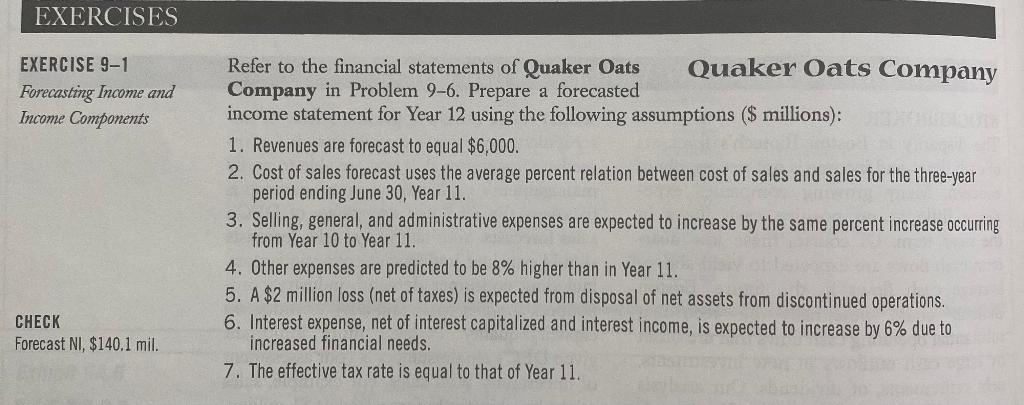

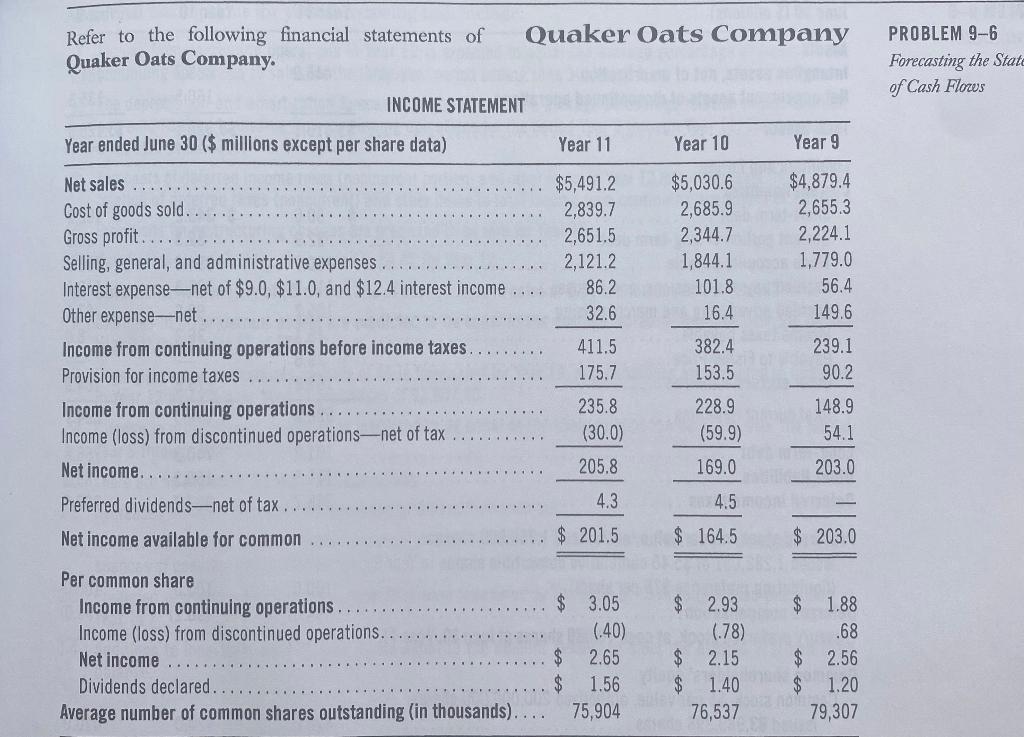

EXERCISES EXERCISE 9-1 Forecasting Income and Income Components Refer to the financial statements of Quaker Oats Quaker Oats Company Company in Problem 9-6. Prepare a forecasted income statement for Year 12 using the following assumptions ($ millions): 1. Revenues are forecast to equal $6,000. 2. Cost of sales forecast uses the average percent relation between cost of sales and sales for the three-year period ending June 30, Year 11. 3. Selling, general, and administrative expenses are expected to increase by the same percent increase occurring from Year 10 to Year 11. 4. Other expenses are predicted to be 8% higher than in Year 11. 5. A $2 million loss (net of taxes) is expected from disposal of net assets from discontinued operations. 6. Interest expense, net of interest capitalized and interest income, is expected to increase by 6% due to increased financial needs. 7. The effective tax rate is equal to that of Year 11. CHECK Forecast NI, $140.1 mil. Quaker Oats Company Refer to the following financial statements of Quaker Oats Company. PROBLEM 9-6 Forecasting the State of Cash Flows INCOME STATEMENT Year ended June 30 ($ millions except per share data) Year 11 Year 10 Year 9 Net sales Cost of goods sold. Gross profit... Selling, general, and administrative expenses.. Interest expense-net of $9.0, $11.0, and $12.4 interest income Other expense net Income from continuing operations before income taxes Provision for income taxes Income from continuing operations Income (loss) from discontinued operations-net of tax $5,491.2 2,839.7 2,651.5 2,121.2 86.2 32.6 $5,030.6 2,685.9 2,344.7 1,844.1 101.8 16.4 $4,879.4 2,655.3 2,224.1 1,779.0 56.4 149.6 239.1 90.2 411.5 175.7 382.4 153.5 235.8 (30.0) 228.9 (59.9) 169.0 148.9 54.1 Net income... 205.8 203.0 4.5 Preferred dividends-net of tax. Net income available for common 4.3 $ 201.5 $ 164.5 $ 203.0 1.88 Per common share Income from continuing operations.. Income (loss) from discontinued operations. Net income Dividends declared. Average number of common shares outstanding (in thousands).... $ 3.05 (.40) $ 2.65 $ 1.56 75,904 69 A $ 2.93 (.78) $ 2.15 $ 1.40 76,537 .68 $ 2.56 $ 1.20 79,307