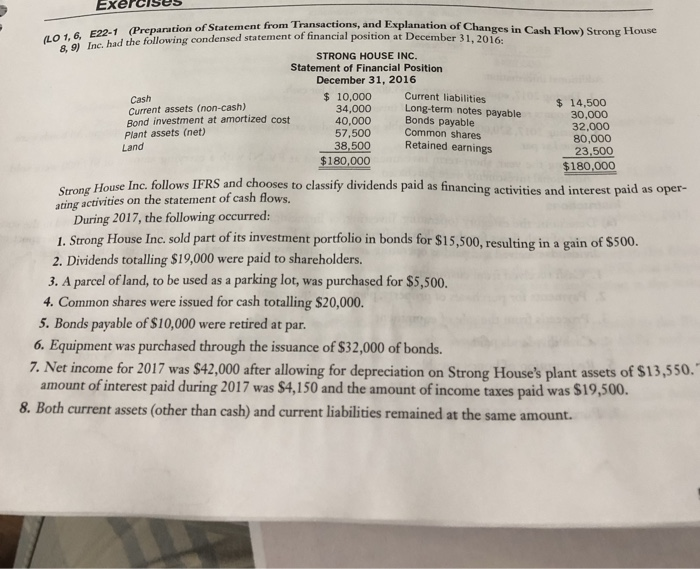

Exerecises aration of Statement from Transactions, and Explanation of Changes in Lo1,o ne, had the following condensed statement of financial position at December 31, 2016 STRONG HOUSE INC. Statement of Financial Position December 31, 2016 Cash Current assets (non-cash) Bond investment at amortized cost Plant assets (net) Land $ 10,000 34,000 40,000 57,500 38,500 180,000 Current liabilities Long-term notes payable Bonds payable Common Retained earnings 14,500 30,000 32,000 80,000 $180,000 Strong House Inc. follows IFRS and chooses to classify dividends paid as financing activities and interest paid as oper- ating activities on the statement of cash flows. During 2017, the following occurred: 1. Strong House Inc. sold part of its investment portfolio in bonds for $15,500, resulting in a gain of $500. 2. Dividends totalling $19,000 were paid to shareholders. 3. A parcel of land, to be used as a parking lot, was purchased for $5,500. 4. Common shares were issued for cash totalling $20,000. 5. Bonds payable of $10,000 were retired at par. 6. Equipment was purchased through the issuance of $32,000 of bonds. 7. Net income for 2017 was $42,000 ter allowing for depreciation on Strong House's plant assets of $13,550 amount of interest paid during 2017 was $4,150 and the amount of income taxes paid was $19,500. 8. Both current assets (other than cash) and current liabilities remained at the same amount. 1423 Exercises Instructions (a) Prepare a statement of cash flows for 2017 using the indirect method. raft a one-page letter to Mr. Gerald Brauer, president of Strong House Inc, in which you briefly explain the changes within each major cash flow category. Refer to the statement of cash flows whenever necessary e) Prepare a condensed statement of financial position at December 31,2017 for Strong House Inc. (d) Comment briefly about why the statement of cash flows used to be called a statement of changes in financial posi- tion. What additional relevant disclosure in fi statement of changes in financial position to the current statement of cash flows? nancial reporting has been achieved with the change from the former E22-2 (CAni