Need help answering case study in the pictures

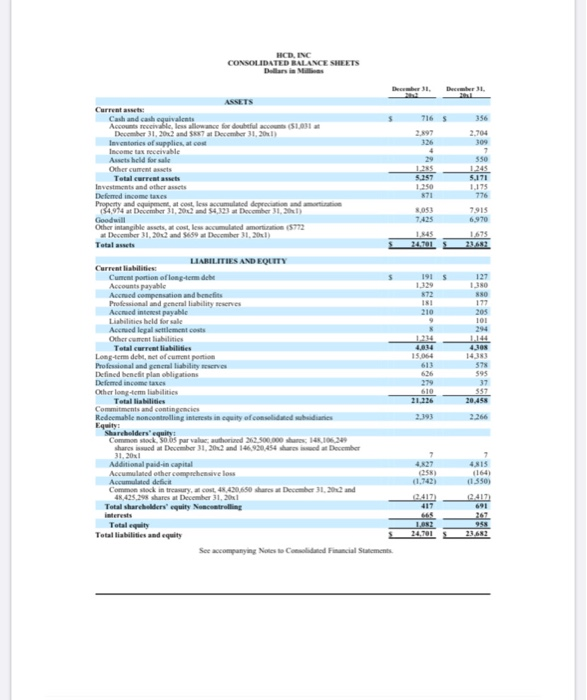

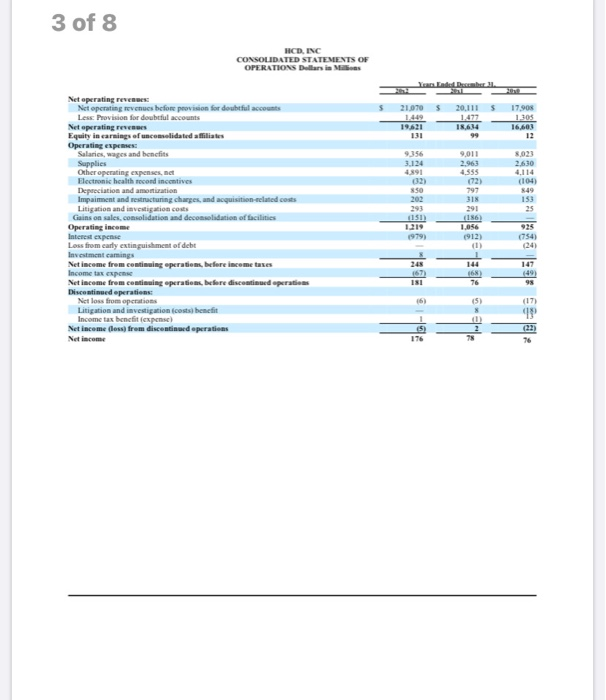

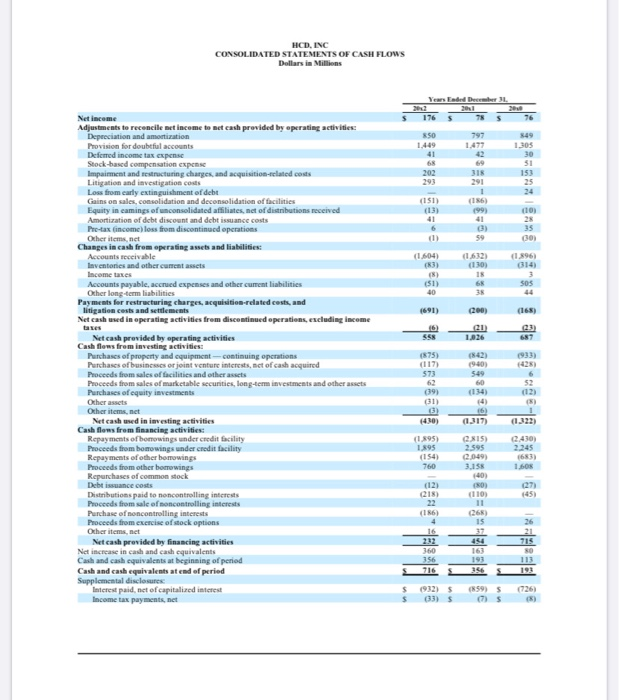

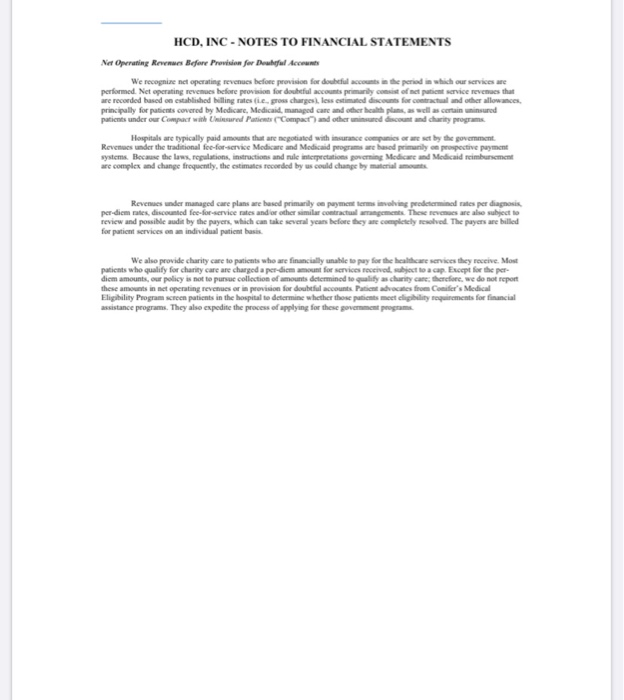

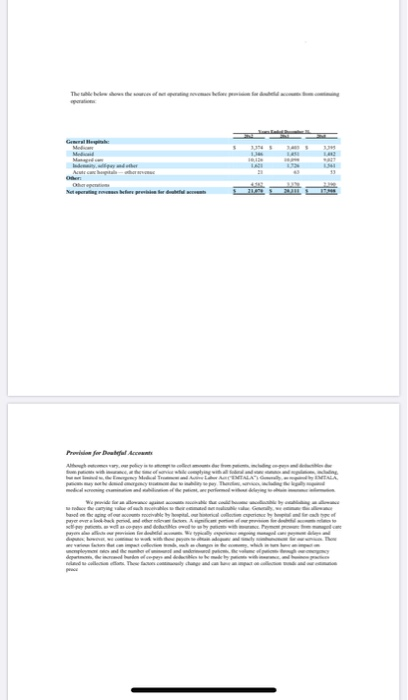

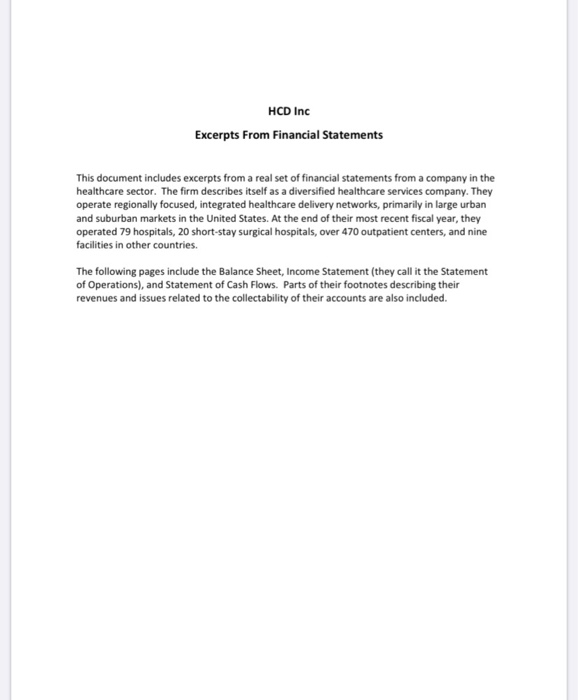

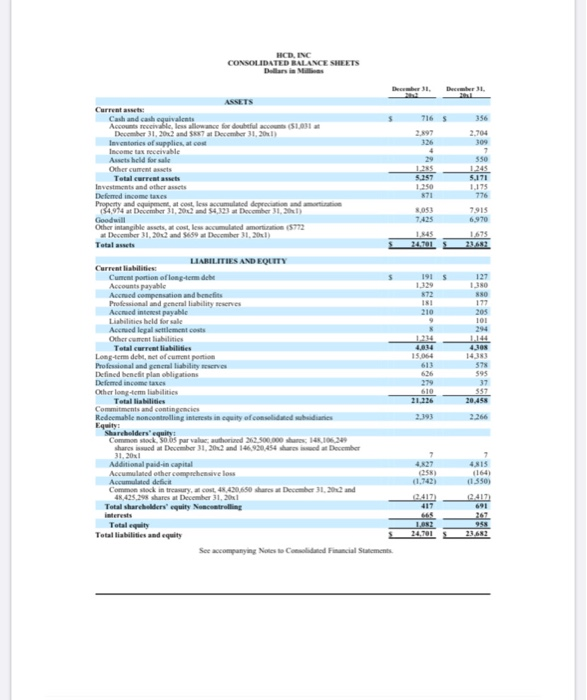

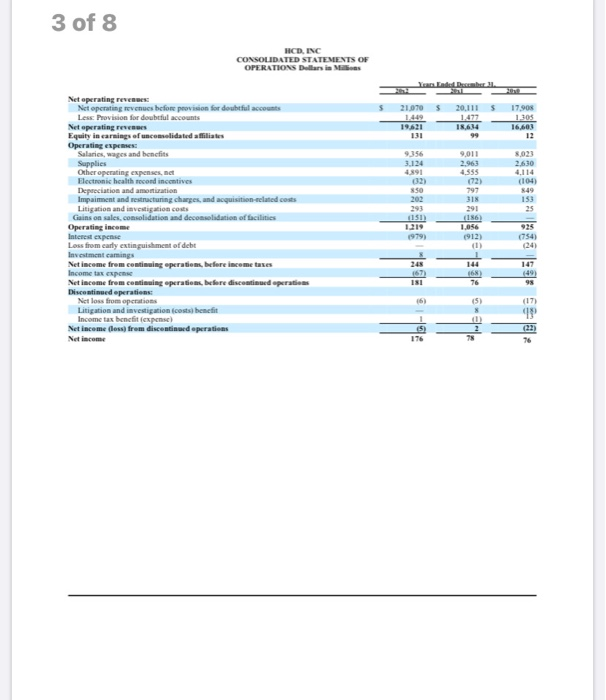

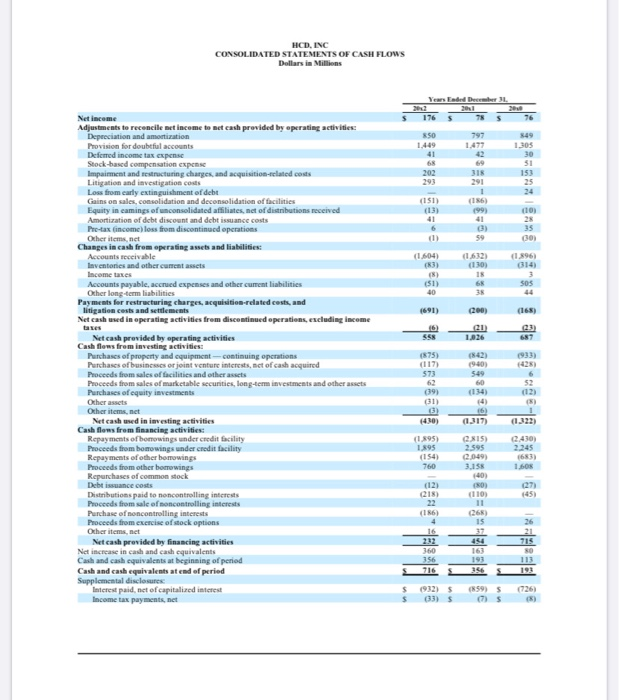

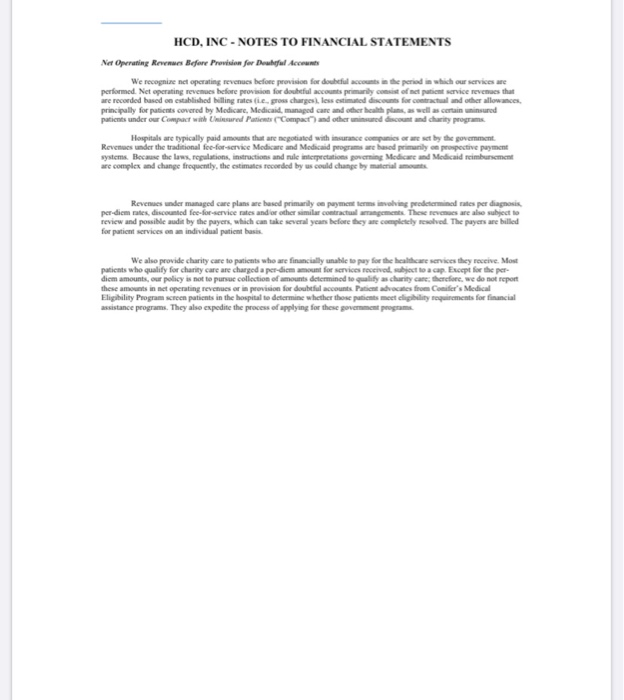

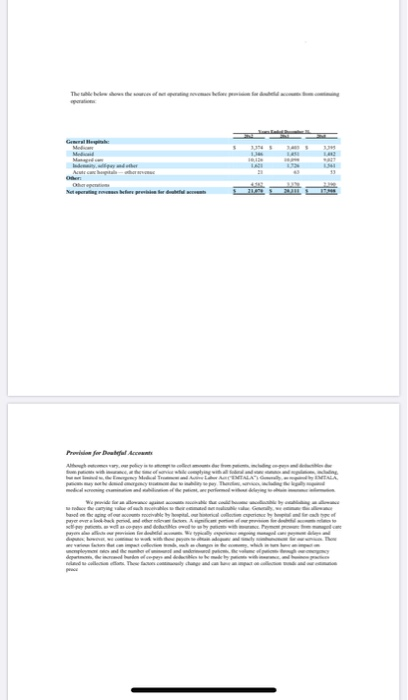

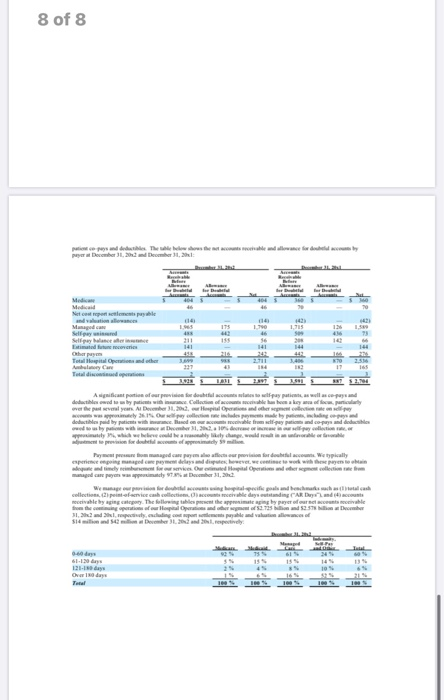

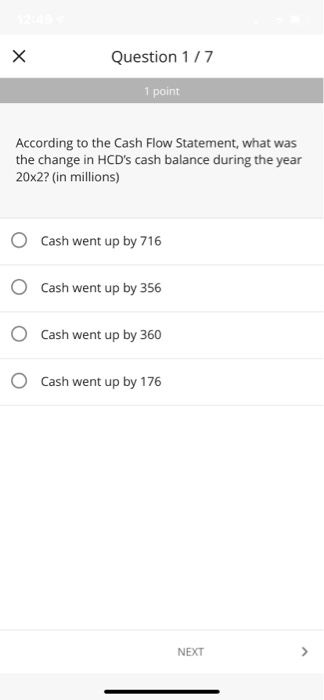

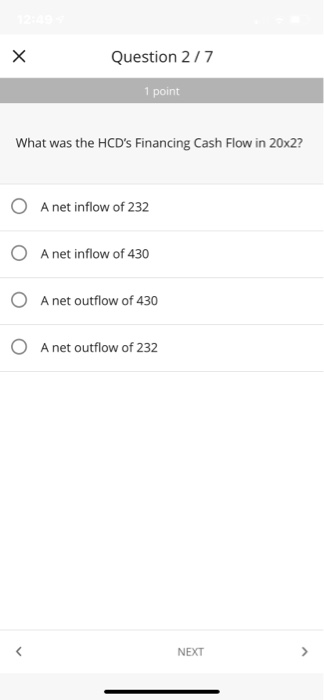

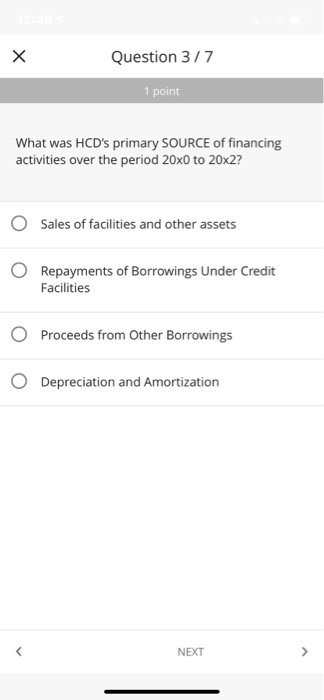

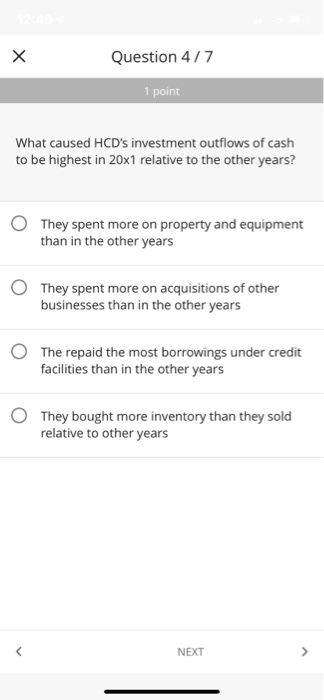

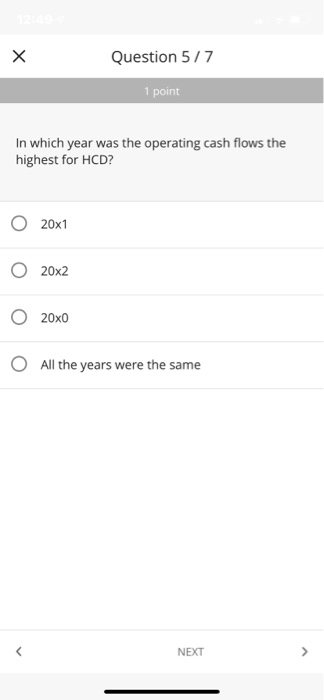

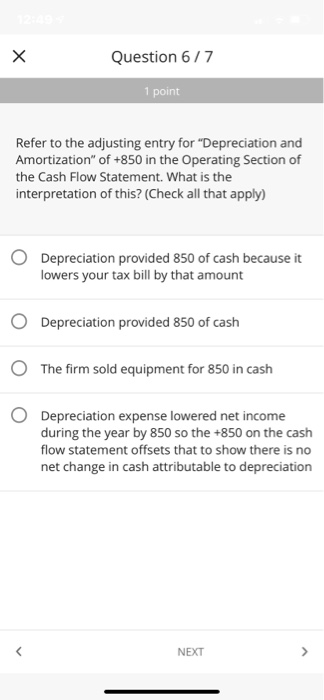

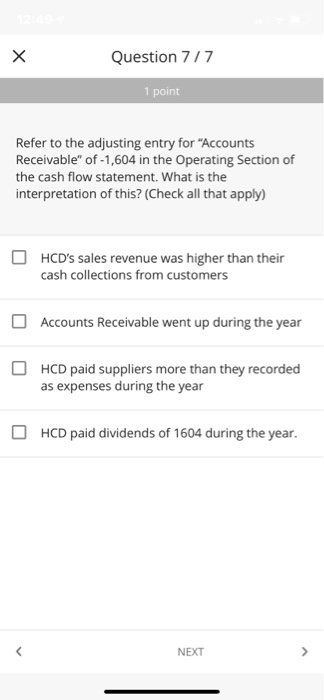

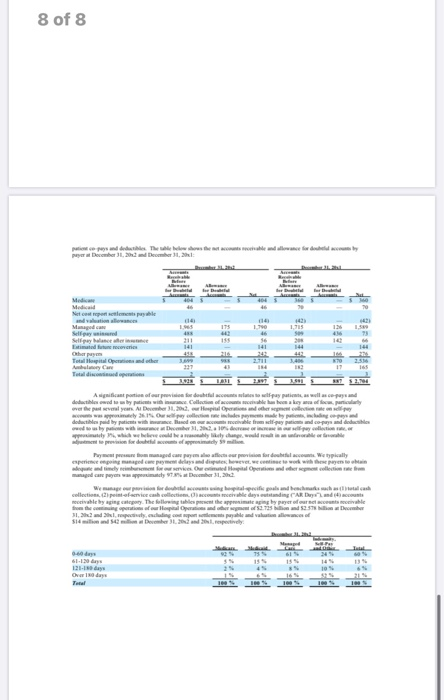

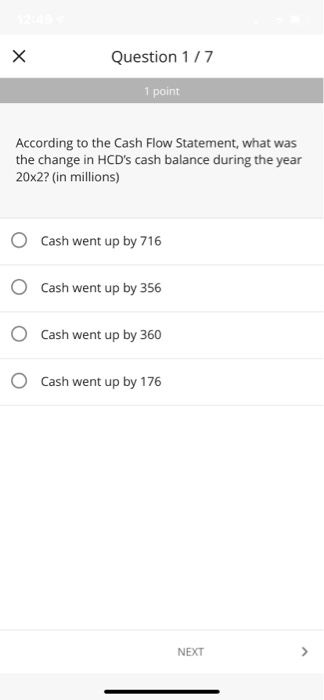

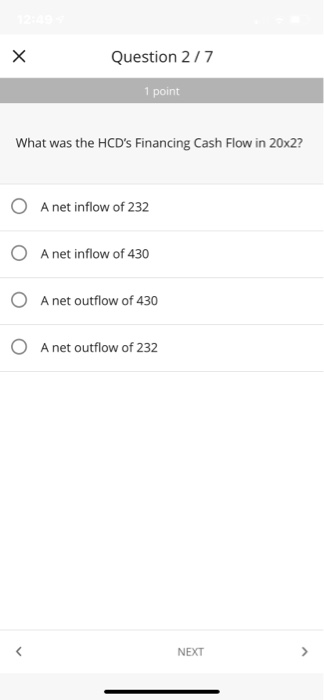

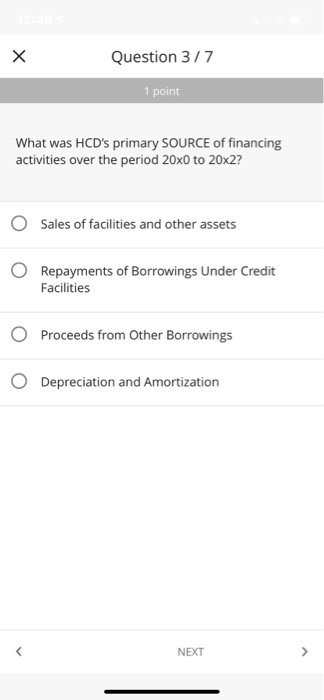

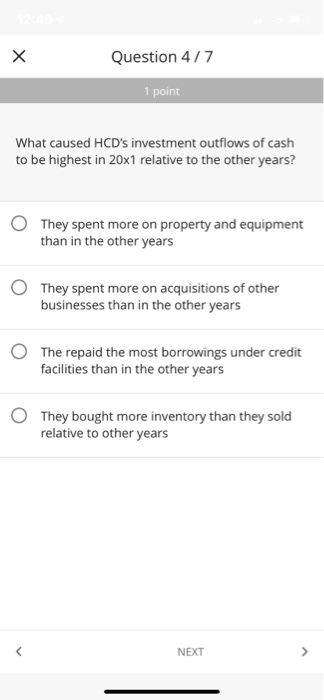

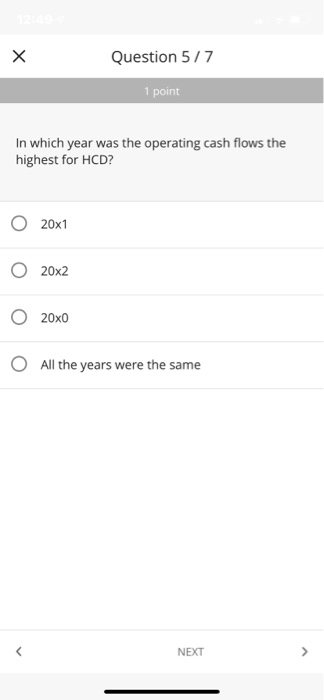

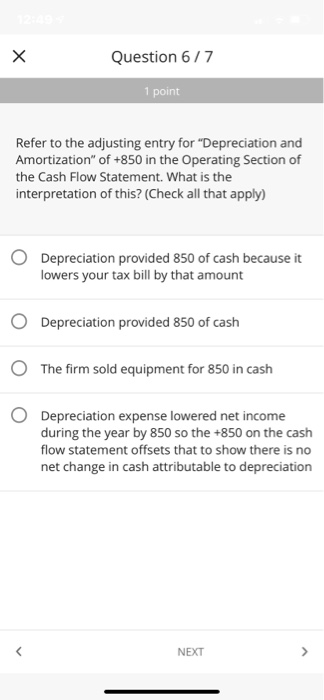

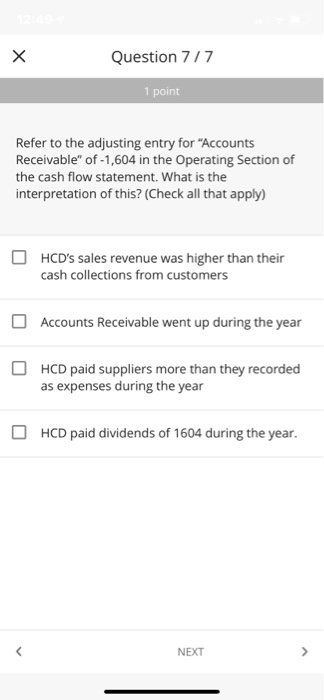

HCD Inc Excerpts From Financial Statements This document includes excerpts from a real set of financial statements from a company in the healthcare sector. The firm describes itself as a diversified healthcare services company. They operate regionally focused, integrated healthcare delivery networks, primarily in large urban and suburban markets in the United States. At the end of their most recent fiscal year, they operated 79 hospitals, 20 short-stay surgical hospitals, over 470 outpatient centers, and nine facilities in other countries. The following pages include the Balance Sheet, Income Statement they call it the Statement of Operations), and Statement of Cash Flows. Parts of their footnotes describing their revenues and issues related to the collectability of their accounts are also included. HINC CONSOLIDATEDRALANCE SHEETS ANNETS Cud 2.704 Incearca 1255 5111 SE P a Total Invaders Defined income Property and com p 3414 December 31, 20 5 4123 December Goodwill Other tha n December 31, 20and 659 December 31, 2011) Total 915 6970 7475 5772 L 11631 LIABILITIES AND EQUITY Cump flegten dhe Account Accued compensation and hencfits Professional and general liability Accued intenst payable Liabilities held for sale Accued legalm ent costs Other current liabilities Total current liabilities Long-term debeat ofcument portion