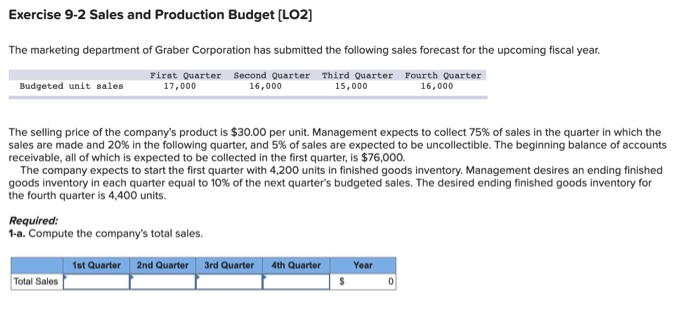

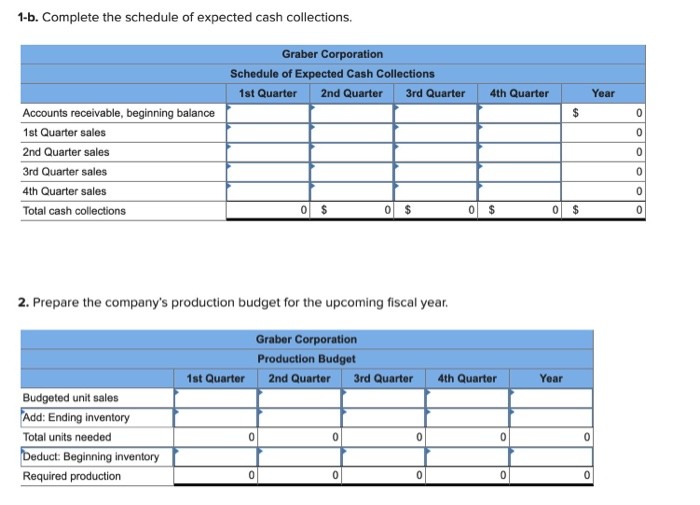

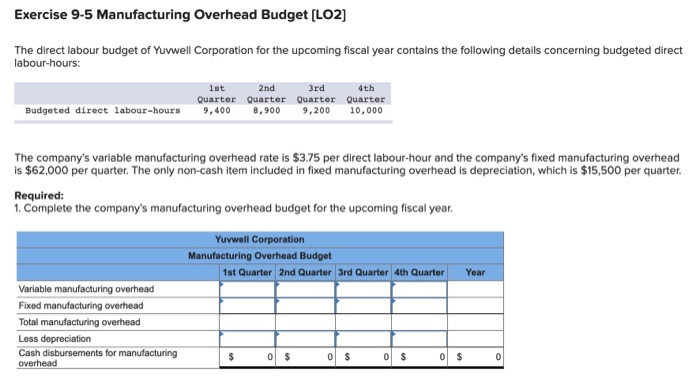

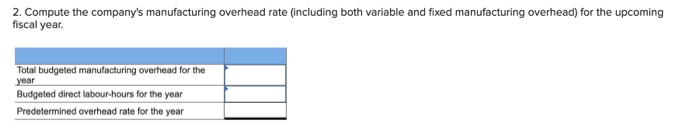

Exercise 9-2 Sales and Production Budget [LO2] The marketing department of Graber Corporation has submitted the following sales forecast for the upcoming fiscal year. First Quarter Second Quarter Third Quarter Fourth Quarter Budgeted unit sales 17,000 16,000 15,000 16,000 The selling price of the company's product is $30.00 per unit. Management expects to collect 75% of sales in the quarter in which the sales are made and 20% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $76,000. The company expects to start the first quarter with 4,200 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 10% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 4,400 units. Required: 1-a. Compute the company's total sales. 1st Quarter 2nd Quarter3rd Quarter 4th Quarter Year Total Sales 1-b. Complete the schedule of expected cash collections. Graber Corporation Schedule of Expected Cash Collections 1st Quarter 2nd Quarter 3rd Quarter4th Quarter Year Accounts receivable, beginning balance 1st Quarter sales 2nd Quarter sales 3rd Quarter sales 4th Quarter sales Total cash 2. Prepare the company's production budget for the upcoming fiscal year Graber Corporation Production Budget 1st Quarter 2nd Quarter 3rd Quarter4th Quarter Year Budgeted unit sales Ending inventory Total units needed 0 t: Beginning inventory Exercise 9-5 Manufacturing Overhead Budget [LO2] The direct labour budget of Yuvwell Corporation for the upcoming fiscal year contains the following details concerning budgeted direct labour-hours: ist 2nd 3rd 4th Quarter Quarter Quarter Quarter Budgeted direct labour-hours 9,400 8,900 9,200 10,000 The company's variable manufacturing overhead rate is $3.75 per direct labour-hour and the company's fixed manufacturing overhead is $62,000 per quarter. The only non-cash item included in fixed manufacturing overhead is depreciation, which is $15,500 per quarter. Required: 1. Complete the company's manufacturing overhead budget for the upcoming fiscal year Yuvwell Corporation Manufacturing Overhead Budget 1st Quarter 2nd Quarter 3rd Quarter 4th QuarterYear Variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Less depreciation Cash disbursements for manufacturing overhead 2. Compute the company's manufacturing overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year. Total budgeted manufacturing overhead for the year Budgeted direct labour-hours for the year Predetermined overhead rate for the year