Answered step by step

Verified Expert Solution

Question

1 Approved Answer

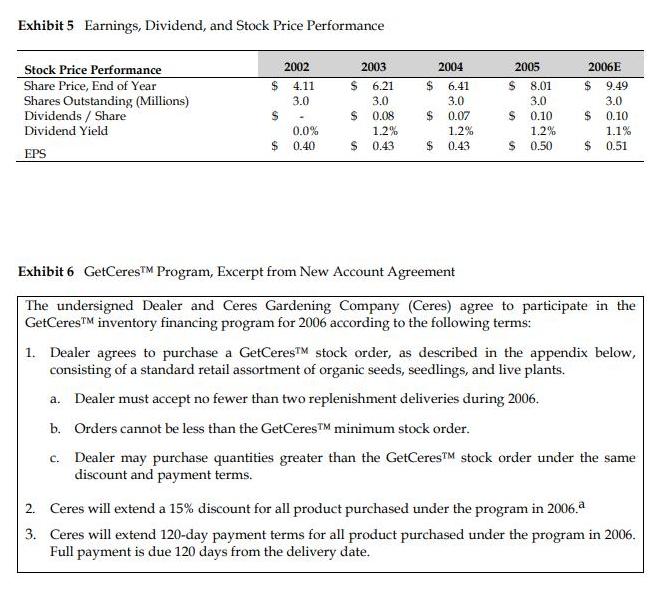

Exhibit 5 Earnings, Dividend, and Stock Price Performance Stock Price Performance Share Price, End of Year Shares Outstanding (Millions) Dividends / Share Dividend Yield

