Answered step by step

Verified Expert Solution

Question

1 Approved Answer

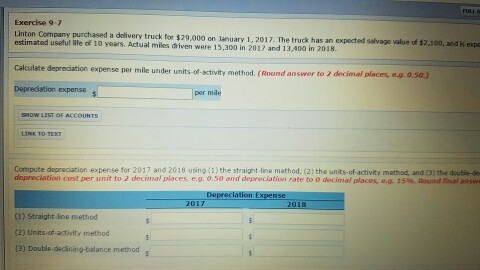

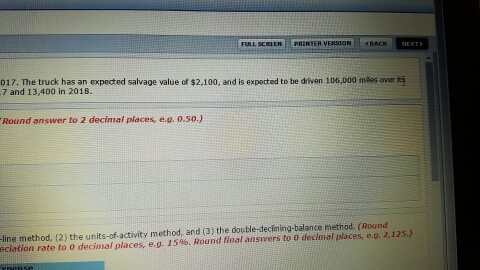

Exercise 9-7 Linton Company purchased a deslivery truck for $29,000 on January 1, 2017. The truck has an expected estimated usetul life of 1o years.

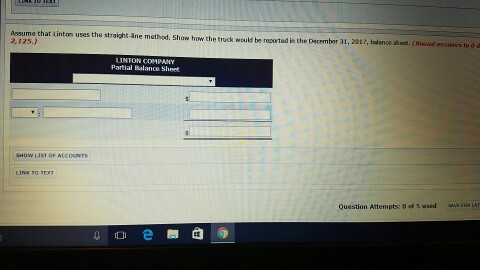

Exercise 9-7 Linton Company purchased a deslivery truck for $29,000 on January 1, 2017. The truck has an expected estimated usetul life of 1o years. Actual miles driven were 15,300 in 2017 and 13,400 in 2018 safvape alue of 2.100, and is expr Caloulate depreciation expense per mile under u expense per mile under units-of-activity method. (Round answer to 2 decmal places, e g o.so) Depredistion expense per mle Compute deprecation expense for 2017 and 2016 using(1) the straight-line method, (2) the units-of-activity matat and the doubl depreclation cost per unit to 2 decimal places, e.g. o.50 and depreciation rate to 0 decimal places, e.g. 15% Round Sinal answ (1) Straight-Ine method (2) Units-of-activity method [3) Double-decining-balance method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started