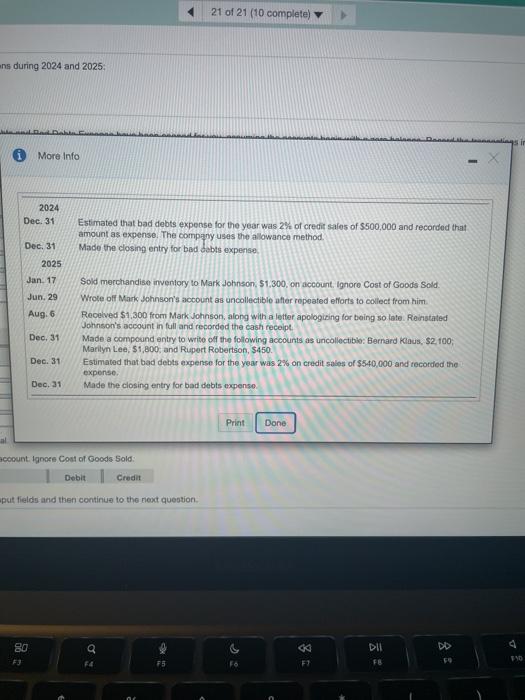

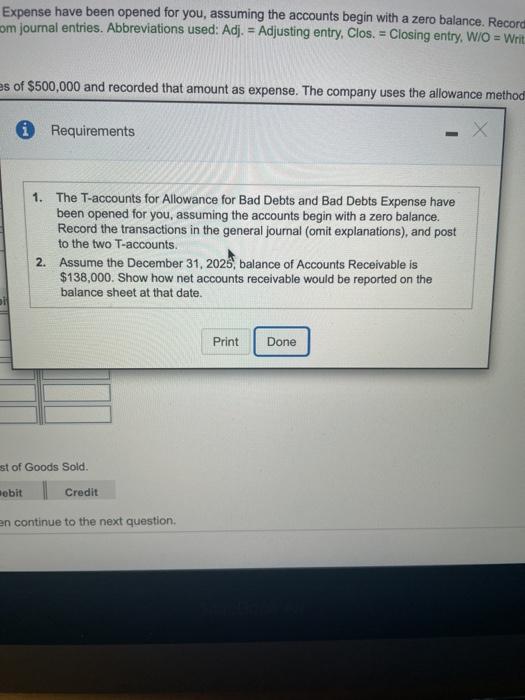

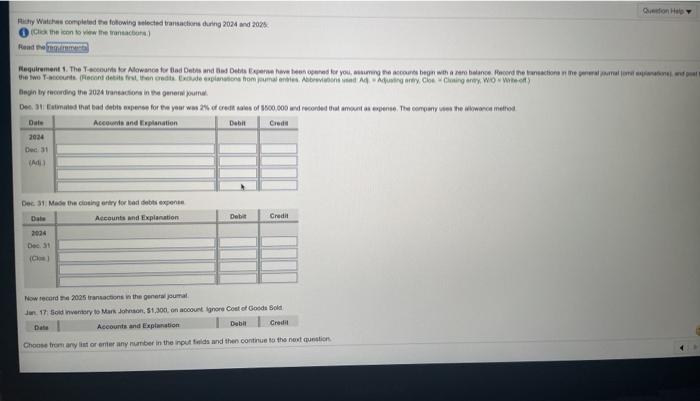

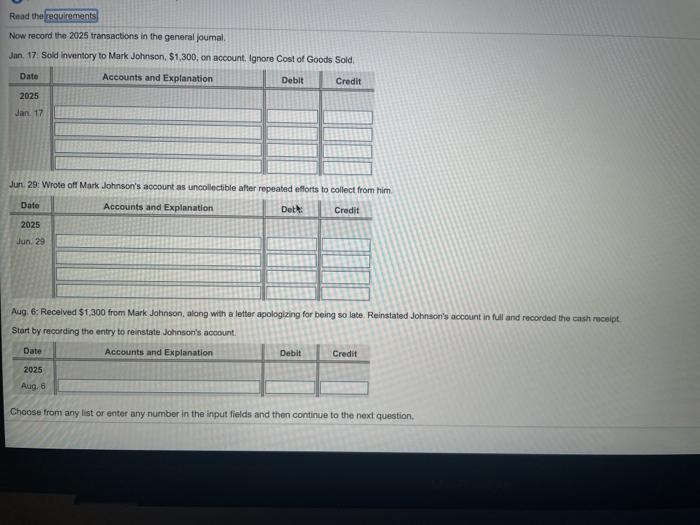

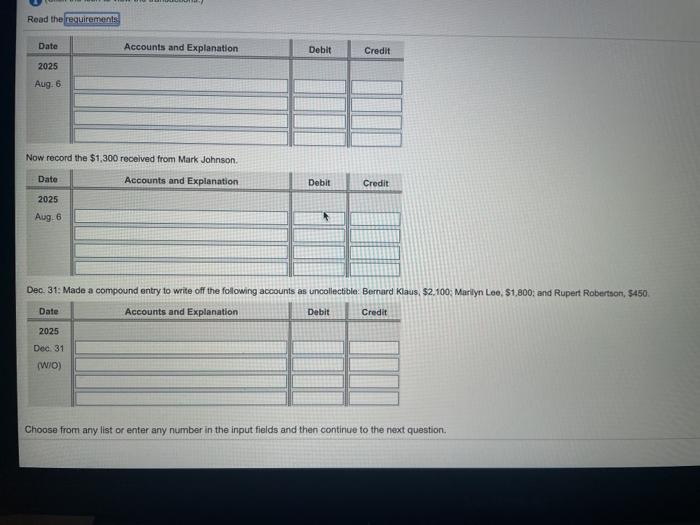

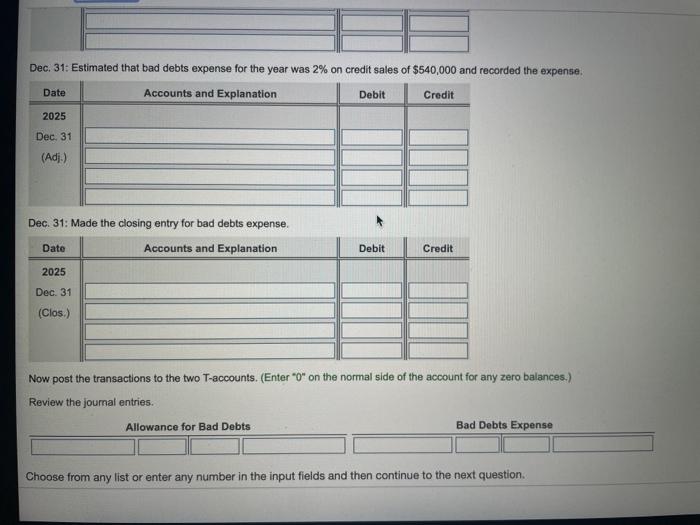

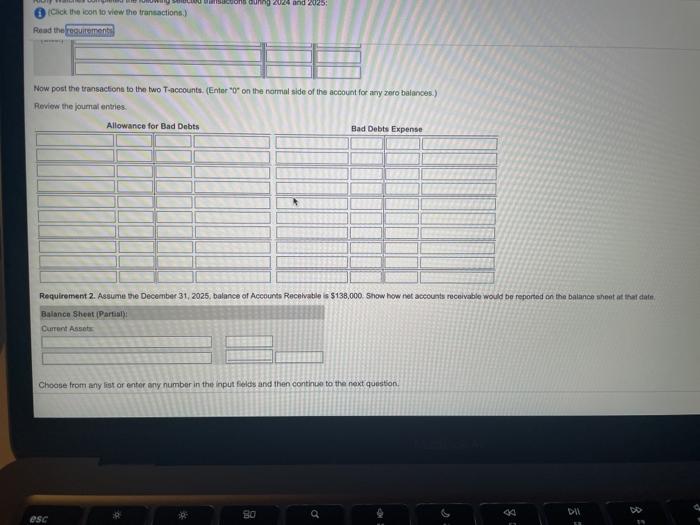

Expense have been opened for you, assuming the accounts begin with a zero balance. Record om journal entries. Abbreviations used: Adj. = Adjusting entry, Clos. = Closing entry, WIO = Writ es of $500,000 and recorded that amount as expense. The company uses the allowance method Requirements 1. The T-accounts for Allowance for Bad Debts and Bad Debts Expense have been opened for you, assuming the accounts begin with a zero balance. Record the transactions in the general journal (omit explanations), and post to the two T-accounts. 2. Assume the December 31, 2025, balance of Accounts Receivable is $138,000. Show how net accounts receivable would be reported on the balance sheet at that date. Print Done st of Goods Sold. webit Credit en continue to the next question, on Help Watches completed the following selected transactions during 2024 and 2025 Chia the conto the transaction Requirements. The actor Alowance for tladers and Debts Expere have been partyou, ang con bagn wth ar balance. Red here to me howo Tour (Recent detits first thing to show the ball My Chann, WOW) Begin by woording the 2024 in the generwuna. Decorated that badoos