Answered step by step

Verified Expert Solution

Question

1 Approved Answer

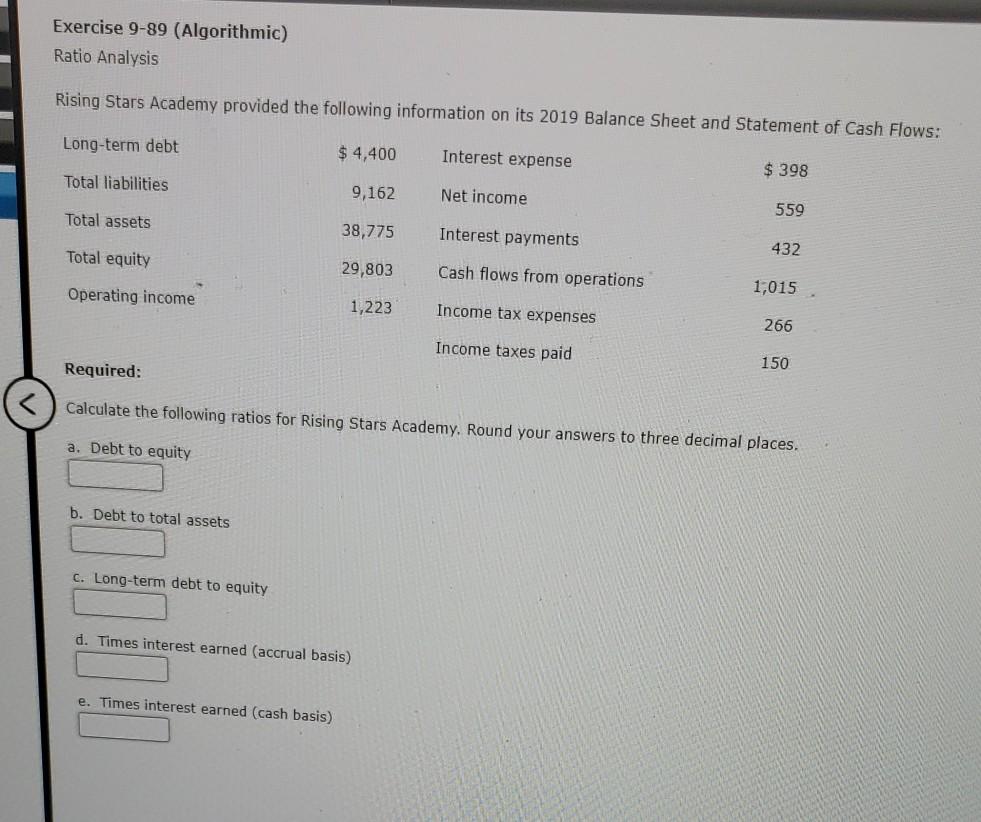

Exercise 9-89 (Algorithmic) Ratio Analysis Rising Stars Academy provided the following information on its 2019 Balance Sheet and Statement of Cash Flows: Long-term debt $

Exercise 9-89 (Algorithmic) Ratio Analysis Rising Stars Academy provided the following information on its 2019 Balance Sheet and Statement of Cash Flows: Long-term debt $ 4,400 Interest expense $ 398 Total liabilities 9,162 Net income 559 Total assets 38,775 Interest payments Total equity 432 29,803 Cash flows from operations Operating income 1,015 1,223 Income tax expenses 266 Income taxes paid Required: 150 Calculate the following ratios for Rising Stars Academy. Round your answers to three decimal places. a. Debt to equity b. Debt to total assets C. Long-term debt to equity d. Times interest earned (accrual basis) e. Times interest earned (cash basis) Exercise 9-89 (Algorithmic) Ratio Analysis Rising Stars Academy provided the following information on its 2019 Balance Sheet and Statement of Cash Flows: Long-term debt $ 4,400 Interest expense $ 398 Total liabilities 9,162 Net income 559 Total assets 38,775 Interest payments Total equity 432 29,803 Cash flows from operations Operating income 1,015 1,223 Income tax expenses 266 Income taxes paid Required: 150 Calculate the following ratios for Rising Stars Academy. Round your answers to three decimal places. a. Debt to equity b. Debt to total assets C. Long-term debt to equity d. Times interest earned (accrual basis) e. Times interest earned (cash basis)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started