Professional and generallability VGS Defined benci plan obligations Defined income Other long hits Total Halides Coi ns and contingencies Redeemable oncologining oc h harderuity Compra 100 shares December 31, 2013 and 146.30.454 December 31.2011 Additional pain capital Accued other c heveless Ac te defici Co r y. Our Dechend RE:11839938 1.4) Total shards quity Nestling Total Total 3 of 8 HCD, INC CONSOLIDATED STATEMENTS OF OPERATIONS Dularia M $ 20.111 1790 21.070 1.449 19.521 18.614 3023 Net operating rev Net operating revenues before provision for doubtful accounts Lesson la debutult Net operating Equity in earnings of unconsolidated affiliates Operating en Salaries, wages and benefits Supplies Other operating expenses, net Flatronic health and insis Depreciation and amontiration Impairment and restructuring charges and acquisition related costs Litigation and investigation costs Gains on sales, consolidation and deconsolidation of facilities Operating income 9356 3.124 2011 2963 72 (104) BIS 153 1,056 (912) (754 Loss from early extinguishment of debt minh cam ung Net income from continuing operations before income taxes als Net income from continuing operation before discontinued opera Discontinued operations: Net loss from operations Litigation and investigation costs) benefit Income tax benefit expense) Net income dess from discontinued operations Net income HCD. INC CONSOLIDATED STATEMENTS OF CASH FLOWS Dollars in Millions Net income Adjustments to reconcile et income to bet cash provided by operating activities Depreciation and amortization Provision for doubtful accounts Defined income tax expense Stock-based compensation expense Impairment and restructuring charges, and acquisition-related costs Litigation and investigation con Loss from early extinguishment of debt Gains on sales, consolidation and deconsolidation of facilities Equity in camins of unconsolidated affiliates, nct of distributions received Amortization of debt discount and debt issuance costs Pre-tax income) loss from discontinued operations Other items, net Changes in cash from operating assets and liabilities: Accounts receivable Leventones and other c lasses (186) (1.604) (R3) (130) (314) (51) sos Accounts payable, accrued expenses and other comment liabilities Other long-term liabilities Payments for restructuring charges acquisitios-related costs, and litigation costs and settlements Net cash used in operating activities from discontinued operations, excluding income (691) 200) (165) 1936 (375) (117) 842) 