pere for a year wa 2% of credite of 0.000 und recorded the most a Theconomy he wance metro Account and Explanation Debit 2024 Dec 31 Dale Debia Credit Dec 31 Made thing for tabsexpone Date Accounts and Explanation 2024 Dec 30 Now record 2025 transactions in the general jumal Jan 17 Godiny Mark Johnson, 51.00, on account ignore Cost of Goods Sold Accounts and Explanation Dube Credit Choose from any or any number in the inputs and then continue to the next question Read the requirements Now record the 2025 transactions in the general Journal Jan. 17. Sold inventory to Mark Johnson, $1,300, on account. Ignore Cost of Goods Sold Date Accounts and Explanation Debit Credit 2025 Jan 17 Jun 29: Wrote off Mark Johnson's account as uncollectible after repeated efforts to collect from him Date Accounts and Explanation Dett Credit 2025 Jun, 29 Aug. 6: Received $1,300 from Mark Johnson, along with a letter apologizing for being so late. Reinstated Johnson's account in full and recorded the cash receipt Start by recording the entry to reinstate Johnson's account. Date Accounts and Explanation Debit Credit 2025 Aug. 6 Choose from any list or enter any number in the input fields and then continue to the next question, Read the requirements Date Accounts and Explanation Debit Credit 2025 Aug. 6 Now record the $1,300 received from Mark Johnson Date Accounts and Explanation Debit Credit 2025 Aug. 6 Dec 31: Made a compound entry to write