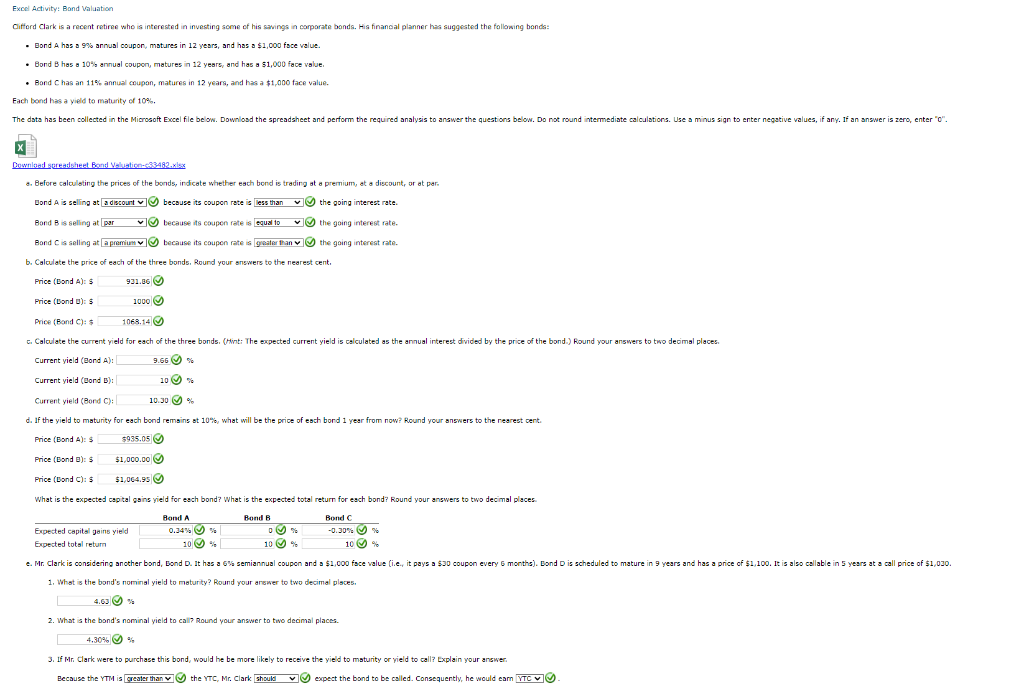

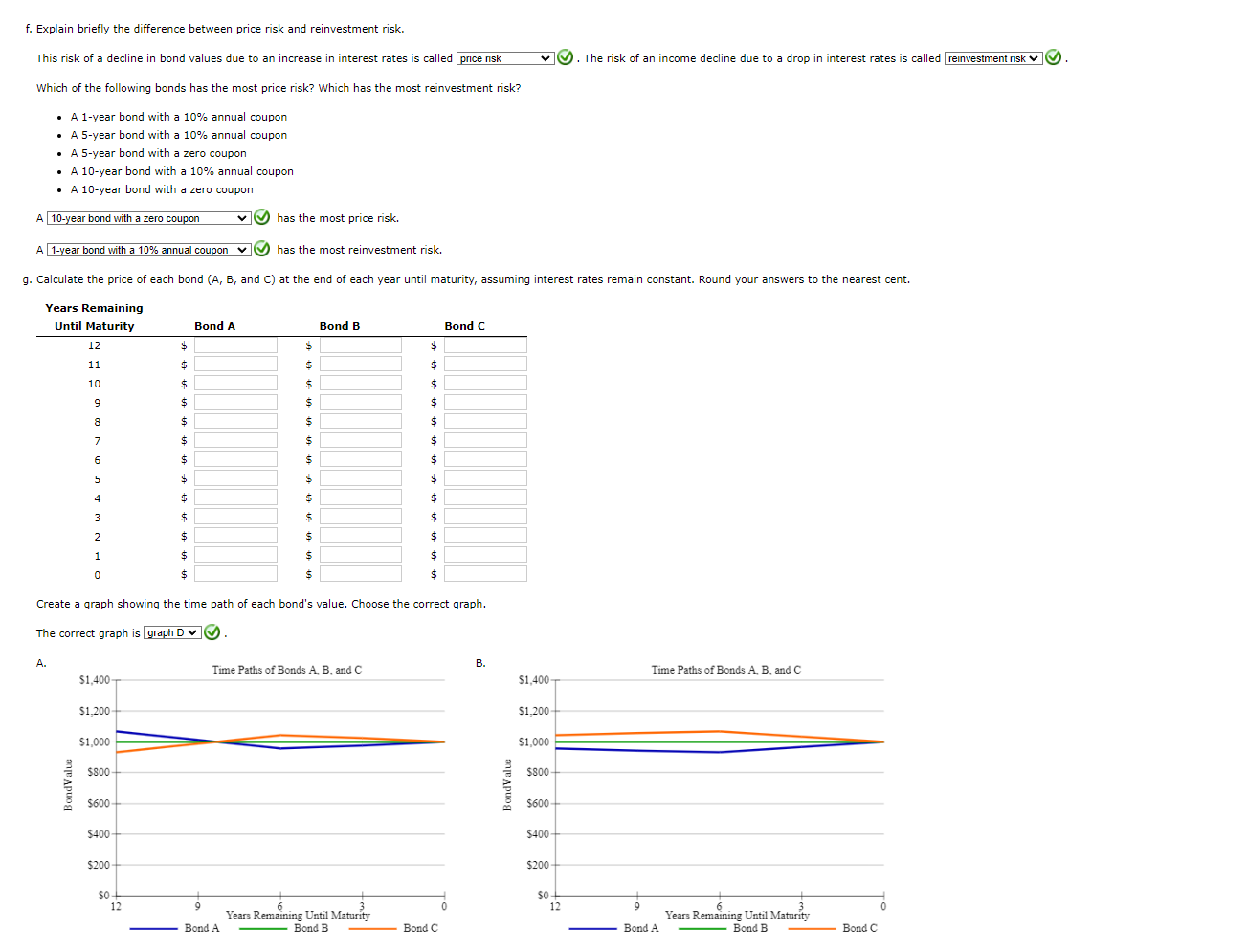

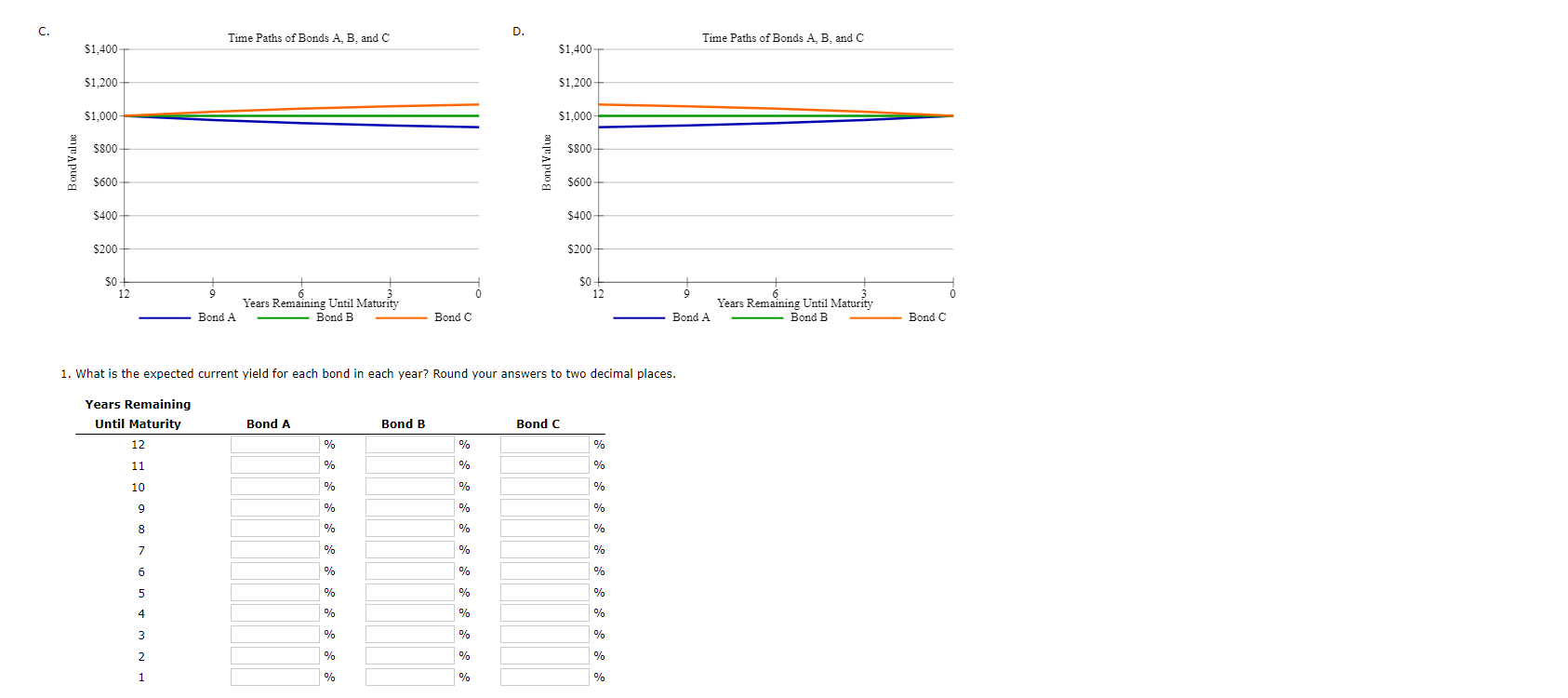

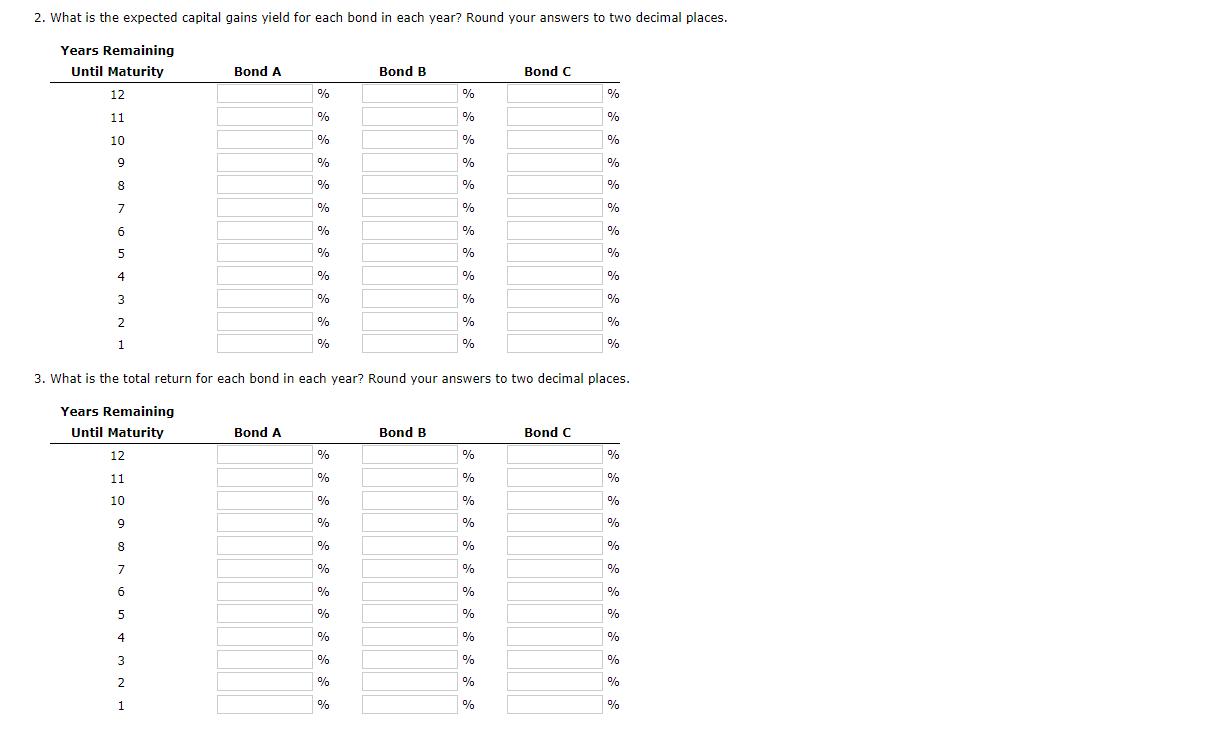

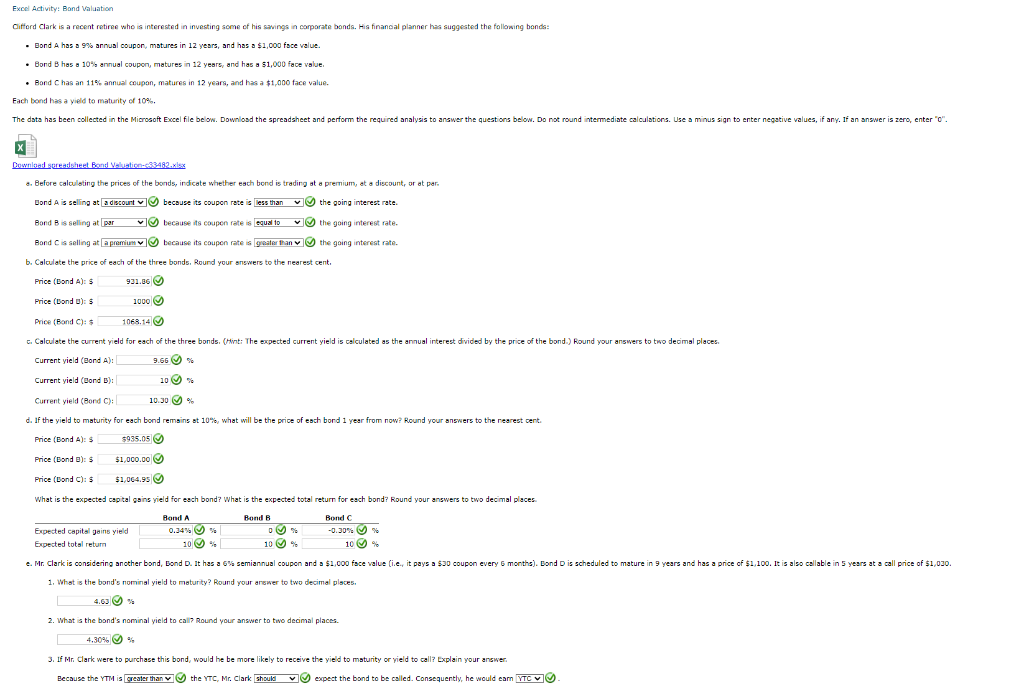

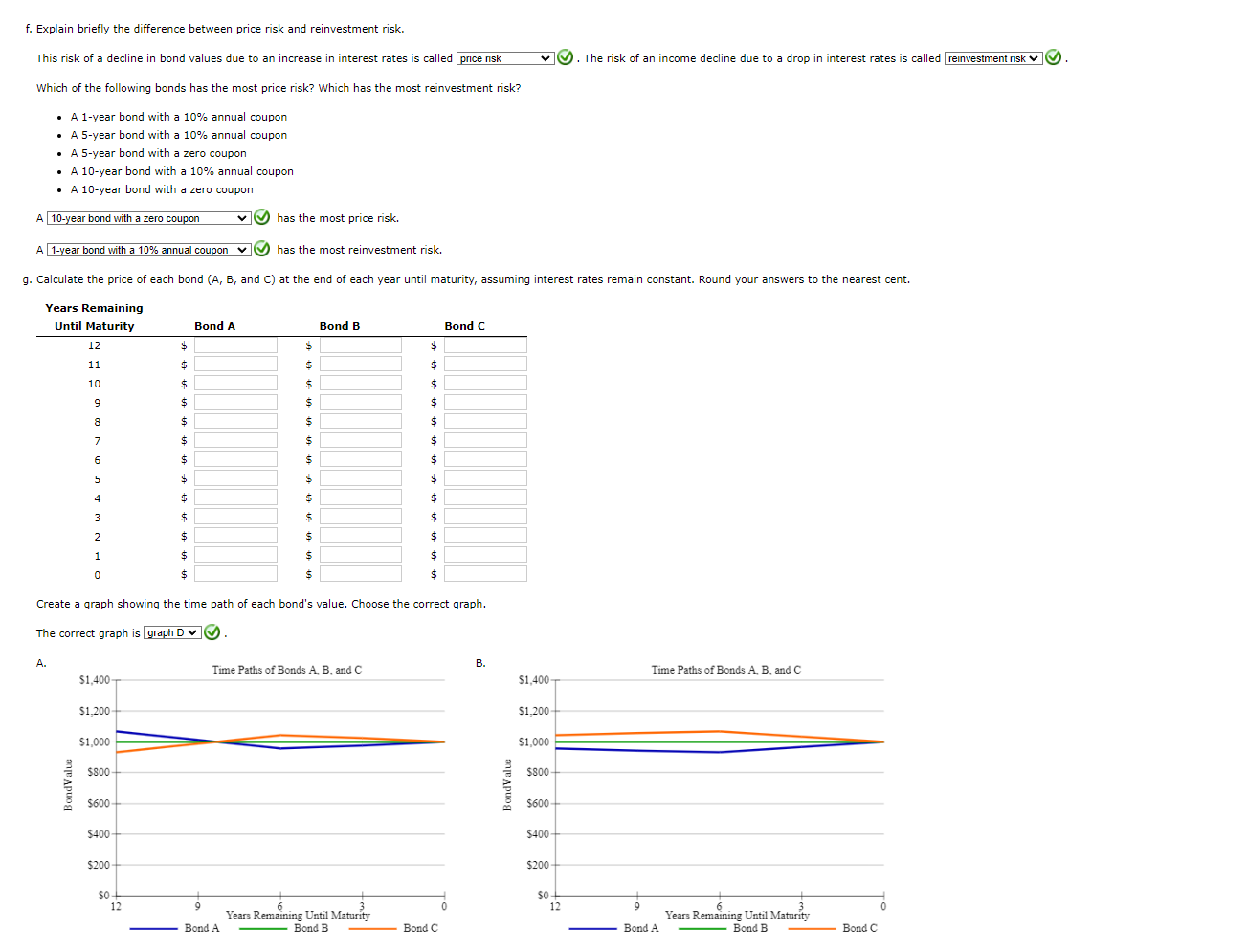

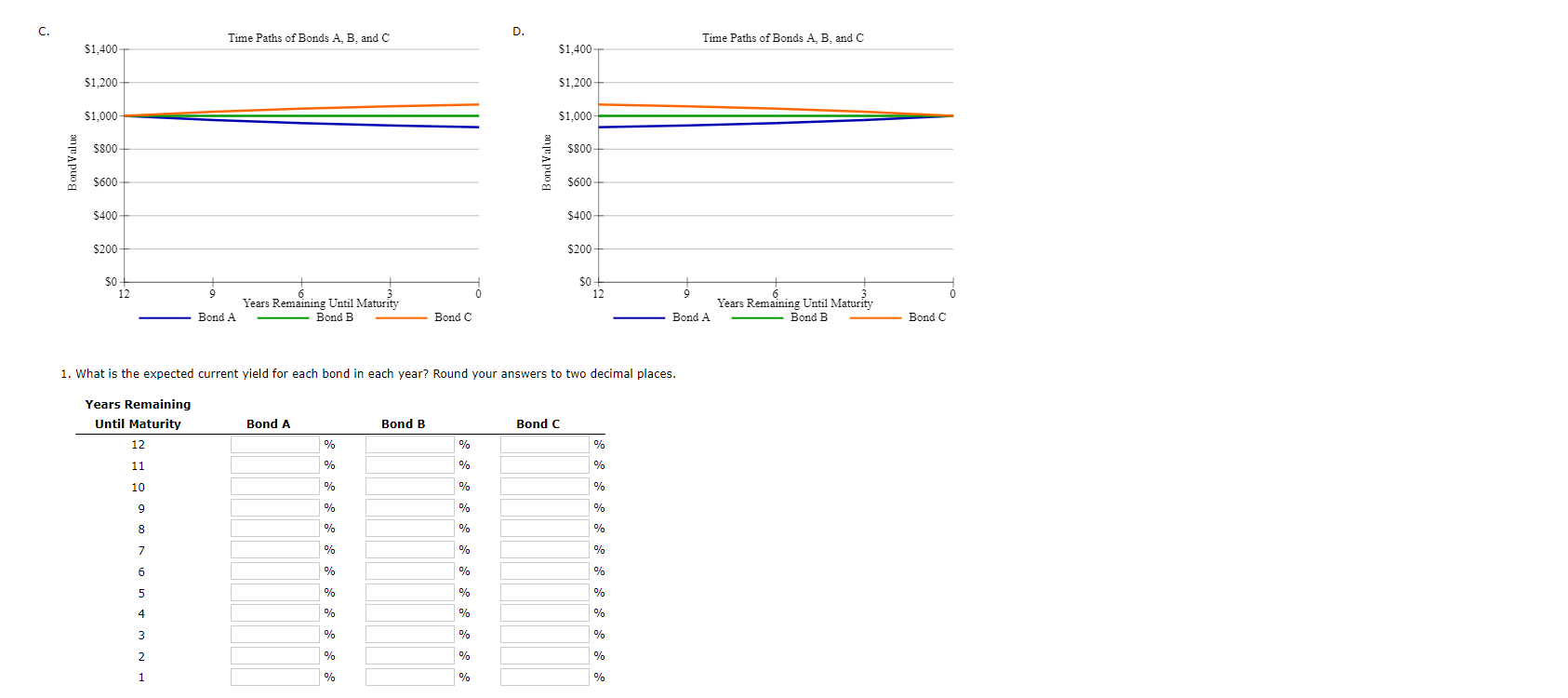

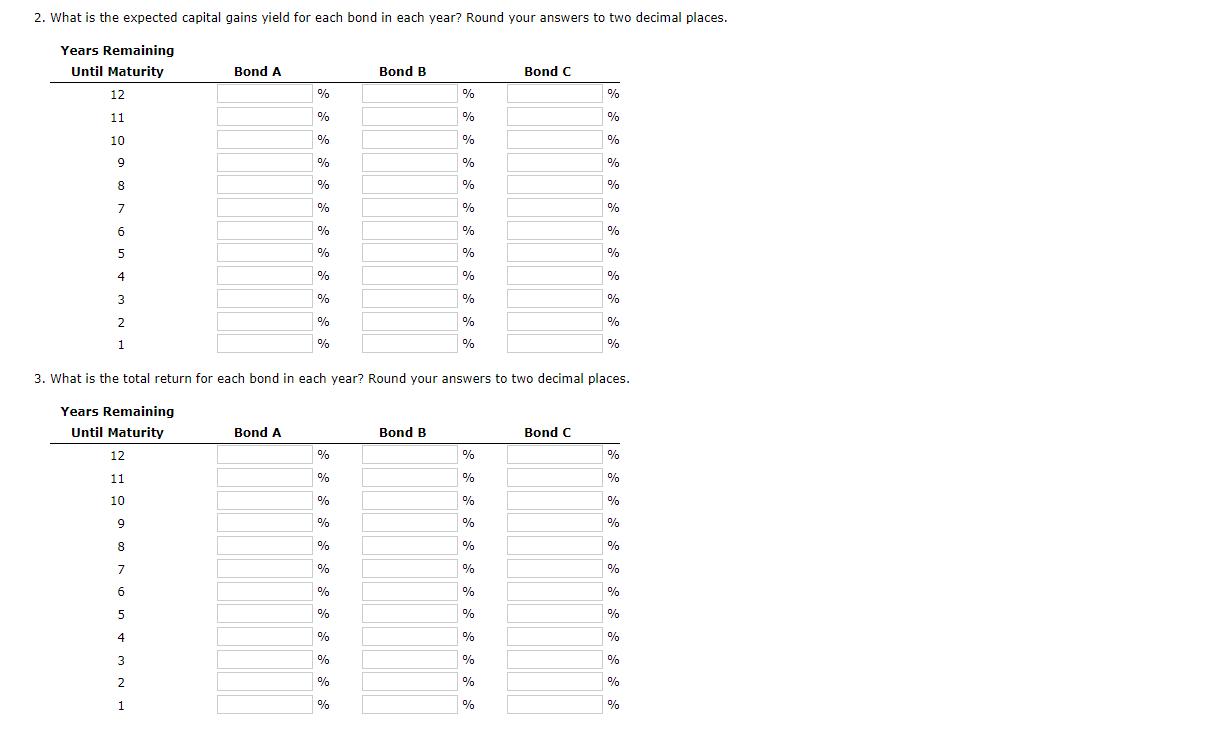