960) (425) 973 a 1997 geega na eee255 angg legac**413919 388 38+33 ( 61 11494990 ang ceg=399219 (134) 1410) (1217) (12) CIS 22595 (1895) 1895 (154) 760 Netcash provided by operating activities Cash flows from investing activities Purchases of property and equipment -- continuing operations Purchases of businesses or joint venture interests, nct of cash acquired Proceeds from sales of facilities and other assets Proceeds from sales of marketable securities, long-term investments and other assets Purchases of equity investments Oxher assets Other items.net Net cash used in investing activities Cash flows from financing activities: Repayments of borowings under credit facility Proceeds from botwings under credit facility Repayments of other bemowings Proceeds from other bome wings Repurchases of common stock Debt issuance costs Distributions paid to noncontrolling in Proceeds from sale of moncontrolling interests Purchase of noncontrolling interests Proceeds from een of stock options Other items, net Net cash provided by financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Supplemental disclosures Interest paid, net of capitalized interest Income tax payments.net 2345 1683) 268) 9A 5 716 S 356 (932) (33) 5 S (859) (1) S S (726) (8) HCD, INC-NOTES TO FINANCIAL STATEMENTS Net Operating Revenues Before Provision for Dateful Acom We recognize net operating revenues before provision for doubl e the period in which our services are performed. Net operating revenues before provision for doubtful account primarily consist of patient service revenues that are recorded based on established billing rates (ie gross charges less estimated discount for contractual and other allowances principally for patients covered by Medicare Medicaid managed came and other health plans, as well as certain insured patients under our Compact with Comparadother discount and charity programs Hospitals are typically paid amounts that are negotiated with insurance co s t by the government Revenues under the traditional fee-for-service Medicare and Medicaid p h ased on prospective payment systems. Because the laws, regulations, instructions and rule interpretations pouring Medicare and Medicaid reimbursement are complex and change frequently, the estimates recorded by could change by manalo Revenues nder managed care plans whosed primarily op v og podi dates per diagnosis per-dicmates, discounted fee for service rates and other similar contracta m ents There are also subject to review and possible audit by the payers, which