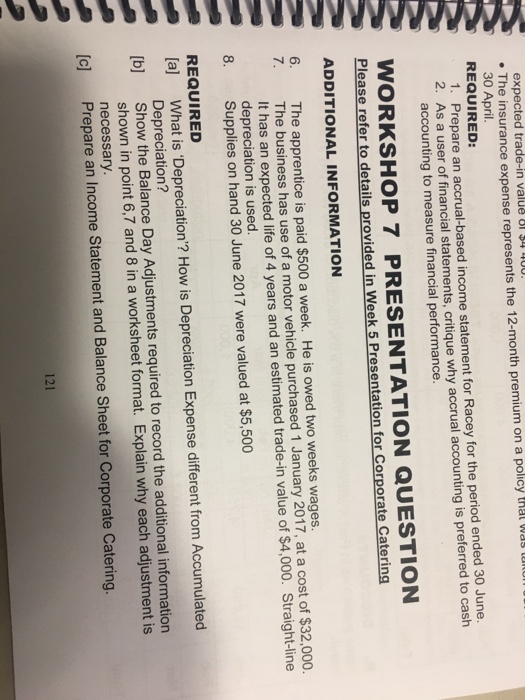

expected trade-in value 81 31 40U . The insurance expense represents the 12-month premium on a policy hal Was (u 30 April REQUIRED 1. Prepare an accrual-based income statement for Racey for the period ended 30 June. 2. As a user of financial statements, critique why accrual accounting is preferred to cash accounting to measure financial performance. WORKSHOP 7 PRESENTATION QUESTION Please refer to details provided in Week 5 Presentation for Corporate Catering ADDITIONAL INFORMATION 6. The apprentice is paid $500 a week. He is owed two weeks wages The business has use of a motor vehicle purchased 1 January 2017, at a cost of $32,000. It has an expected life of 4 years and an estimated trade-in value of $4,000. Straight-line depreciation is used. Supplies on hand 30 June 2017 were valued at $5,500 7. 8. REQUIRED [a] What is 'Depreciation'? How is Depreciation Expense different from Accumulated Depreciation? Show the Balance Day Adjustments required to record the additional information shown in point 6,7 and 8 in a worksheet format. Explain why each adjustment is necessary Prepare an Income Statement and Balance Sheet for Corporate Catering. ??? [b] [c] 121 expected trade-in value 81 31 40U . The insurance expense represents the 12-month premium on a policy hal Was (u 30 April REQUIRED 1. Prepare an accrual-based income statement for Racey for the period ended 30 June. 2. As a user of financial statements, critique why accrual accounting is preferred to cash accounting to measure financial performance. WORKSHOP 7 PRESENTATION QUESTION Please refer to details provided in Week 5 Presentation for Corporate Catering ADDITIONAL INFORMATION 6. The apprentice is paid $500 a week. He is owed two weeks wages The business has use of a motor vehicle purchased 1 January 2017, at a cost of $32,000. It has an expected life of 4 years and an estimated trade-in value of $4,000. Straight-line depreciation is used. Supplies on hand 30 June 2017 were valued at $5,500 7. 8. REQUIRED [a] What is 'Depreciation'? How is Depreciation Expense different from Accumulated Depreciation? Show the Balance Day Adjustments required to record the additional information shown in point 6,7 and 8 in a worksheet format. Explain why each adjustment is necessary Prepare an Income Statement and Balance Sheet for Corporate Catering. ??? [b] [c] 121