Exoel Activity! Band Valuation - Eond a has a gos annual coupor, matures in 12 years, and has a $1,000 face velue. - Gond B has a 10\%, annual coupon, matures in 12 yearsy and has a $1,000 face value, - Bond C has an 11% annual coupan, matures in 12 yeara, and has a $1,000 face value. Fach band has a yield to matunty of 10% Price (Eond 4 ) 3 Price (Eand e ) : 5 Price (Eond C): 5 What is the expected capital gains yield for esch bond? What is the expected total retum for esch bond? Round your answers to two decimal places. 1. What is the bond's nominal yield to naturity? Round your answer to two decimal places. 97 2. What is the band's nominal yield to calp Round your answer to two decimal places. 1an 3. If I. Ir. Clark were to purchase this bond, would he be more likely to receive the yield to maturity or vield to call? Explain your answer. Recause the YTI is D the rTc, Mr. Clark D expect the band to be called. Consequertly, he would earn STC V(1. f. Explain briefly the difference between price risk and reinvestment risk. This risk of a decline in bond values due to an increase in interest rates is called W. The risk of an income decline due to a drop in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment risk? - A 1-year bond with a 10\% annual coupon - A 5 -year bond with a 10% annual coupon - A 5-year bond with a zero coupon - A 10-year bond with a 10% annual coupon - A 10-year bond with a zero coupon A has the most price risk. A has the most reinvestment risk. g. Calculate the price of each bond ( A,B, and C) at the end of each year until maturity, assuming interest rates remain constant. Round your answers to the nearest cent. Create a graph showing the time path of each bond's value. Choose the correct graph. The correct graph is graph DV 1. What is the expected current yield for each bond in each year? Round your answers to two decimal places. 2. What is the expected capital gains yield for each bond in each year? Round your answers to two decimal places. 3. What is the total return for each bond in each year? Round your answers to two decimal places