can take several years before they are completely resolved. The payers are billed for patient services on individual patient basis We also provide charity came to patients who are financially unable to pay for the healthcare services they receive. Most patients who qualify for charity care are charged a per-dicm amount for services re j ect to a cup. Except for the per diem amounts, our policy is not to pursue collection of amount determined to qualify as charity can therefore, we do not report these amounts in net operating revenues or in provision for doubtful accounts Patch cales from Comer's Medical Eligibility Program screen patients in the hospital to determine whether these patients meet cibly requirements for financial assistance programs. They also expedite the process of applying for these govem programs 8 of 8) |EHEAF -si Tatal ileana - Question 1/7 1 point According to the Cash Flow Statement, what was the change in HCD's cash balance during the year 20x2? (in millions) O Cash went up by 716 O Cash went up by 356 O Cash went up by 360 Cash went up by 176 NEXT Question 2/7 1 point What was the HCD's Financing Cash Flow in 20x2? O A net inflow of 232 O A net inflow of 430 O A net outflow of 430 O A net outflow of 232 NEXT Question 3/7 1 point What was HCD's primary SOURCE of financing activities over the period 20x0 to 20x2? O Sales of facilities and other assets Repayments of Borrowings Under Credit Facilities O Proceeds from Other Borrowings O Depreciation and Amortization NEXT Question 4/7 1 point What caused HCD's investment outflows of cash to be highest in 20x1 relative to the other years? O They spent more on property and equipment than in the other years They spent more on acquisitions of other businesses than in the other years The repaid the most borrowings under credit facilities than in the other years O They bought more inventory than they sold relative to other years NEXT Question 5/7 1 point In which year was the operating cash flows the highest for HCD? 20x1 O 20x2 O 20x0 O All the years were the same NEXT Question 6/7 1 point Refer to the adjusting entry for "Depreciation and Amortization" of +850 in the Operating Section of the Cash Flow Statement. What is the interpretation of this? (Check all that apply) O Depreciation provided 850 of cash because it lowers your tax bill by that amount O Depreciation provided 850 of cash O The firm sold equipment for 850 in cash O Depreciation expense lowered net income during the year by 850 so the +850 on the cash