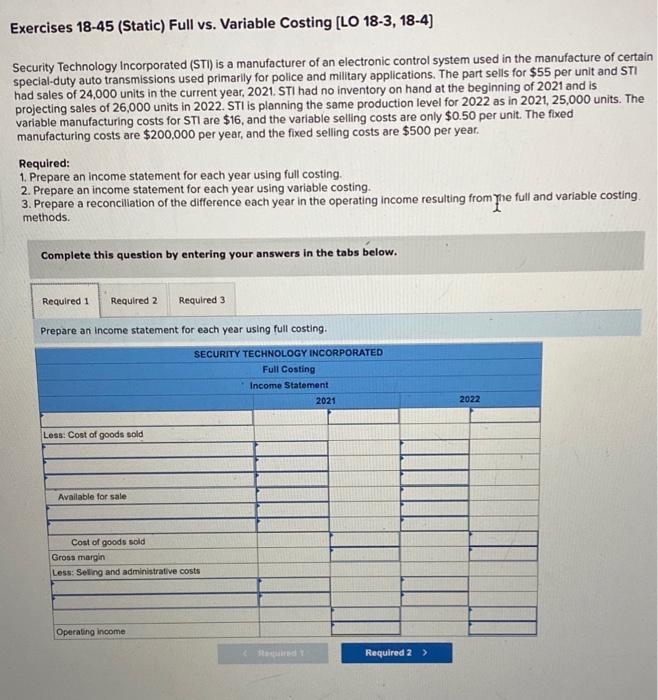

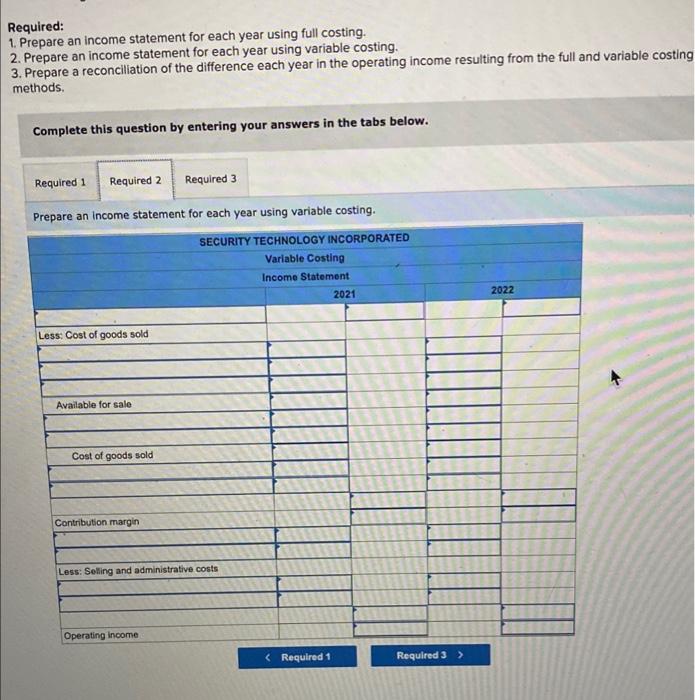

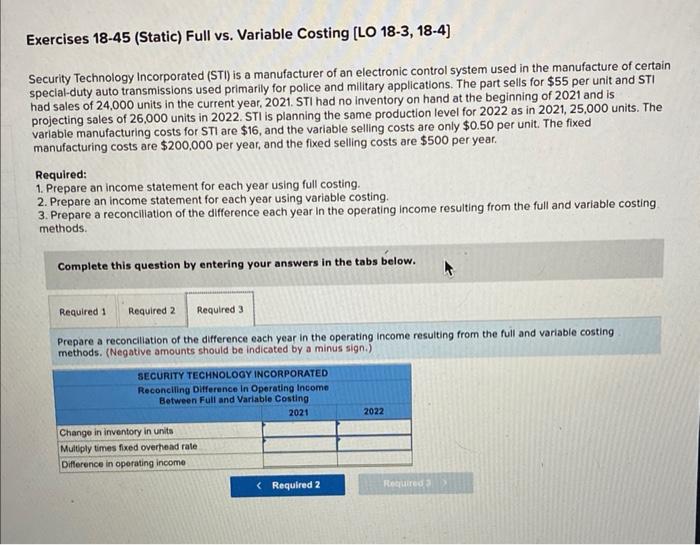

Exercises 18-45 (Static) Full vs. Variable Costing [LO 18-3, 18-4] Security Technology Incorporated (STI) is a manufacturer of an electronic control system used in the manufacture of certain special-duty auto transmissions used primarily for police and military applications. The part sells for $55 per unit and STI had sales of 24,000 units in the current year, 2021. STI had no inventory on hand at the beginning of 2021 and is projecting sales of 26,000 units in 2022. STI is planning the same production level for 2022 as in 2021, 25,000 units. The variable manufacturing costs for STi are $16, and the variable selling costs are only $0.50 per unit. The fixed manufacturing costs are $200,000 per year, and the fixed selling costs are $500 per year. Required: 1. Prepare an income statement for each year using full costing. 2. Prepare an income statement for each year using variable costing. 3. Prepare a reconcillation of the difference each year in the operating income resulting from foe full and variable costing. methods. Complete this question by entering your answers in the tabs below. Prepare an income statement for each year using full costing. Required: 1. Prepare an income statement for each year using full costing. 2. Prepare an income statement for each year using variable costing. 3. Prepare a reconciliation of the difference each year in the operating income resulting from the full and variable costing methods. Complete this question by entering your answers in the tabs below. Predare an income statement for each year using variable costing. Exercises 1845 (Static) Full vs. Variable Costing [LO 18-3, 18-4] Security Technology Incorporated (STI) is a manufacturer of an electronic control system used in the manufacture of certain special-duty auto transmissions used primarily for police and military applications. The part sells for $55 per unit and STI had sales of 24,000 units in the current year, 2021. STI had no inventory on hand at the beginning of 2021 and is projecting sales of 26,000 units in 2022. STI is planning the same production level for 2022 as in 2021,25,000 units. The variable manufacturing costs for $T1 are $16, and the variable selling costs are only $0.50 per unit. The fixed manufacturing costs are $200,000 per year, and the fixed selling costs are $500 per year. Required: 1. Prepare an income statement for each year using full costing. 2. Prepare an income statement for each year using variable costing. 3. Prepare a reconcillation of the difference each year in the operating income resulting from the full and variable costing methods. Complete this question by entering your answers in the tabs below. Prepare a reconciliation of the difference each year in the operating income resulting from the full and variable costing methods. (Negative amounts should be indicated by a minus sign.)