Answered step by step

Verified Expert Solution

Question

1 Approved Answer

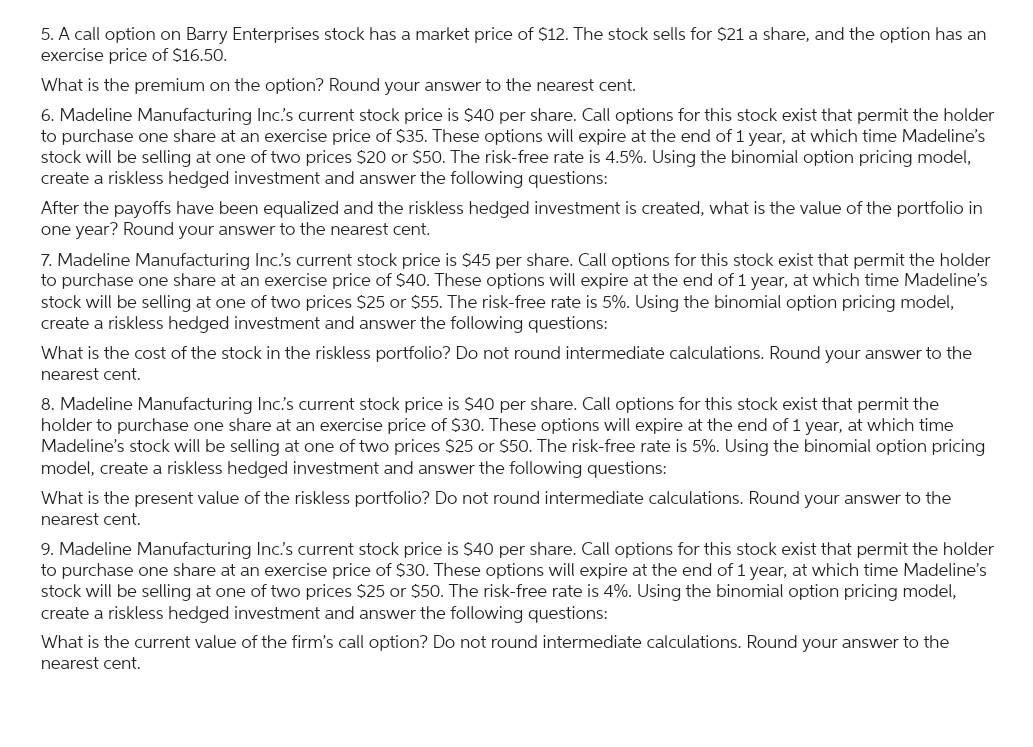

!! exercise price of ( $ 16.50 ). What is the premium on the option? Round your answer to the nearest cent. 6. Madeline Manufacturing

!!

exercise price of \\( \\$ 16.50 \\). What is the premium on the option? Round your answer to the nearest cent. 6. Madeline Manufacturing Inc.'s current stock price is \\( \\$ 40 \\) per share. Call options for this stock exist that permit the holder to purchase one share at an exercise price of \\( \\$ 35 \\). These options will expire at the end of 1 year, at which time Madeline's stock will be selling at one of two prices \\( \\$ 20 \\) or \\( \\$ 50 \\). The risk-free rate is \4.5. Using the binomial option pricing model, create a riskless hedged investment and answer the following questions: After the payoffs have been equalized and the riskless hedged investment is created, what is the value of the portfolio in one year? Round your answer to the nearest cent. 7. Madeline Manufacturing Inc.'s current stock price is \\( \\$ 45 \\) per share. Call options for this stock exist that permit the holder to purchase one share at an exercise price of \\( \\$ 40 \\). These options will expire at the end of 1 year, at which time Madeline's stock will be selling at one of two prices \\( \\$ 25 \\) or \\( \\$ 55 \\). The risk-free rate is \5. Using the binomial option pricing model, create a riskless hedged investment and answer the following questions: What is the cost of the stock in the riskless portfolio? Do not round intermediate calculations. Round your answer to the nearest cent. 8. Madeline Manufacturing Inc.'s current stock price is \\( \\$ 40 \\) per share. Call options for this stock exist that permit the holder to purchase one share at an exercise price of \\( \\$ 30 \\). These options will expire at the end of 1 year, at which time Madeline's stock will be selling at one of two prices \\( \\$ 25 \\) or \\( \\$ 50 \\). The risk-free rate is \5. Using the binomial option pricing model, create a riskless hedged investment and answer the following questions: What is the present value of the riskless portfolio? Do not round intermediate calculations. Round your answer to the nearest cent. 9. Madeline Manufacturing Inc.'s current stock price is \\( \\$ 40 \\) per share. Call options for this stock exist that permit the holder to purchase one share at an exercise price of \\( \\$ 30 \\). These options will expire at the end of 1 year, at which time Madeline's stock will be selling at one of two prices \\( \\$ 25 \\) or \\( \\$ 50 \\). The risk-free rate is \4. Using the binomial option pricing model, create a riskless hedged investment and answer the following questions: What is the current value of the firm's call option? Do not round intermediate calculations. Round your answer to the nearest centStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started