flow statement offsets that to show there is no net change in cash attributable to depreciation NEXT Question 7/7 1 point Refer to the adjusting entry for "Accounts Receivable" of -1,604 in the Operating Section of the cash flow statement. What is the interpretation of this? (Check all that apply) O HCD's sales revenue was higher than their cash collections from customers O Accounts Receivable went up during the year O HCD paid suppliers more than they recorded as expenses during the year O HCD paid dividends of 1604 during the year. NEXT HCD Inc Excerpts From Financial Statements This document includes excerpts from a real set of financial statements from a company in the healthcare sector. The firm describes itself as a diversified healthcare services company. They operate regionally focused, integrated healthcare delivery networks, primarily in large urban and suburban markets in the United States. At the end of their most recent fiscal year, they operated 79 hospitals, 20 short-stay surgical hospitals, over 470 outpatient centers, and nine facilities in other countries. The following pages include the Balance Sheet, Income Statement they call it the Statement of Operations), and Statement of Cash Flows. Parts of their footnotes describing their revenues and issues related to the collectability of their accounts are also included. HINC CONSOLIDATEDRALANCE SHEETS ANNETS Cud 2.704 Incearca 1255 5111 SE P a Total Invaders Defined income Property and com p 3414 December 31, 20 5 4123 December Goodwill Other tha n December 31, 20and 659 December 31, 2011) Total 915 6970 7475 5772 L 11631 LIABILITIES AND EQUITY Cump flegten dhe Account Accued compensation and hencfits Professional and general liability Accued intenst payable Liabilities held for sale Accued legalm ent costs Other current liabilities Total current liabilities Long-term debeat ofcument portion Professional and generallability VGS Defined benci plan obligations Defined income Other long hits Total Halides Coi ns and contingencies Redeemable oncologining oc h harderuity Compra 100 shares December 31, 2013 and 146.30.454 December 31.2011 Additional pain capital Accued other c heveless Ac te defici Co r y. Our Dechend RE:11839938 1.4) Total shards quity Nestling Total Total 3 of 8 HCD, INC CONSOLIDATED STATEMENTS OF OPERATIONS Dularia M $ 20.111 1790 21.070 1.449 19.521 18.614 3023 Net operating rev Net operating revenues before provision for doubtful accounts Lesson la debutult Net operating Equity in earnings of unconsolidated