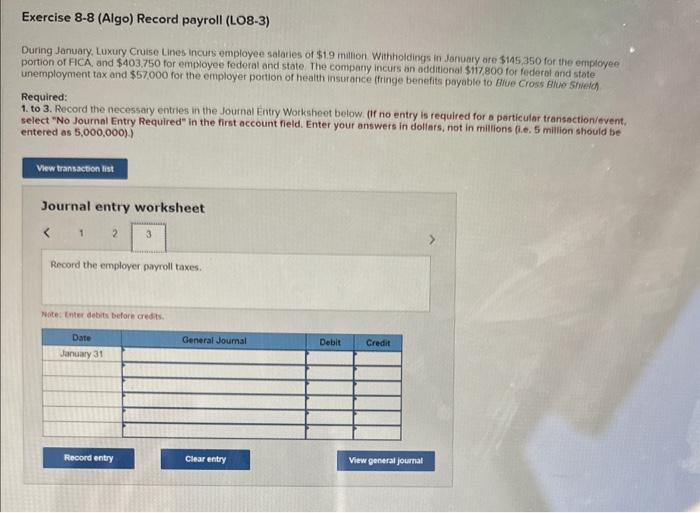

Exercise 8-8 (Algo) Record payroll (LO8-3) During January, Luxury Crulse Lines incurs employee salaries of $19 million Withholdings in January are $145,350 for the employee portion of ACA and $403,750 for employee federal and state. The company incurs an additional $117.800 for federal and state unemployment tax and $57000 for the employer portion of health insurance (fringe benefits payable to Blue Cross Brue Shielch Required: 1. to 3. Record the necessary entries in the Joumal Entry Worksheet below. (if no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000).) Journal entry worksheet Record the employee salary expense, withholdings, and salanes payable. Notet-thter debits before credits. Exercise 8-8 (Algo) Record payroll (LO8-3) During January, Luxury Cruise Lines incurs employee salaties of $19 milion. Withholdings in Januaty are 3145.350 for the employee portion of FICA and $403,750 for employee federal and state. The company incurs an additional $117,800 for federal and state unemployment tax and $57,000 for the employer portion of health insutance (fringe benefits payable to Blue Cross Blive Sineld Required: 1. to 3. Record the necessary entries in the Joumal Entry Worksheet below. (If no entry is required for a particulor transaction/event. select "No Joumal Entry Required" in the first account field. Enter your answers in dollars, not in millions (i.e. 5 million should be entered as 5,000,000) Journal entry worksheet Record the employer-provided fringe benefits. Note: Enter debits before credits. During January, Luxury Cruise Lines incurs employee salanies of $1.9 milion. Withitoldings in January are $145350 for the employee portion of FICA, and $403,750 for employee federal and state. The company incurs an odditional $117,800 for fecleral and state unemployment tax and $57,000 for the employer portion of health insurance (fringe benefits poyabte to Blue Cross Blue Strield Required: 1. to 3. Record the necessary entries in the Jouinal Entry Worksheet below. (If no entry is required for a particular transaction/event. select "No Journal Entry Required" in the first account field. Enter your answers in dollars, not in militions (i.e. 5 million should be entered as 5,000,000)} Journal entry worksheet Record the employer payroll taxes. Wite: Eneri debits before credits