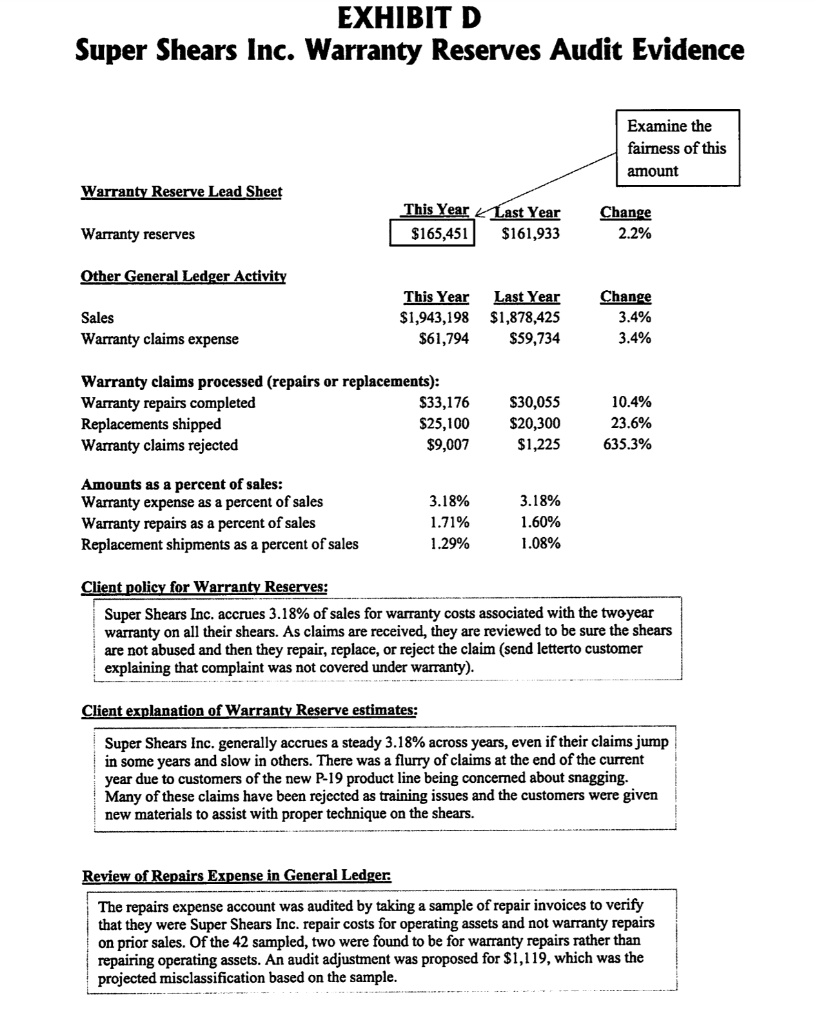

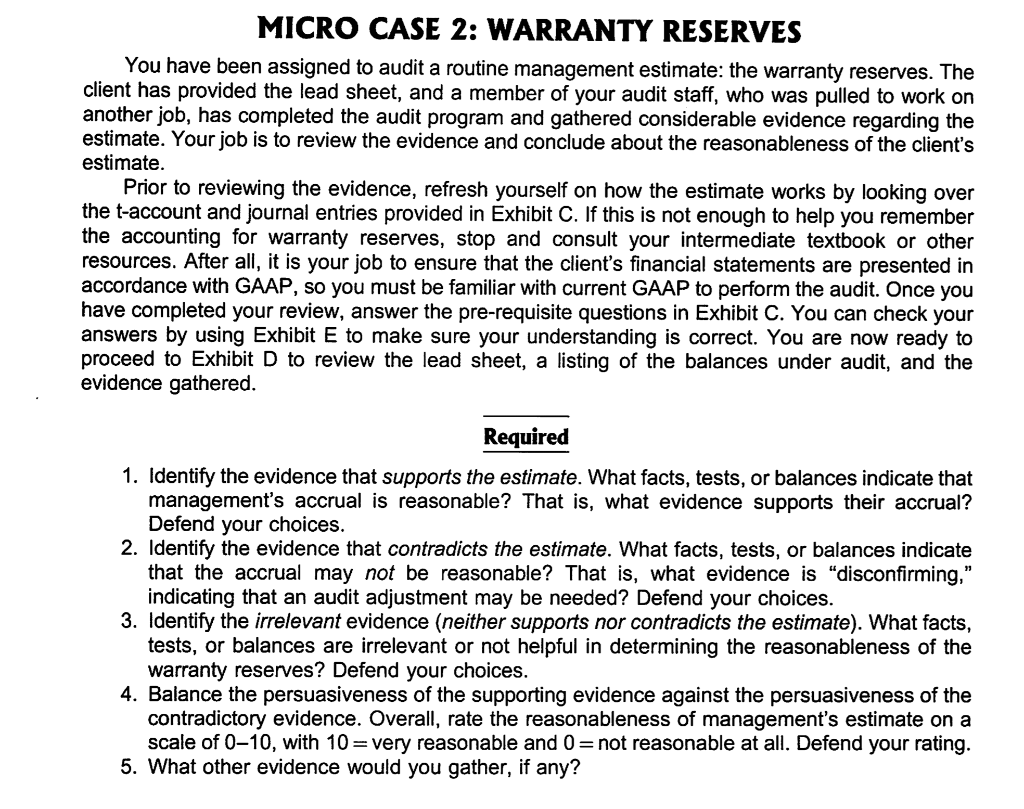

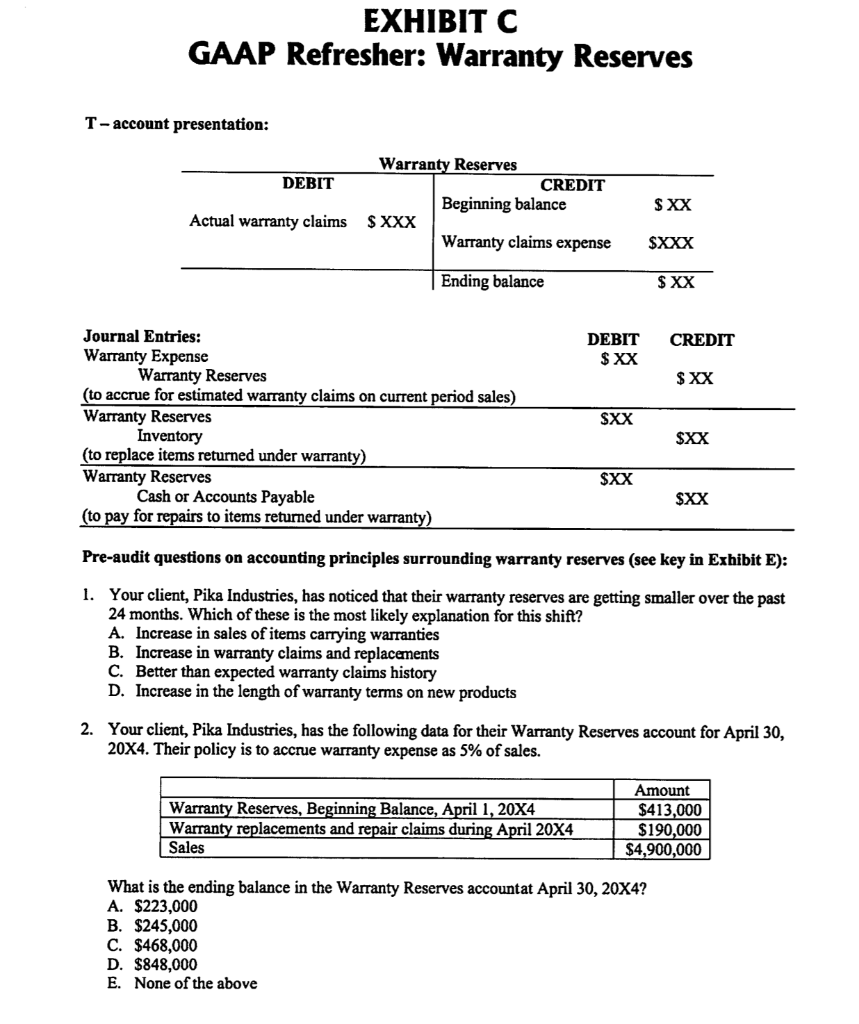

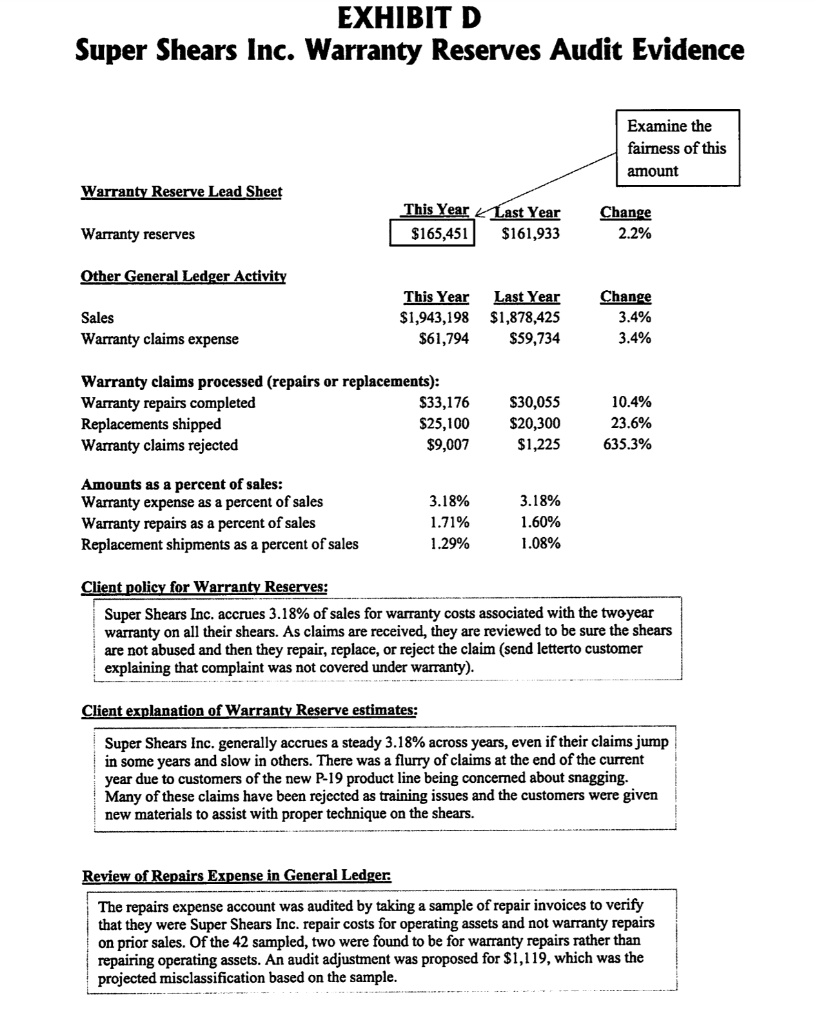

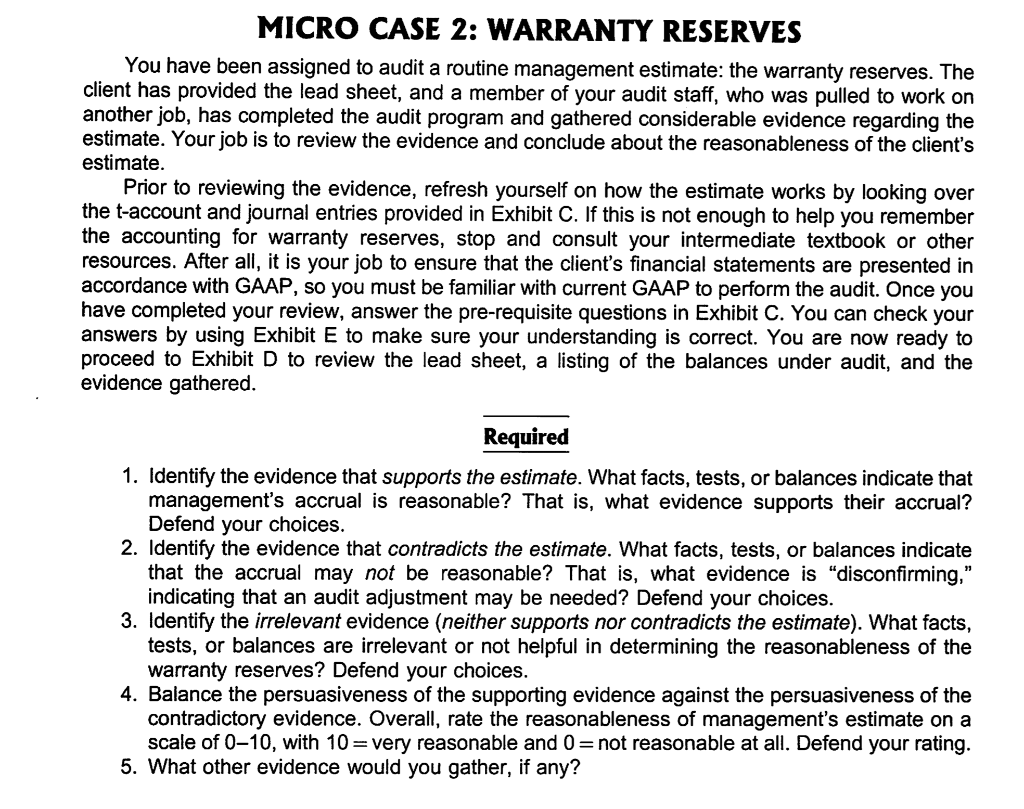

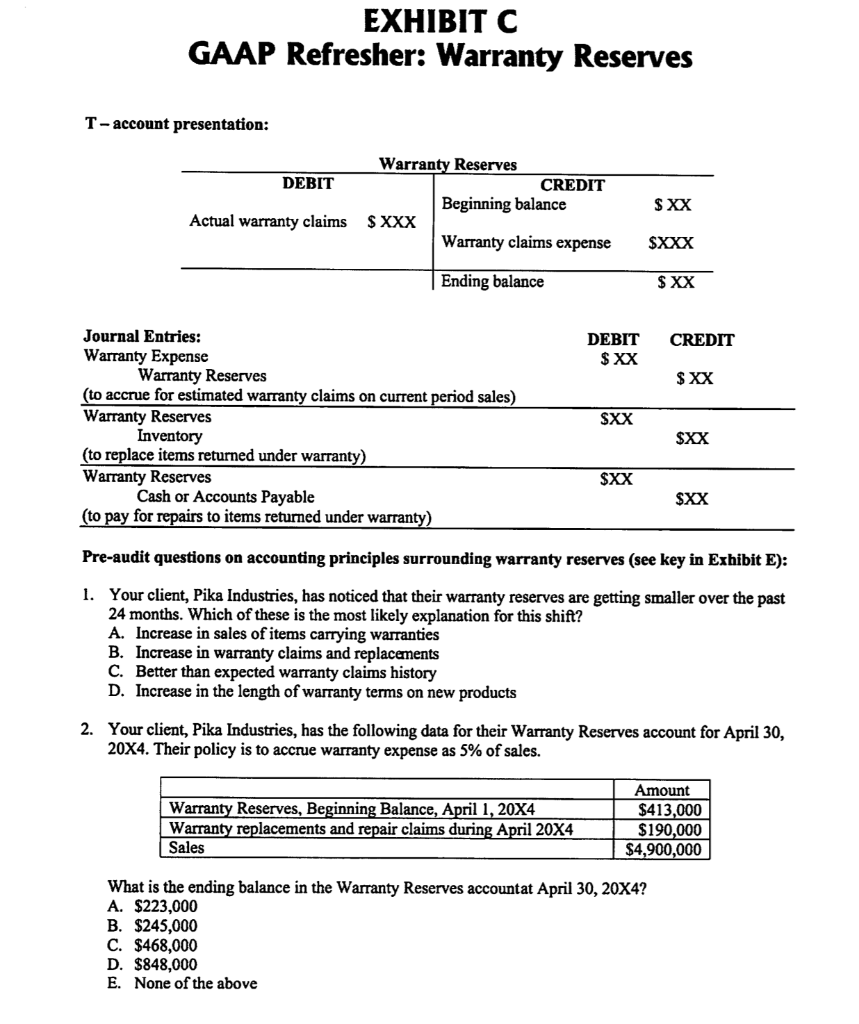

EXHIBIT D Super Shears Inc. Warranty Reserves Audit Evidence Examine the fairness of this amount Warranty Reserve Lead Sheet This Year $165,451 Last Year $161,933 Change 2.2% Warranty reserves Other General Ledger Activity Sales Warranty claims expense This Year Last Year $1,943,198 $1,878,425 $61,794 $59,734 Change 3.4% 3.4% Warranty claims processed (repairs or replacements): Warranty repairs completed $33,176 Replacements shipped $25,100 Warranty claims rejected $9,007 $30,055 $20,300 $1,225 10.4% 23.6% 635.3% Amounts as a percent of sales: Warranty expense as a percent of sales Warranty repairs as a percent of sales Replacement shipments as a percent of sales 3.18% 1.71% 1.29% 3.18% 1.60% 1.08% Client policy for Warranty Reserves: Super Shears Inc. accrues 3.18% of sales for warranty costs associated with the twoyear warranty on all their shears. As claims are received, they are reviewed to be sure the shears are not