affiliates Operating en Salaries, wages and benefits Supplies Other operating expenses, net Flatronic health and insis Depreciation and amontiration Impairment and restructuring charges and acquisition related costs Litigation and investigation costs Gains on sales, consolidation and deconsolidation of facilities Operating income 9356 3.124 2011 2963 72 (104) BIS 153 1,056 (912) (754 Loss from early extinguishment of debt minh cam ung Net income from continuing operations before income taxes als Net income from continuing operation before discontinued opera Discontinued operations: Net loss from operations Litigation and investigation costs) benefit Income tax benefit expense) Net income dess from discontinued operations Net income HCD. INC CONSOLIDATED STATEMENTS OF CASH FLOWS Dollars in Millions Net income Adjustments to reconcile et income to bet cash provided by operating activities Depreciation and amortization Provision for doubtful accounts Defined income tax expense Stock-based compensation expense Impairment and restructuring charges, and acquisition-related costs Litigation and investigation con Loss from early extinguishment of debt Gains on sales, consolidation and deconsolidation of facilities Equity in camins of unconsolidated affiliates, nct of distributions received Amortization of debt discount and debt issuance costs Pre-tax income) loss from discontinued operations Other items, net Changes in cash from operating assets and liabilities: Accounts receivable Leventones and other c lasses (186) (1.604) (R3) (130) (314) (51) sos Accounts payable, accrued expenses and other comment liabilities Other long-term liabilities Payments for restructuring charges acquisitios-related costs, and litigation costs and settlements Net cash used in operating activities from discontinued operations, excluding income (691) 200) (165) 1936 (375) (117) 842) 960) (425) 973 a 1997 geega na eee255 angg legac**413919 388 38+33 ( 61 11494990 ang ceg=399219 (134) 1410) (1217) (12) CIS 22595 (1895) 1895 (154) 760 Netcash provided by operating activities Cash flows from investing activities Purchases of property and equipment -- continuing operations Purchases of businesses or joint venture interests, nct of cash acquired Proceeds from sales of facilities and other assets Proceeds from sales of marketable securities, long-term investments and other assets Purchases of equity investments Oxher assets Other items.net Net cash used in investing activities Cash flows from financing activities: Repayments