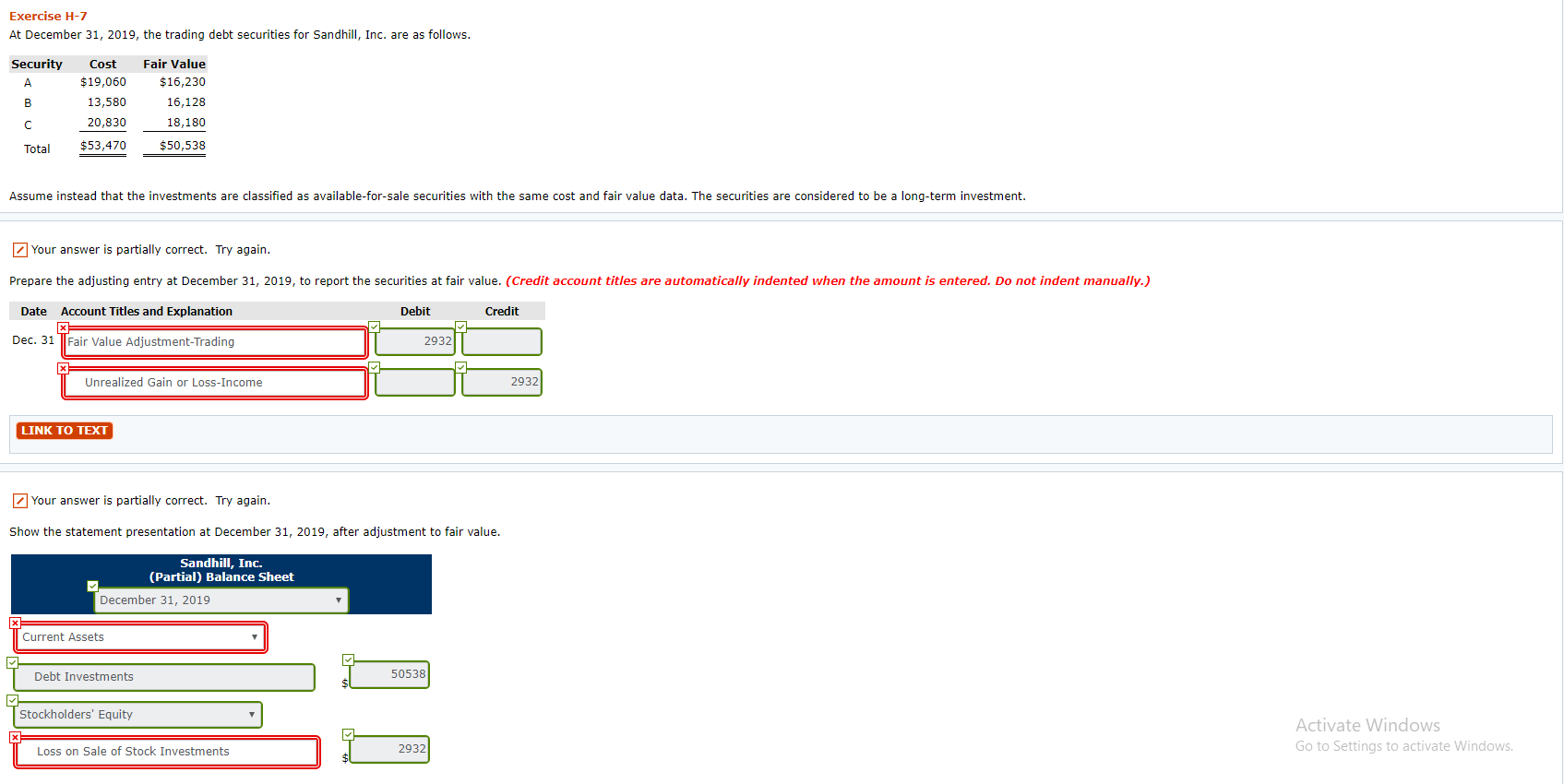

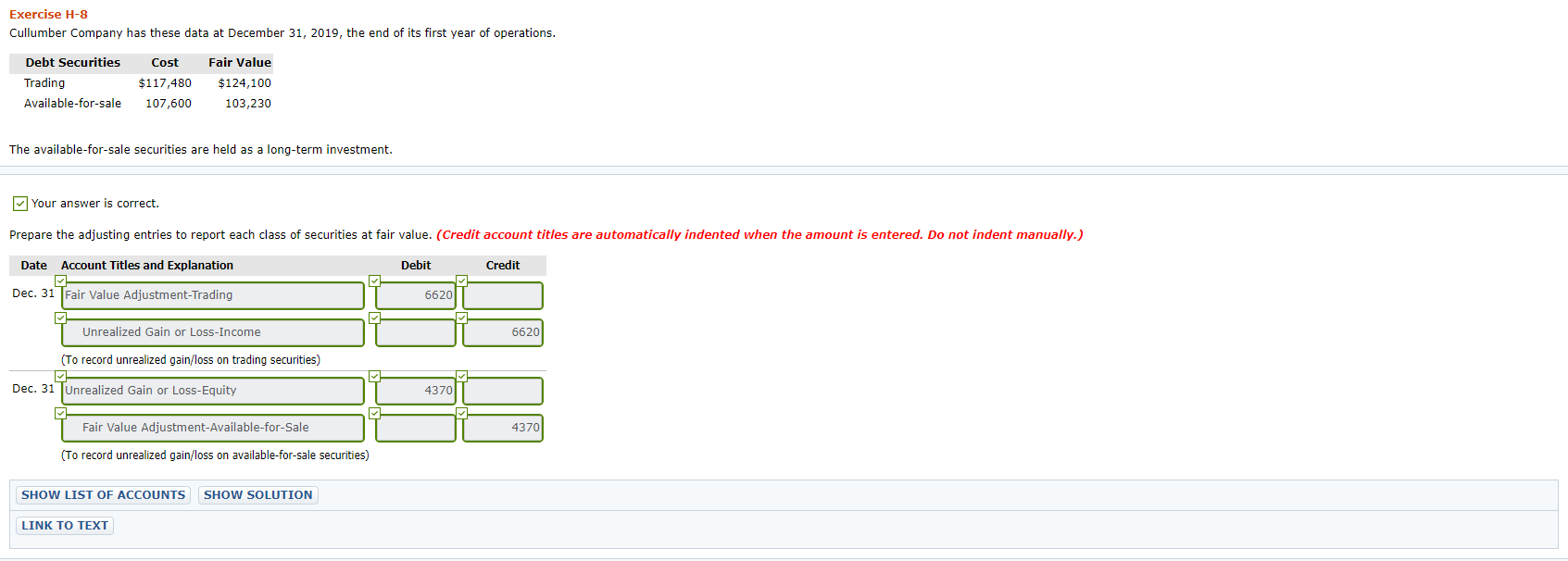

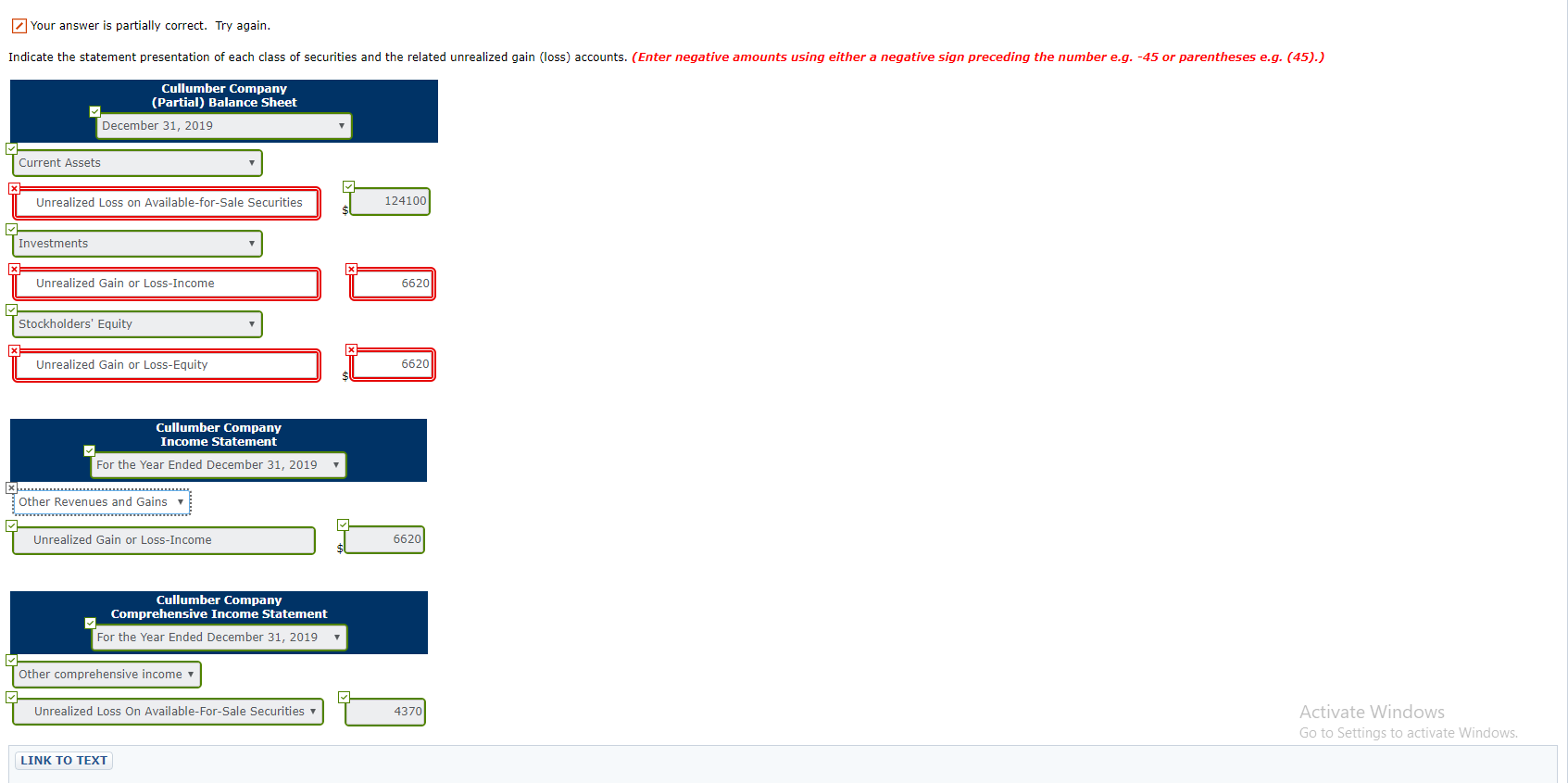

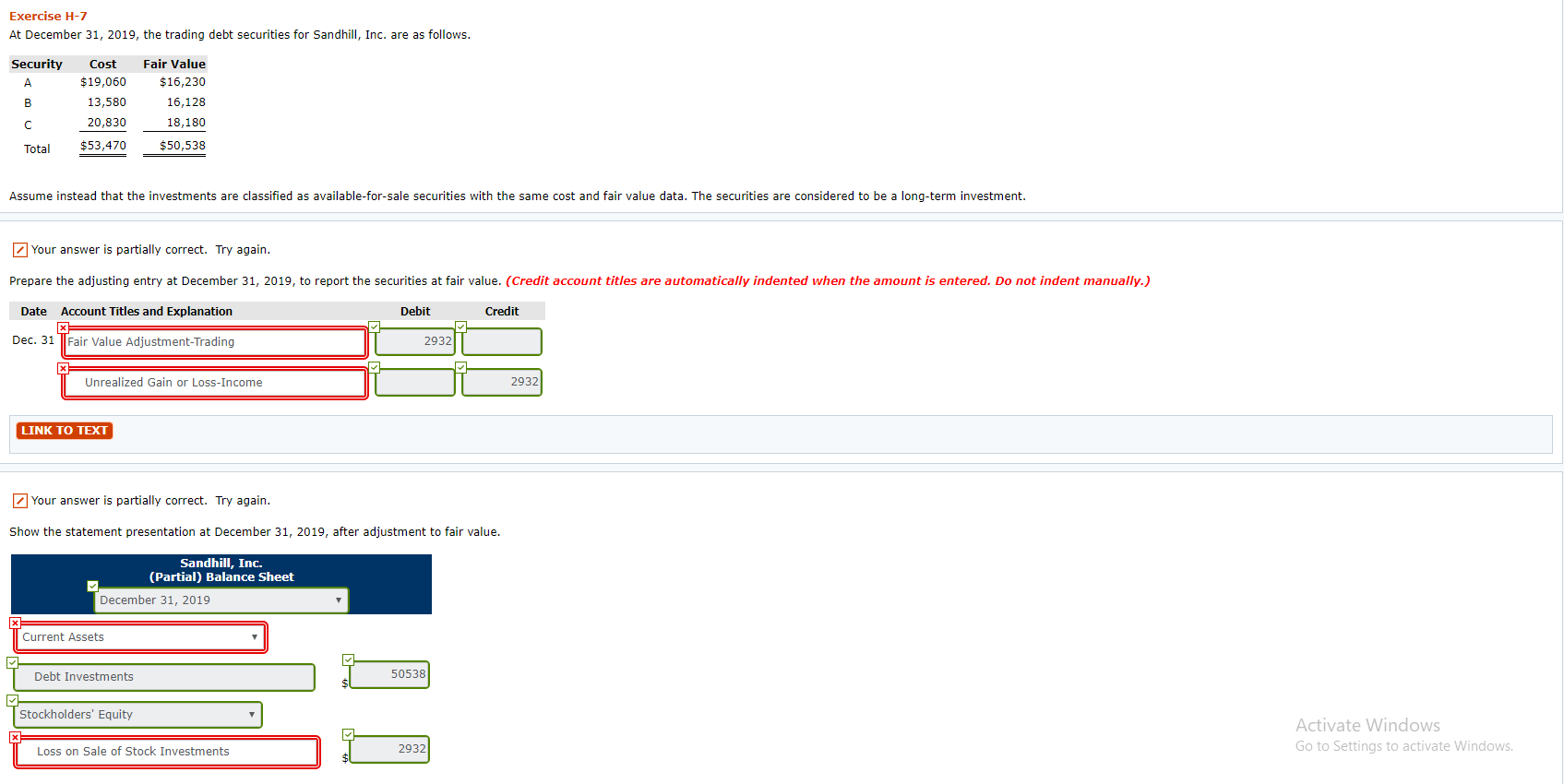

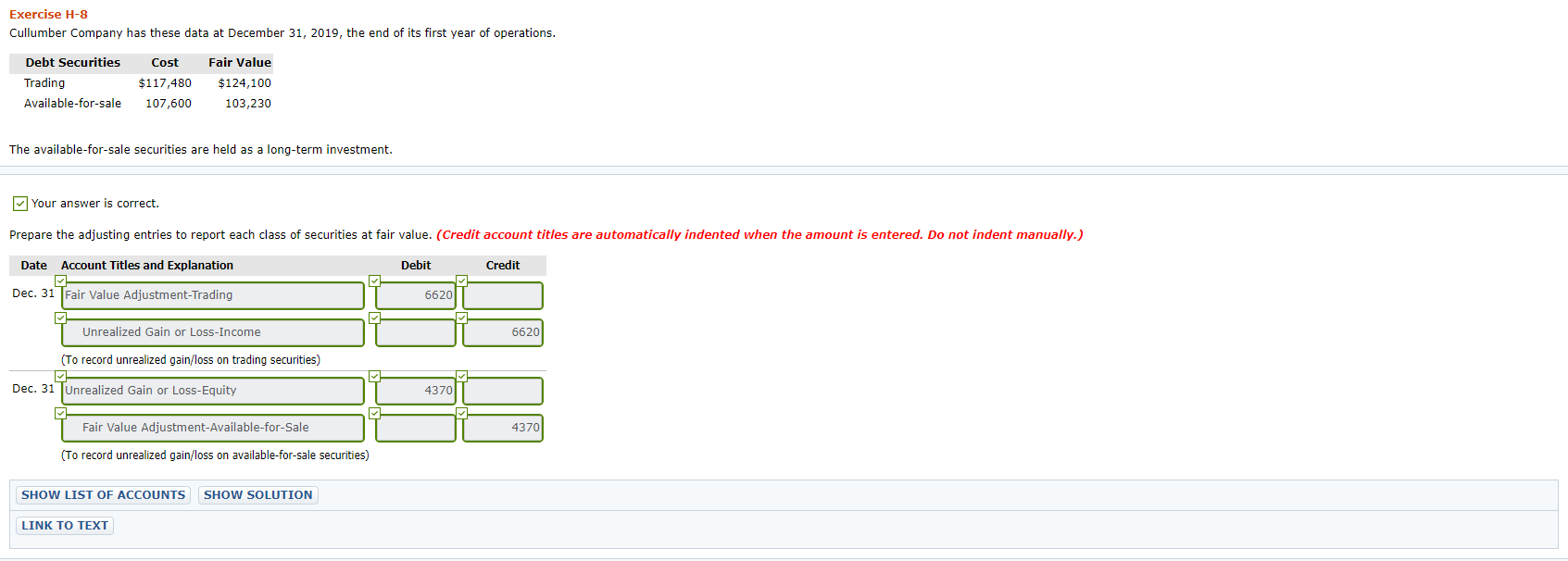

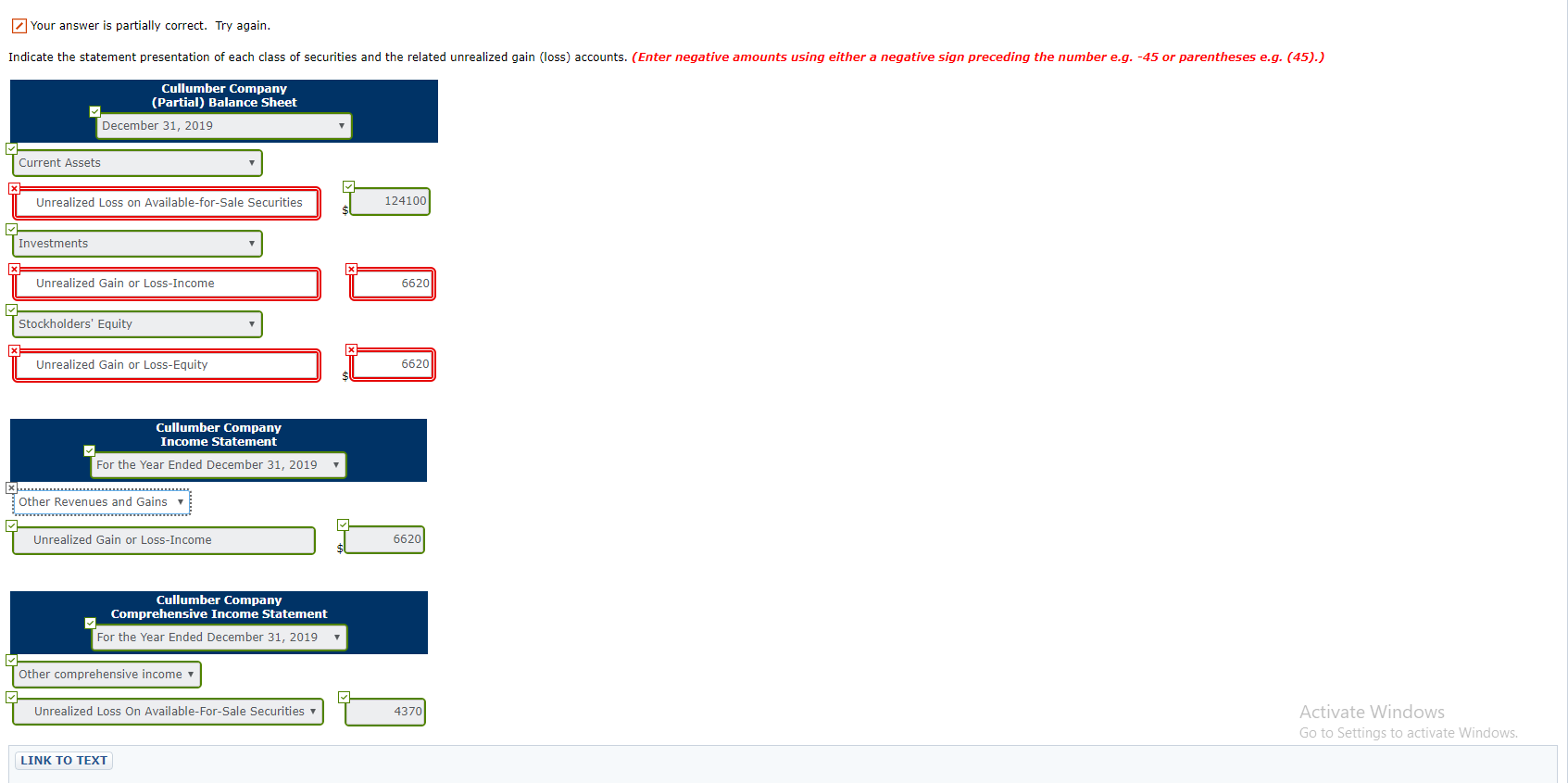

Exercise H-7 At December 31, 2019, the trading debt securities for Sandhill, Inc. are as follows. Security B Cost $19,060 13,580 20,830 $53,470 Fair Value $16,230 16,128 18,180 $50,538 Total Assume instead that the