Answered step by step

Verified Expert Solution

Question

1 Approved Answer

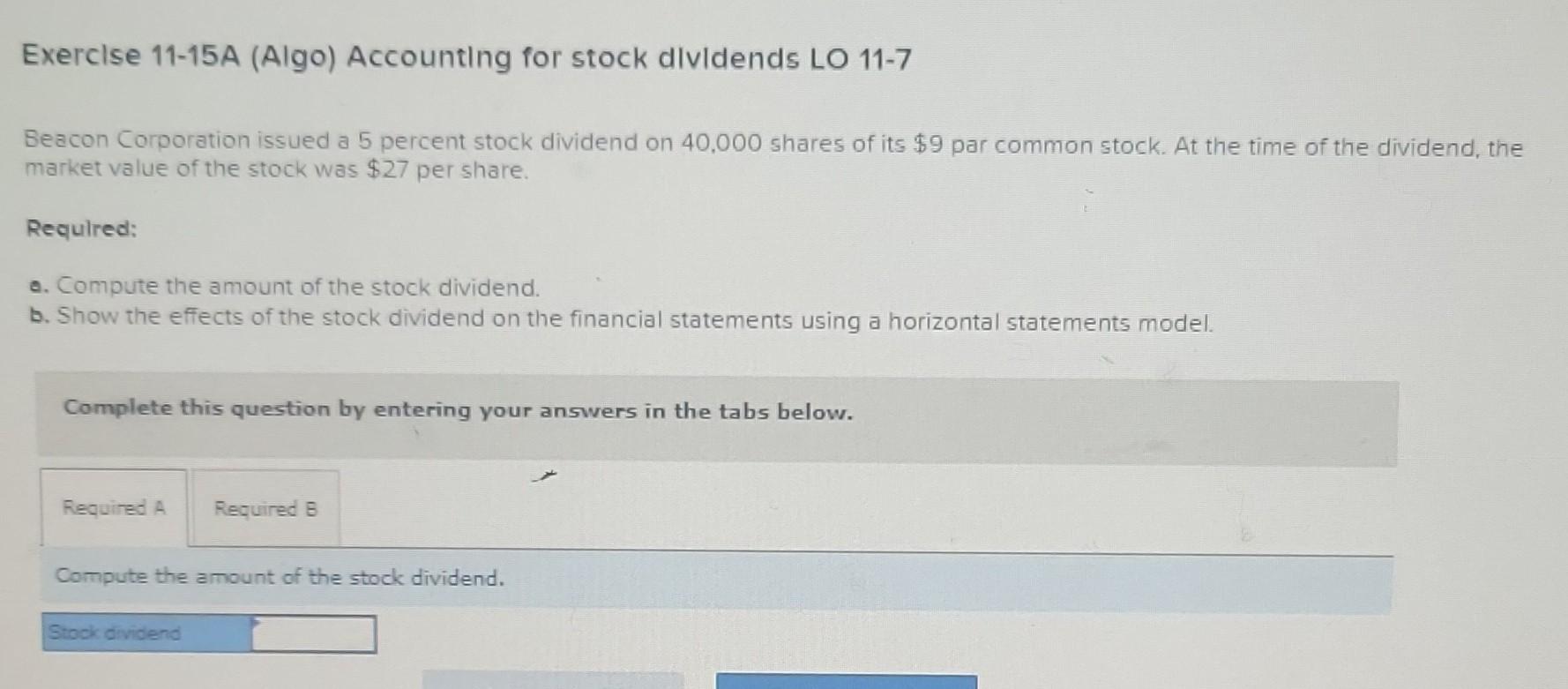

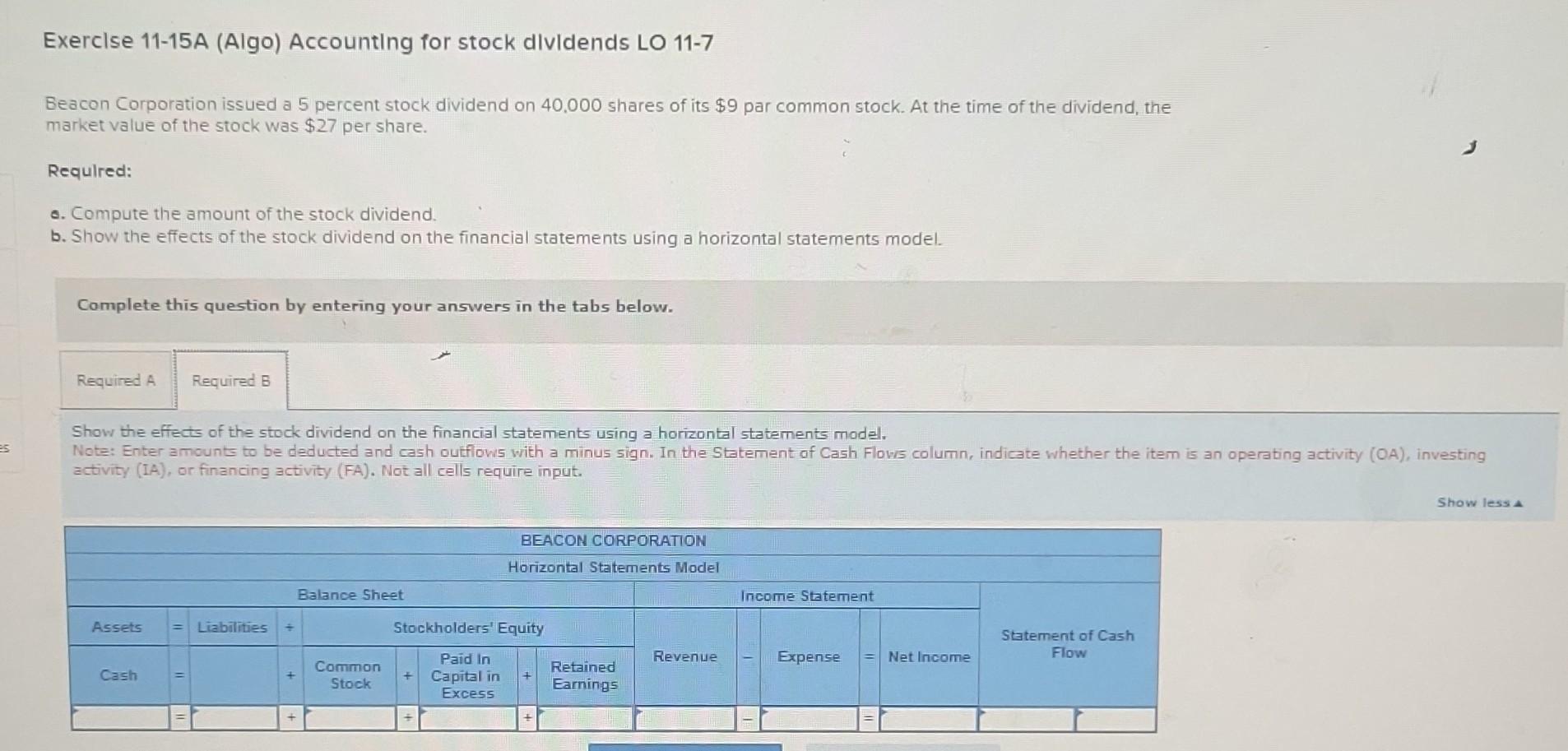

Exerclse 11-15A (Algo) Accounting for stock dlvldends LO 11-7 Beacon Corporation issued a 5 percent stock dividend on 40,000 shares of its $9 par common