of borowings under credit facility Proceeds from botwings under credit facility Repayments of other bemowings Proceeds from other bome wings Repurchases of common stock Debt issuance costs Distributions paid to noncontrolling in Proceeds from sale of moncontrolling interests Purchase of noncontrolling interests Proceeds from een of stock options Other items, net Net cash provided by financing activities Net increase in cash and cash equivalents Cash and cash equivalents at beginning of period Cash and cash equivalents at end of period Supplemental disclosures Interest paid, net of capitalized interest Income tax payments.net 2345 1683) 268) 9A 5 716 S 356 (932) (33) 5 S (859) (1) S S (726) (8) HCD, INC-NOTES TO FINANCIAL STATEMENTS Net Operating Revenues Before Provision for Dateful Acom We recognize net operating revenues before provision for doubl e the period in which our services are performed. Net operating revenues before provision for doubtful account primarily consist of patient service revenues that are recorded based on established billing rates (ie gross charges less estimated discount for contractual and other allowances principally for patients covered by Medicare Medicaid managed came and other health plans, as well as certain insured patients under our Compact with Comparadother discount and charity programs Hospitals are typically paid amounts that are negotiated with insurance co s t by the government Revenues under the traditional fee-for-service Medicare and Medicaid p h ased on prospective payment systems. Because the laws, regulations, instructions and rule interpretations pouring Medicare and Medicaid reimbursement are complex and change frequently, the estimates recorded by could change by manalo Revenues nder managed care plans whosed primarily op v og podi dates per diagnosis per-dicmates, discounted fee for service rates and other similar contracta m ents There are also subject to review and possible audit by the payers, which can take several years before they are completely resolved. The payers are billed for patient services on individual patient basis We also provide charity came to patients who are financially unable to pay for the healthcare services they receive. Most patients who qualify for charity care are charged a per-dicm amount for services re j ect to a cup. Except for the per diem amounts, our policy is not to pursue collection of amount determined to qualify as charity can therefore, we do not report these amounts in net operating revenues