abused and then they repair, replace, or reject the claim (send letterto customer explaining that complaint was not covered under warranty). Client explanation of Warranty Reserve estimates: Super Shears Inc. generally accrues a steady 3.18% across years, even if their claims jump in some years and slow in others. There was a flurry of claims at the end of the current year due to customers of the new P-19 product line being concerned about snagging. Many of these claims have been rejected as training issues and the customers were given new materials to assist with proper technique on the shears. Review of Repairs Expense in General Ledger The repairs expense account was audited by taking a sample of repair invoices to verify that they were Super Shears Inc. repair costs for operating assets and not warranty repairs on prior sales. Of the 42 sampled, two were found to be for warranty repairs rather than repairing operating assets. An audit adjustment was proposed for $1,119, which was the projected misclassification based on the sample. MICRO CASE 2: WARRANTY RESERVES You have been assigned to audit a routine management estimate: the warranty reserves. The client has provided the lead sheet, and a member of your audit staff, who was pulled to work on another job, has completed the audit program and gathered considerable evidence regarding the estimate. Your job is to review the evidence and conclude about the reasonableness of the client's estimate. Prior to reviewing the evidence, refresh yourself on how the estimate works by looking over the t-account and journal entries provided in Exhibit C. If this is not enough to help you remember the accounting for warranty reserves, stop and consult your intermediate textbook or other resources. After all, it is your job to ensure that the client's financial statements are presented in accordance with GAAP, so you must be familiar with current GAAP to perform the audit. Once you have completed your review, answer the pre-requisite questions in Exhibit C. You can check your answers by using Exhibit E to make sure your understanding is correct. You are now ready to proceed to Exhibit D to review the lead sheet, a listing of the balances under audit, and the evidence gathered. Required 1. Identify the evidence that supports the estimate. What facts, tests, or balances indicate that management's accrual is reasonable? That is, what evidence supports their accrual? Defend your choices. 