Answered step by step

Verified Expert Solution

Question

1 Approved Answer

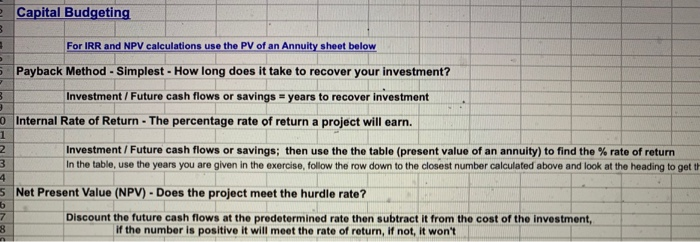

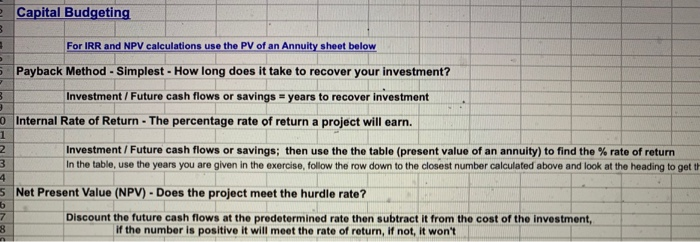

Exercises e Capital Budgeting For IRR and NPV calculations use the PV of an Annuity sheet below 3 Payback Method - Simplest - How long

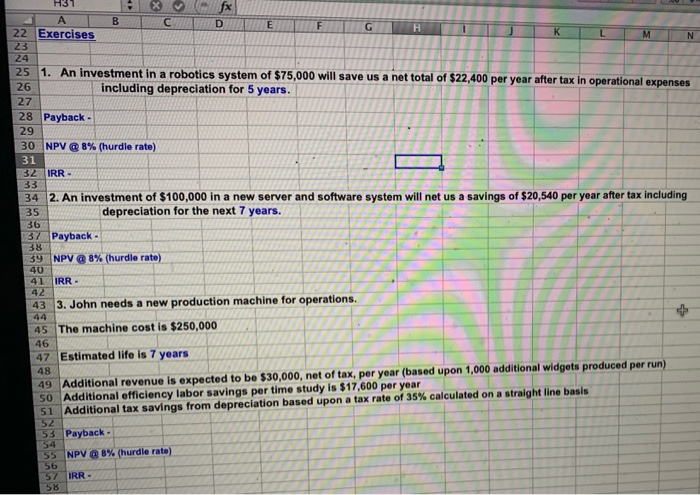

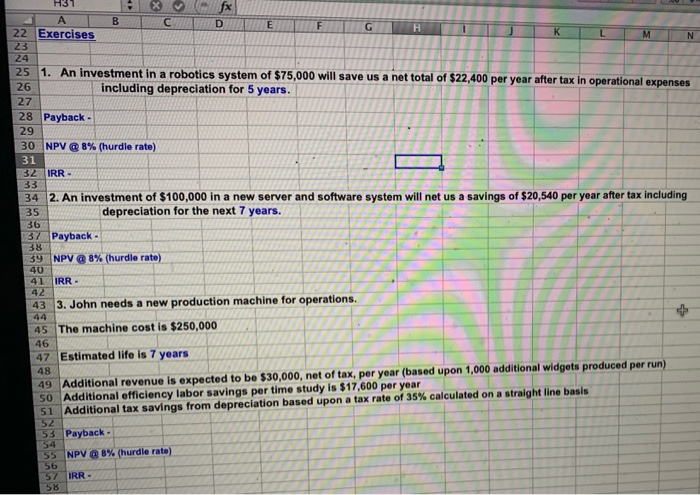

Exercises

e Capital Budgeting For IRR and NPV calculations use the PV of an Annuity sheet below 3 Payback Method - Simplest - How long does it take to recover your investment? Investment / Future cash flows or savings = years to recover investment Internal Rate of Return - The percentage rate of return a project will earn. 1 2 3 4 Investment / Future cash flows or savings; then use the the table (present value of an annuity) to find the % rate of return In the table, use the years you are given in the exercise, follow the row down to the closest number calculated above and look at the heading to get th 5 Net Present Value (NPV) - Does the project meet the hurdle rate? Discount the future cash flows at the predetermined rate then subtract it from the cost of the investment, if the number is positive it will meet the rate of return, if not, it won't b 7 3 M3 x A B D E F 22 Exercises G K M 23 N 24 25 1. An investment in a robotics system of $75,000 will save us a net total of $22,400 per year after tax in operational expenses 26 including depreciation for 5 years. 27 28 Payback 29 30 NPV @8% (hurdle rate) 31 32 IRR - 33 34 2. An investment of $100,000 in a new server and software system will net us a savings of $20,540 per year after tax including 35 depreciation for the next 7 years. 36 37 Payback 38 39 NPV @8% (hurdle rate) 40 41 IRR - 42 43 3. John needs a new production machine for operations. 44 45 The machine cost is $250,000 46 47 Estimated life is 7 years 48 49 Additional revenue is expected to be $30,000, net of tax, per year (based upon 1,000 additional widgets produced per run) 50 Additional efficiency labor savings per time study is $17,600 per year 51 Additional tax savings from depreciation based upon a tax rate of 35% calculated on a straight line basis 32 53 Payback 54 S5 NPV @8% (hurdle rate) 56 57 IRR - 58

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started