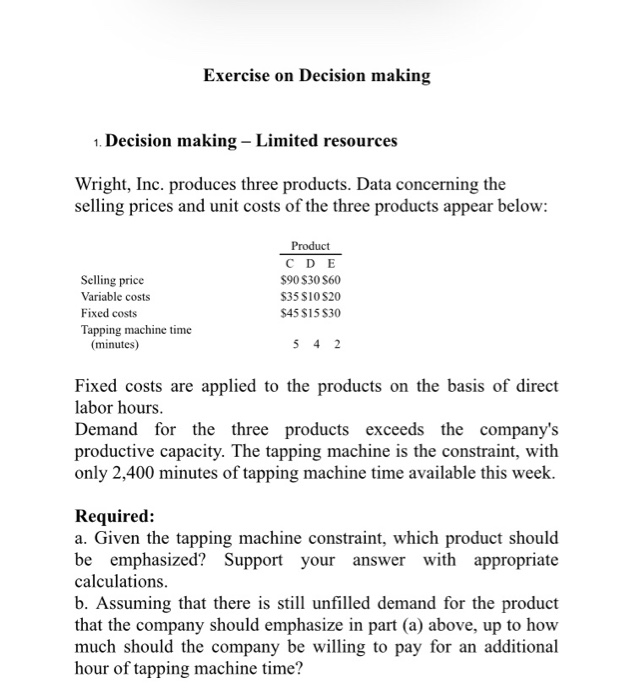

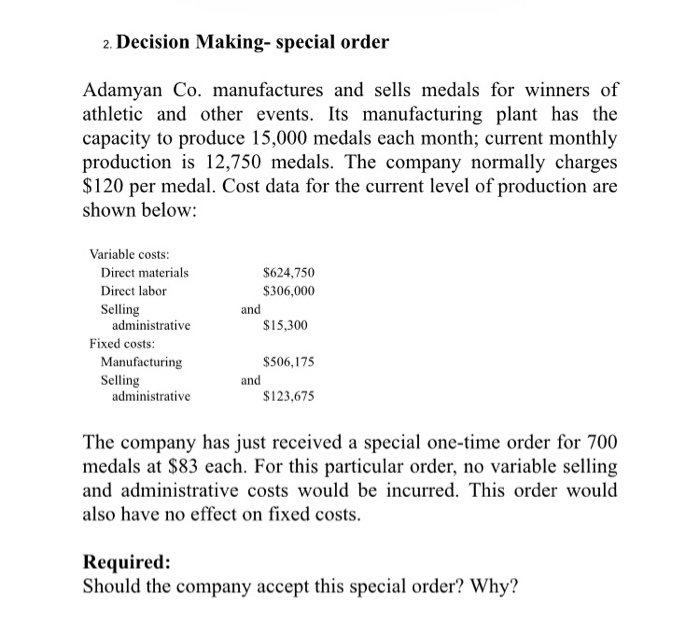

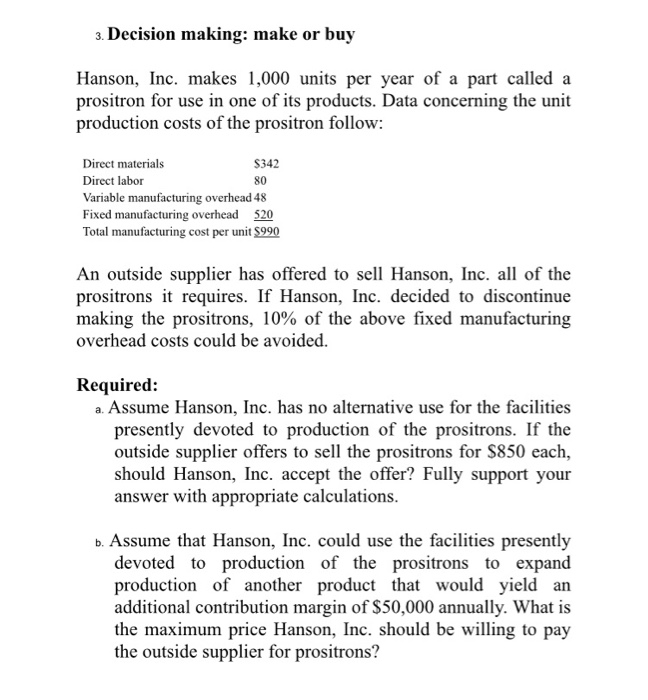

Exercise on Decision making 1. Decision making - Limited resources Wright, Inc. produces three products. Data concerning the selling prices and unit costs of the three products appear below: Selling price Variable costs Fixed costs Tapping machine time (minutes) Product C DE $90 $30 $60 $35 S10520 $45 $15530 5 4 2 Fixed costs are applied to the products on the basis of direct labor hours. Demand for the three products exceeds the company's productive capacity. The tapping machine is the constraint, with only 2,400 minutes of tapping machine time available this week. Required: a. Given the tapping machine constraint, which product should be emphasized? Support your answer with appropriate calculations. b. Assuming that there is still unfilled demand for the product that the company should emphasize in part (a) above, up to how much should the company be willing to pay for an additional hour of tapping machine time? 2. Decision Making- special order Adamyan Co. manufactures and sells medals for winners of athletic and other events. Its manufacturing plant has the capacity to produce 15,000 medals each month; current monthly production is 12,750 medals. The company normally charges $120 per medal. Cost data for the current level of production are shown below: Variable costs: Direct materials Direct labor Selling administrative Fixed costs: Manufacturing Selling administrative $624,750 $306,000 and $15,300 $506,175 and $123,675 The company has just received a special one-time order for 700 medals at $83 each. For this particular order, no variable selling and administrative costs would be incurred. This order would also have no effect on fixed costs. Required: Should the company accept this special order? Why? 3. Decision making: make or buy Hanson, Inc. makes 1,000 units per year of a part called a prositron for use in one of its products. Data concerning the unit production costs of the prositron follow: 80 Direct materials $342 Direct labor Variable manufacturing overhead 48 Fixed manufacturing overhead 520 Total manufacturing cost per unit 8990 An outside supplier has offered to sell Hanson, Inc. all of the prositrons it requires. If Hanson, Inc. decided to discontinue making the prositrons, 10% of the above fixed manufacturing overhead costs could be avoided. Required: a. Assume Hanson, Inc. has no alternative use for the facilities presently devoted to production of the prositrons. If the outside supplier offers to sell the prositrons for $850 each, should Hanson, Inc. accept the offer? Fully support your answer with appropriate calculations. b. Assume that Hanson, Inc. could use the facilities presently devoted to production of the prositrons to expand production of another product that would yield an additional contribution margin of $50,000 annually. What is the maximum price Hanson, Inc. should be willing to pay the outside supplier for prositrons