2. Identify the evidence that contradicts the estimate. What facts, tests, or balances indicate that the accrual may not be reasonable? That is, what evidence is "disconfirming," indicating that an audit adjustment may be needed? Defend your choices. 3. Identify the irrelevant evidence (neither supports nor contradicts the estimate). What facts, tests, or balances are irrelevant or not helpful in determining the reasonableness of the warranty reserves? Defend your choices. 4. Balance the persuasiveness of the supporting evidence against the persuasiveness of the contradictory evidence. Overall, rate the reasonableness of management's estimate on a scale of 0-10, with 10 = very reasonable and 0 = not reasonable at all. Defend your rating. 5. What other evidence would you gather, if any? EXHIBIT C GAAP Refresher: Warranty Reserves T-account presentation: DEBIT Warranty Reserves CREDIT Beginning balance $ XXX Warranty claims expense $ XX Actual warranty claims $XXX Ending balance $ XX DEBIT $ XX CREDIT $ XX SXX Journal Entries: Warranty Expense Warranty Reserves (to accrue for estimated warranty claims on current period sales) Warranty Reserves Inventory (to replace items returned under warranty) Warranty Reserves Cash or Accounts Payable (to pay for repairs to items returned under warranty) $XX $XX $XX Pre-audit questions on accounting principles surrounding warranty reserves (see key in Exhibit E): 1. Your client, Pika Industries, has noticed that their warranty reserves are getting smaller over the past 24 months. Which of these is the most likely explanation for this shift? A. Increase in sales of items carrying warranties B. Increase in warranty claims and replacements C. Better than expected warranty claims history D. Increase in the length of warranty terms on new products 2. Your client, Pika Industries, has the following data for their Warranty Reserves account for April 30, 20X4. Their policy is to accrue warranty expense as 5% of sales. Warranty Reserves, Beginning Balance, April 1, 20X4 Warranty replacements and repair claims during April 20X4 Sales Amount $413,000 $190,000 $4,900,000 What is the ending balance in the Warranty Reserves accountat April 30, 20X4? A. $223,000 B. $245,000 C. $468,000 D. $848,000 E. None of the above