off the following accounts as uncollectible: Bernard Klaus, $2,100; Marilyn Lee, $1,800; and Rupert Robertson, 5450 Date Accounts and Explanation Debit Credit 2025 Dec 31 (WIO) Choose from any list or enter any number in the input fields and then continue to the next question. Dec. 31: Estimated that bad debts expense for the year was 2% on credit sales of $540,000 and recorded the expense. Date Accounts and Explanation Debit Credit 2025 Dec. 31 (Adj.) Dec. 31: Made the closing entry for bad debts expense. Accounts and Explanation Date Debit Credit 2025 Dec. 31 (Clos.) Now post the transactions to the two T-accounts. (Enter "o" on the normal side of the account for any zero balances.) Review the journal entries. Allowance for Bad Debts Bad Debts Expense Choose from any list or enter any number in the input fields and then continue to the next question. onungan : Click the icon to view the transactions.) Read the requirements Now post the transactions to the two T-accounts. (Enter"0" on the normal side of the account for any zero balances) Review the journal entries. Allowance for Bad Debts Bad Debts Expense Requirement 2. Assume the December 31, 2025, balance of Accounts Receivable is $138,000 Show how net accounts receivable would be reported on the balance sheet at that cate Balance Sheet (Partial Current Asset Choose from any list or enter any number in the input fields and then continue to the next question esc BO