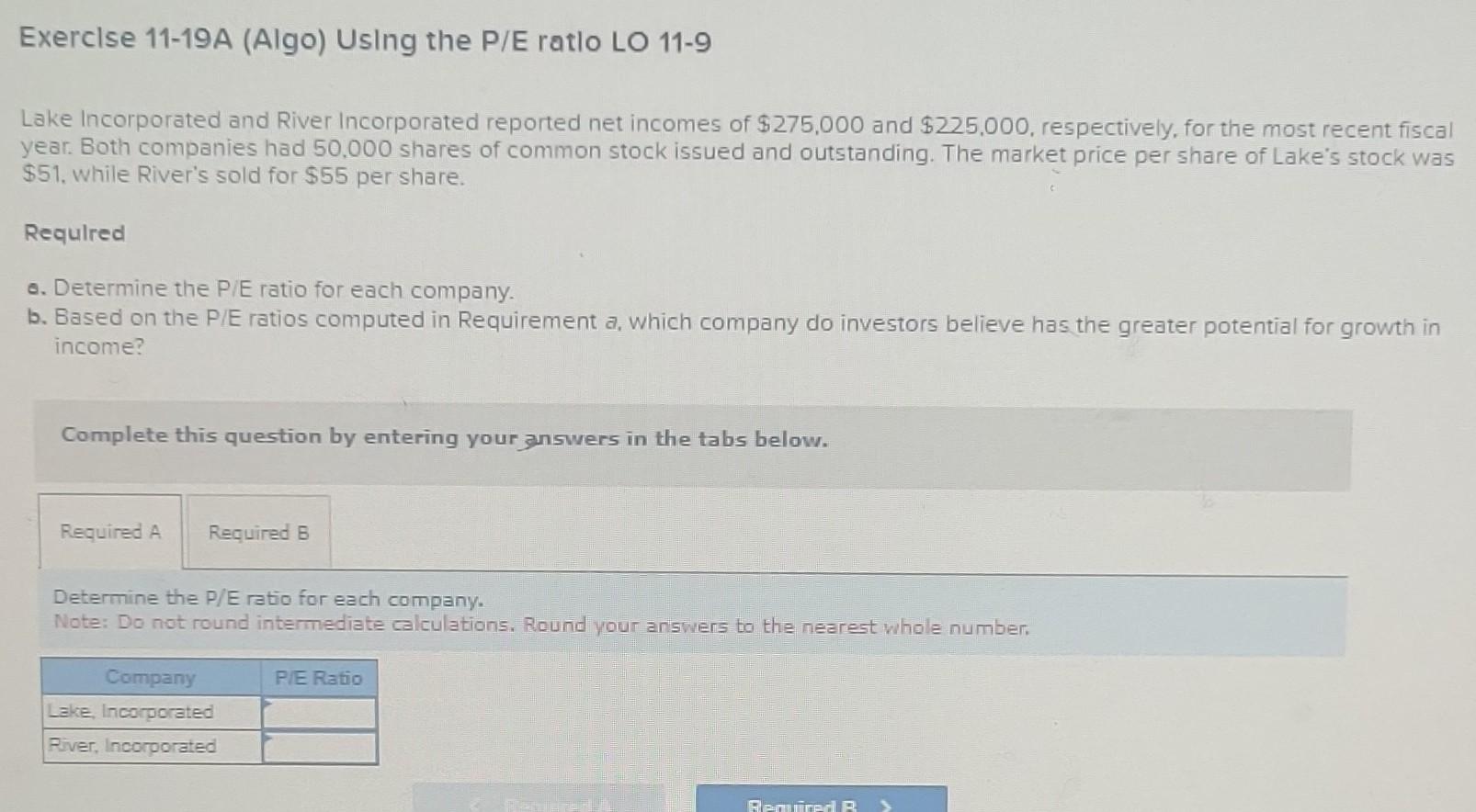

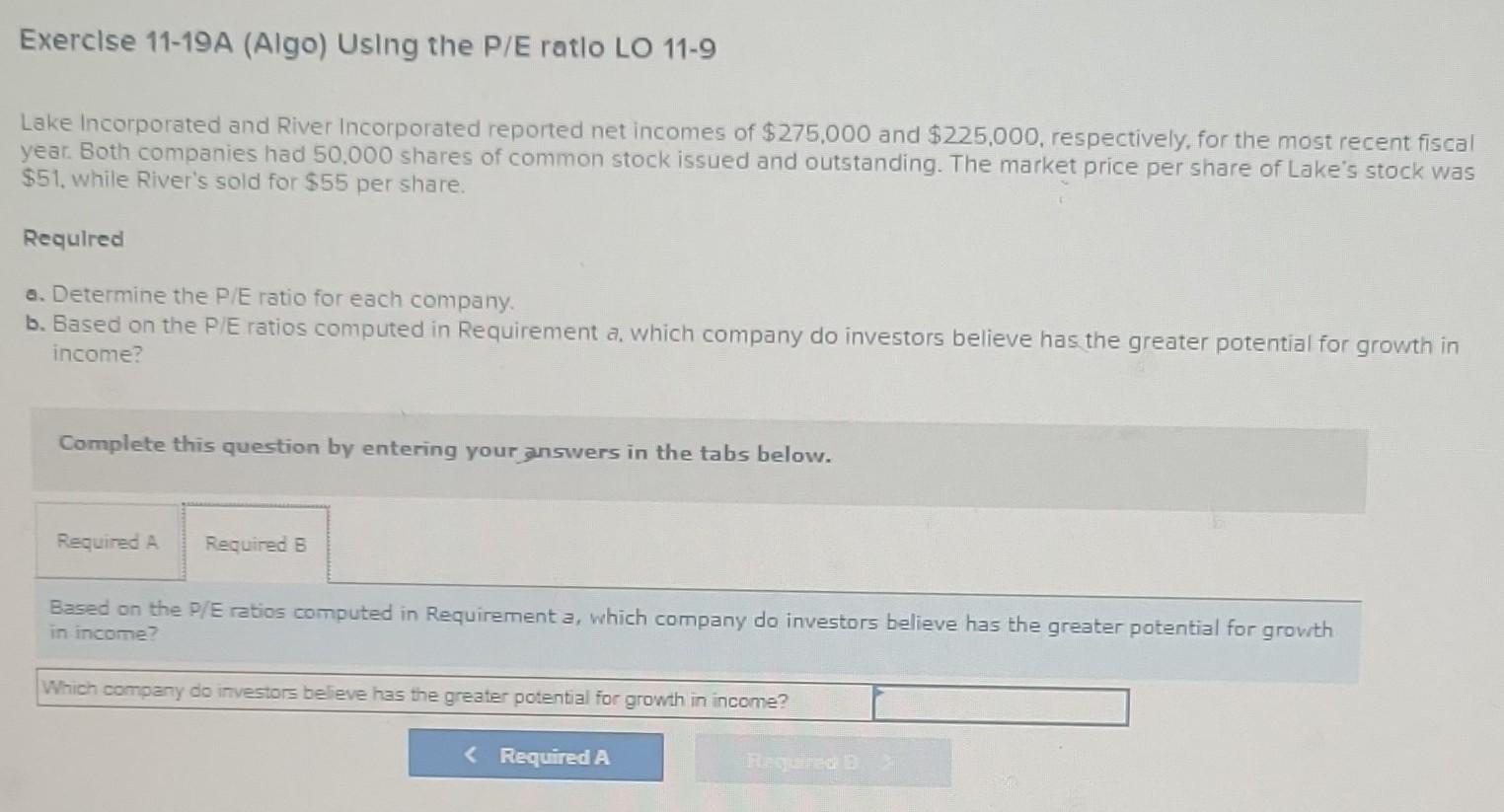

Exerclse 11-15A (Algo) Accounting for stock dlvldends LO 11-7 Beacon Corporation issued a 5 percent stock dividend on 40,000 shares of its $9 par common stock. At the time of the dividend, the market value of the stock was $27 per share. Reculred: a. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. Complete this question by entering your answers in the tabs below. Compute the amount of the stock dividend. Exerclse 11-15A (Algo) AccountIng for stock dlvidends LO 11-7 Beacon Corporation issued a 5 percent stock dividend on 40,000 shares of its $9 par common stock. At the time of the dividend, the market value of the stock was $27 per share. Requlred: o. Compute the amount of the stock dividend. b. Show the effects of the stock dividend on the financial statements using a horizontal statements model. Complete this question by entering your answers in the tabs below. Show the effects of the stock dividend on the financial statements using a horizontal statements model. Note: Enter amounts to be deducted and cash outflow 5 with a minus sign. In the Statement of Cash Flowis column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). Not all cells require input. Exerclse 11-19A (Algo) Uslng the P/E ratlo LO 11-9 Lake Incorporated and River Incorporated reported net incomes of $275,000 and $225,000, respectively, for the most recent fiscal year. Both companies had 50,000 shares of common stock issued and outstanding. The market price per share of Lake's stock was $51, while River's sold for $55 per share. Requlred 0. Determine the P/E ratio for each company. b. Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? Complete this question by entering your answers in the tabs below. Determine the P/E ratio for each company. Note: Do not round intermediate calculations. Round your answers to the nearest whole number. Exercise 11-19A (Algo) Usling the P/E ratlo LO 11-9 Lake Incorporated and River Incorporated reported net incomes of $275,000 and $225,000, respectively, for the most recent fiscal year. Both companies had 50,000 shares of common stock issued and outstanding. The market price per share of Lake's stock was \$51, while River's sold for $55 per share. Requlred Q. Determine the P/E ratio for each company. b. Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? Complete this question by entering your gonswers in the tabs below. Based on the P/E ratios computed in Requirement a, which company do investors believe has the greater potential for growth in income? in income? Which company do investors believe has the greater potential for growth in income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started