or in provision for doubtful accounts Patch cales from Comer's Medical Eligibility Program screen patients in the hospital to determine whether these patients meet cibly requirements for financial assistance programs. They also expedite the process of applying for these govem programs 8 of 8) |EHEAF -si Tatal ileana - Question 1/7 1 point According to the Cash Flow Statement, what was the change in HCD's cash balance during the year 20x2? (in millions) O Cash went up by 716 O Cash went up by 356 O Cash went up by 360 Cash went up by 176 NEXT Question 2/7 1 point What was the HCD's Financing Cash Flow in 20x2? O A net inflow of 232 O A net inflow of 430 O A net outflow of 430 O A net outflow of 232 NEXT Question 3/7 1 point What was HCD's primary SOURCE of financing activities over the period 20x0 to 20x2? O Sales of facilities and other assets Repayments of Borrowings Under Credit Facilities O Proceeds from Other Borrowings O Depreciation and Amortization NEXT Question 4/7 1 point What caused HCD's investment outflows of cash to be highest in 20x1 relative to the other years? O They spent more on property and equipment than in the other years They spent more on acquisitions of other businesses than in the other years The repaid the most borrowings under credit facilities than in the other years O They bought more inventory than they sold relative to other years NEXT Question 5/7 1 point In which year was the operating cash flows the highest for HCD? 20x1 O 20x2 O 20x0 O All the years were the same NEXT Question 6/7 1 point Refer to the adjusting entry for "Depreciation and Amortization" of +850 in the Operating Section of the Cash Flow Statement. What is the interpretation of this? (Check all that apply) O Depreciation provided 850 of cash because it lowers your tax bill by that amount O Depreciation provided 850 of cash O The firm sold equipment for 850 in cash O Depreciation expense lowered net income during the year by 850 so the +850 on the cash flow statement offsets that to show there is no net change in cash attributable to depreciation NEXT Question 7/7 1 point Refer to the adjusting entry for "Accounts Receivable" of -1,604 in the Operating Section of the cash flow statement. What is the interpretation of this? (Check all that apply) O HCD's sales revenue was higher than their cash collections from customers O Accounts Receivable went up during the year O HCD paid suppliers more than they recorded as expenses during the year O HCD paid dividends of 1604 during the year. NEXT