investments are classified as available-for-sale securities with the same cost and fair value data. The securities are considered to be a long-term investment. Your answer is partially correct. Try again. Prepare the adjusting entry at December 31, 2019, to report the securities at fair value. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 TFair Value Adjustment-Trading Unrealized Gain or Loss-Income JUC2932 2932 LINK TO TEXT Your answer is partially correct. Try again. Show the statement presentation at December 31, 2019, after adjustment to fair value. Sandhill, Inc. (Partial) Balance Sheet December 31, 2019 Current Assets 7 50529] | Debt Investments Stockholders' Equity | Loss on Sale of Stock Investments Activate Windows Go to Settings to activate Windows. 2932 Exercise H-8 Cullumber Company has these data at December 31, 2019, the end of its first year of operations. Debt Securities Trading Available-for-sale Cost $117,480 107,600 Fair Value $124,100 103,230 The available-for-sale securities are held as a long-term investment. Your answer is correct. Prepare the adjusting entries to report each class of securities at fair value. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Fair Value Adjustment-Trading Unrealized Gain or Loss-Income 5620 (To record unrealized gain/loss on trading securities) Dec. 31 unrealized Gain or Loss-Equity Fair Value Adjustment-Available-for-Sale 4370 (To record unrealized gain/loss on available-for-sale securities) SHOW LIST OF ACCOUNTS SHOW SOLUTION LINK TO TEXT Your answer is partially correct. Try again. Indicate the statement presentation of each class of securities and the related unrealized gain (loss) accounts. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Cullumber Company (Partial) Balance Sheet December 31, 2019 Current Assets Unrealized Loss on Available-for-Sale Securities 124100 Investments T Unrealized Gain or Loss-Income 6620 Stockholders' Equity Unrealized Gain or Loss-Equity 6620 Cullumber Company Income Statement For the Year Ended December 31, 2019 Other Revenues and Gains Unrealized Gain or Loss-Income 6620 Cullumber Company Comprehensive Income Statement For the Year Ended December 31, 2019 Other comprehensive income Unrealized Loss On Available-For-Sale Securities 4370 Activate Windows Go to Settings to activate Windows LINK TO TEXT