Answered step by step

Verified Expert Solution

Question

1 Approved Answer

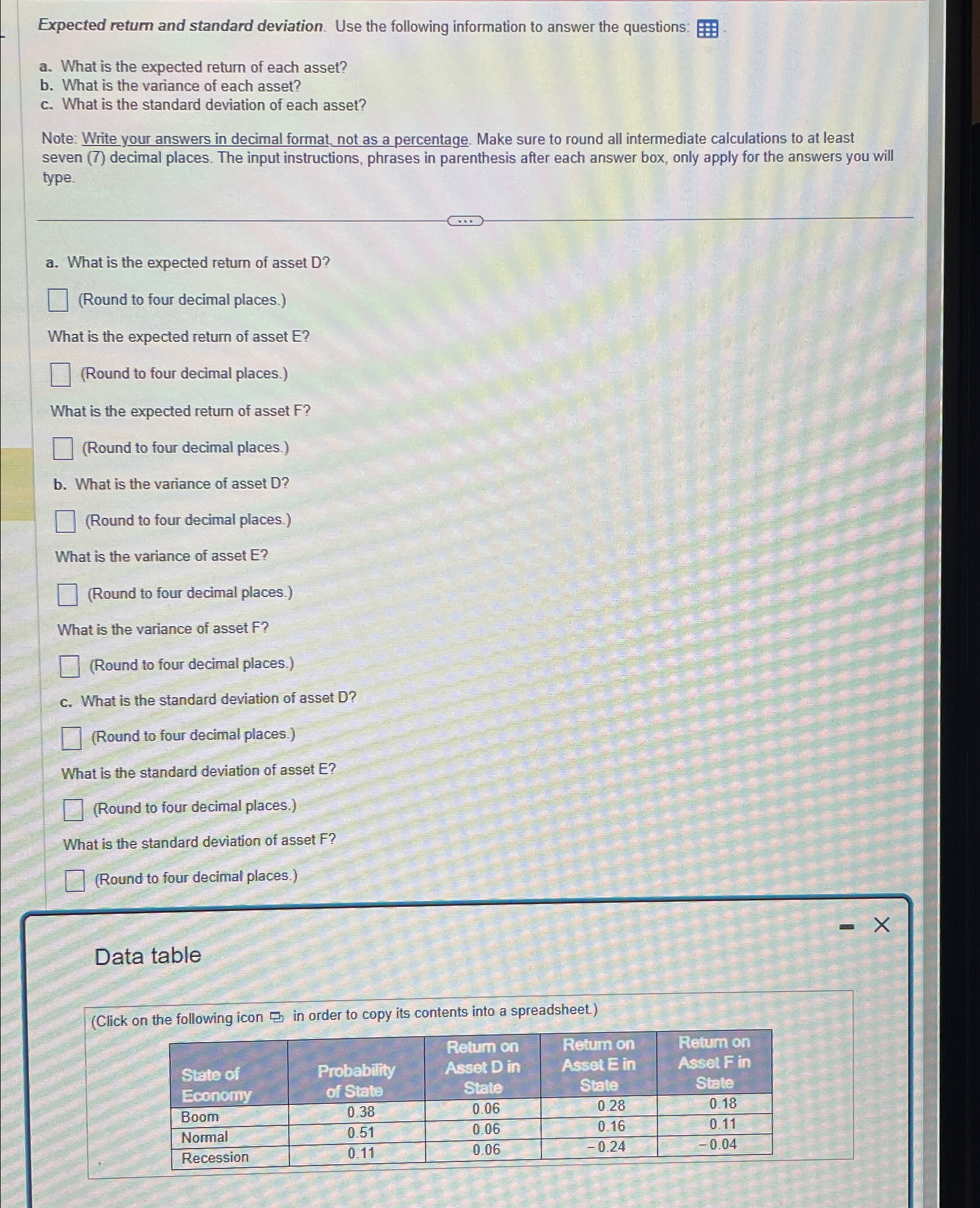

Expected retum and standard deviation. Use the following information to answer the questions: a . What is the expected return of each asset? b .

Expected retum and standard deviation. Use the following information to answer the questions:

a What is the expected return of each asset?

b What is the variance of each asset?

c What is the standard deviation of each asset?

Note: Write your answers in decimal format, not as a percentage. Make sure to round all intermediate calculations to at least seven decimal places. The input instructions, phrases in parenthesis after each answer box, only apply for the answers you will type.

a What is the expected return of asset D

Round to four decimal places.

What is the expected return of asset

Round to four decimal places.

What is the expected return of asset F

Round to four decimal places.

b What is the variance of asset D

Round to four decimal places.

What is the variance of asset

Round to four decimal places.

What is the variance of asset F

Round to four decimal places.

c What is the standard deviation of asset D

Round to four decimal places.

What is the standard deviation of asset

Round to four decimal places.

What is the standard deviation of asset F

Round to four decimal places.

Data table

Click on the following icon by in order to copy its contents into a spreadsheet

tabletableSele ofEconorixytableProbabilityof ShatetableRetuin onAsset D inSiatetableRetum onAsset E inSraletableRetum onAsset inStateBoomNormalRecession

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started