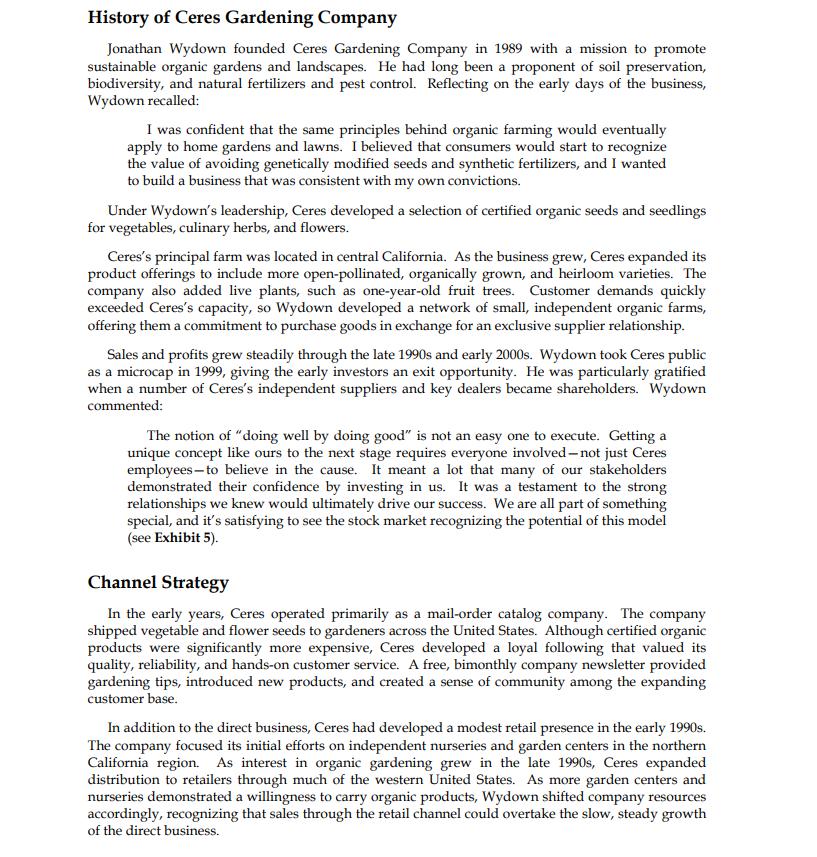

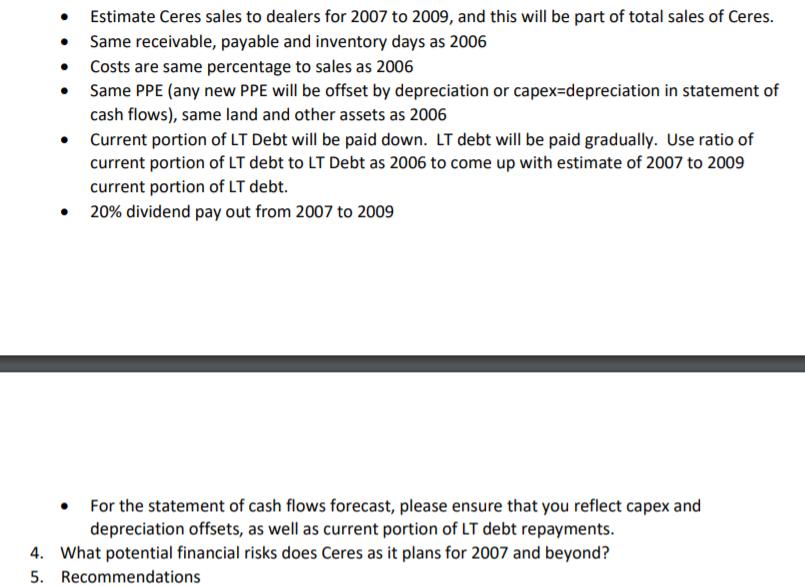

Exhibit 5 Earnings, Dividend, and Stock Price Performance Stock Price Performance Share Price, End of Year Shares Outstanding (Millions) Dividends / Share Dividend Yield EPS 2002 $4.11 3.0 $ 0.0% $ 0.40 2003 $ 6.21 3.0 0.08 1.2% $ 0.43 2004 $ 6.41 3.0 $ 0.07 1.2% $ 0.43 2005 8.01 3.0 0.10 1.2% $ 0.50 $ 2006E $ 9.49 3.0 0.10 $ 1.1 % $ 0.51 Exhibit 6 GetCeresTM Program, Excerpt from New Account Agreement The undersigned Dealer and Ceres Gardening Company (Ceres) agree to participate in the GetCeresTM inventory financing program for 2006 according to the following terms: 1. Dealer agrees to purchase a GetCeresTM stock order, as described in the appendix below, consisting of a standard retail assortment of organic seeds, seedlings, and live plants. a. Dealer must accept no fewer than two replenishment deliveries during 2006. b. Orders cannot be less than the GetCeresTM minimum stock order. c. Dealer may purchase quantities greater than the GetCeresTM stock order under the same discount and payment terms. 2. Ceres will extend a 15% discount for all product purchased under the program in 2006. 3. Ceres will extend 120-day payment terms for all product purchased under the program in 2006. Full payment is due 120 days from the delivery date. History of Ceres Gardening Company Jonathan Wydown founded Ceres Gardening Company in 1989 with a mission to promote sustainable organic gardens and landscapes. He had long been a proponent of soil preservation, biodiversity, and natural fertilizers and pest control. Reflecting on the early days of the business, Wydown recalled: I was confident that the same principles behind organic farming would eventually apply to home gardens and lawns. I believed that consumers would start to recognize the value of avoiding genetically modified seeds and synthetic fertilizers, and I wanted to build a business that was consistent with my own convictions. Under Wydown's leadership, Ceres developed a selection of certified organic seeds and seedlings for vegetables, culinary herbs, and flowers. Ceres's principal farm was located in central California. As the business grew, Ceres expanded its product offerings to include more open-pollinated, organically grown, and heirloom varieties. The company also added live plants, such as one-year-old fruit trees. Customer demands quickly exceeded Ceres's capacity, so Wydown developed a network of small, independent organic farms, offering them a commitment to purchase goods in exchange for an exclusive supplier relationship. Sales and profits grew steadily through the late 1990s and early 2000s. Wydown took Ceres public as a microcap in 1999, giving the early investors an exit opportunity. He was particularly gratified when a number of Ceres's independent suppliers and key dealers became shareholders. Wydown commented: The notion of "doing well by doing good" is not an easy one to execute. Getting a unique concept like ours to the next stage requires everyone involved- not just Ceres employees to believe in the cause. It meant a lot that many of our stakeholders demonstrated their confidence by investing in us. It was a testament to the strong relationships we knew would ultimately drive our success. We are all part of something special, and it's satisfying to see the stock market recognizing the potential of this model (see Exhibit 5). Channel Strategy In the early years, Ceres operated primarily as a mail-order catalog company. The company shipped vegetable and flower seeds to gardeners across the United States. Although certified organic products were significantly more expensive, Ceres developed a loyal following that valued its quality, reliability, and hands-on customer service. A free, bimonthly company newsletter provided gardening tips, introduced new products, and created a sense of community among the expanding customer base. In addition to the direct business, Ceres had developed a modest retail presence in the early 1990s. The company focused its initial efforts on independent nurseries and garden centers in the northern California region. As interest in organic gardening grew in the late 1990s, Ceres expanded distribution to retailers through much of the western United States. As more garden centers and nurseries demonstrated a willingness to carry organic products, Wydown shifted company resources accordingly, recognizing that sales through the retail channel could overtake the slow, steady growth of the direct business. Estimate Ceres sales to dealers for 2007 to 2009, and this will be part of total sales of Ceres. Same receivable, payable and inventory days as 2006 Costs are same percentage to sales as 2006 Same PPE (any new PPE will be offset by depreciation or capex-depreciation in statement of cash flows), same land and other assets as 2006 Current portion of LT Debt will be paid down. LT debt will be paid gradually. Use ratio of current portion of LT debt to LT Debt as 2006 to come up with estimate of 2007 to 2009 current portion of LT debt. 20% dividend pay out from 2007 to 2009 For the statement of cash flows forecast, please ensure that you reflect capex and depreciation offsets, as well as current portion of LT debt repayments. 4. What potential financial risks does Ceres as it plans for 2007 and beyond? 5. Recommendations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Interpretation The scatterplot illustrates that the data is scatterered upwards Hence There exi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started