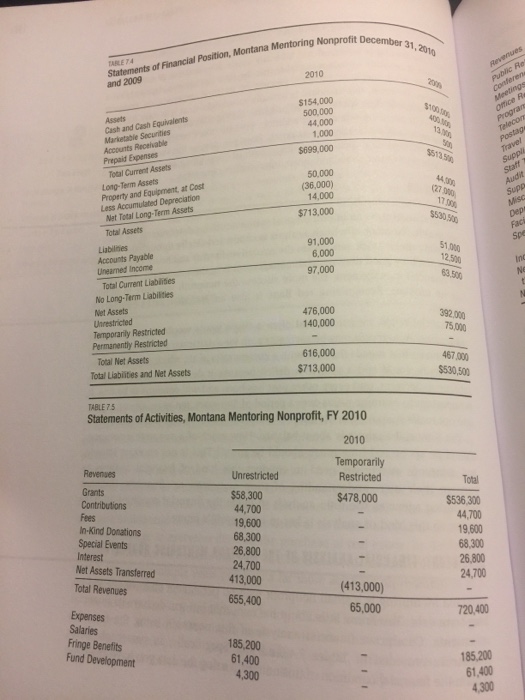

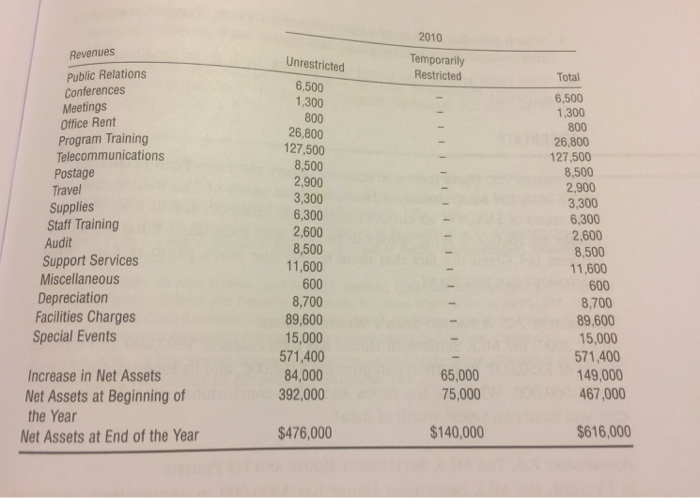

Exercise 9 - Financial Analysis Use the case study in Chapter 7 of the Weikart textbook, pp. 147-149 to complete the following questions: 1. Complete the following ratios in Excel for FY 10: current, working capital, quick, debt-to- asset, debt-to-equity, asset-turnover, days- receivable, profit margin, return-on-assets, common size, and contributions. For each, write a sentence reporting the results and briefly describing what it means. CASE STUDY: FINANCIAL ANALYSIS OF THE MONTANA MENTORING NONPROFIT Montana Mentoring is a small nonprofit with no permanent endowment and no long-term debt. You know little about the nonprofit but you do have its financial statements. Conduct a financial analysis of this nonprofit using the financial satements provided in Tables 7.4 and 7.5. Specifically, in paragraph form, Pxplain the financial condition of this nonprofit using the data you have analyzed Statements of Financial Position, Montana Mentoring Nonprofit December 31,2010 ARLE 74 Revenues and 2009 2010 Public Re Conferens 20 Meetings office Re $154,000 500.000 44.000 Assets Cash and Cash Equivalents Marketable Securities Accounts Recelvable Prepaid Expenses $1000 Progran Telecom Postage Travel Suppli 1,000 130 $699.000 $51350 Total Current Assets 50,000 (36,000) 14,000 Long-Term Assets Property and Equipment, at Cost Less Accumulated Depreciation Net Total Long-Term Assets Staff 44.000 (27 Audit Sup Misc Dep Faci Sp 1700 $530500 $713,000 Total Assets Liabilities Accounts Payable Unearned Income 91.000 6,000 51,000 12.500 In 97,000 Total Current Liablites 63,500 Ne No Long-Term Liabilities Net Assets Unrestricted Temporarily Restricted Permanently Restricted 476,000 140,000 392.000 75,000 Total Net Assets 616,000 467 000 Total Liabilities and Net Assets $713,000 $530,50 TABLE 7.5 Statements of Activities, Montana Mentoring Nonprofit, FY 2010 2010 Revenues Temporarily Unrestricted Restricted Grants Contributions Fees In-Kind Donations Special Events Interest Net Assets Transferred Total $58,300 44,700 19,600 68,300 26.800 24,700 413,000 $478,000 $536 300 44,700 19,600 68,300 26.800 Total Revenues 24,700 (413,000) 655,400 Expenses Salaries Fringe Benefits Fund Development 65,000 720,400 185,200 61,400 4,300 185,200 61,400 4,300 IIIIL III 2010 Revenues Temporarily Restricted Unrestricted Public Relations Conferences Meetings Office Rent Program Training Telecommunications Postage Travel Total 6,500 1,300 800 26,800 127,500 8,500 2,900 3,300 6,300 2,600 8,500 11,600 600 8,700 89,600 15,000 571,400 84,000 392,000 6,500 1,300 800 26,800 127,500 8,500 2,900 3,300 6,300 Supplies Staff Training Audit Support Services Miscellaneous 2,600 8,500 11,600 600 Depreciation Facilities Charges Special Events 8,700 89,600 15,000 571,400 65,000 75,000 Increase in Net Assets 149,000 467,000 Net Assets at Beginning of the Year $140,000 $616,000 $476,000 Net Assets at End of the Year IIIIIIII IIIIIT